What does a successful guaranteed income program look like? Jackson might have the answer

By Stephan Bisaha and Aubri Juhasz

After months of planning, several cities in the Gulf South are finally ready to give guaranteed income a test run.

Birmingham, New Orleans and Shreveport, Louisiana each received a $500,000 grant to pilot a guaranteed income — the idea that one of the best ways to help people in need is to give them regular cash payments without any strings. Participants for each city’s pilot have been selected and, in some cases, money has already been sent out.

In March, Shreveport sent out its first $680 monthly payment to 110 single parents near or below the federal poverty line. Birmingham’s pilot is focused on 110 moms who received their first deposit last month as well. New Orleans is giving its money to young people, ages 16-24, out of school and work and said it will begin sending them money by the end of this week.

Mayors For A Guaranteed Income, an advocacy group for a national guaranteed income, is paying for at least part of all three programs.

But those unwilling to wait for these roughly year-long pilots to end to see what impact a guaranteed income has can look to Jackson, Mississippi. For the last three years, Springboard to Opportunities, a local non-profit, has been successfully running its own guaranteed income program focused on helping Black mothers living in affordable housing.

The pilot, named the Magnolia Mother’s Trust, began in late 2018, giving an initial group of 20 moms $1,000 a month for a year — free to use however they wanted. Many moms used the payments to help cover monthly expenses or pay down debt, while others put the money toward education, better housing or invested it in their own small businesses.

Since then, the trust has gone from pilot to program and has given out two additional rounds of cash to a total of 210 moms. It has also become a national model, inspiring cities across the country to launch their own programs.

Last week, Springboard invited the moms to share their stories about the program and Black motherhood more broadly during a live storytelling event. Kimberly McNair, a mom of two who was part of the trust’s most recent round of payments which ended last month, told a story about how the $1,000 checks helped turn a potentially crippling situation into a bearable one.

While McNair was a part of the pilot, she crashed her car into a driver who made an illegal U-turn. She wasn’t hurt in the crash, but her vehicle was totaled. Neither McNair nor the other driver had insurance at the time, so she had to pay for a new car out of pocket.

Her mind ran through all the consequences of losing her car. How would she get to work? Run household errands? Or drop her kids off at school?

When it comes to covering an emergency expense of $400, about 37% of American adults said they didn’t have the cash on-hand to cover it, according to a Federal Reserve survey conducted before the pandemic.

But thanks to the $1,000 checks, McNair was able to cover her own emergency expense without going further into debt.

“The money was there,” she said at the event. “All I had to do was find a car and withdraw some cash. Sounds like a simple process? Well, it was.”

While the money helped her buy a car, the safety net it provided was temporary.

McNair works full-time for the state but still makes well below Mississippi’s median income. Her salary, and the money she brings in from a side business baking birthday cakes, is usually enough to cover her family’s expenses, but saving money each month can be difficult.

“Hopefully I don’t have any big incident like before, then I probably would start worrying again,” she said. “But as long as I continue to work and continue to try to put something aside, I think I will be alright.”

After McNair told her story, Jackson Mayor Chokwe Antar Lumumba spoke to the live and virtual audiences. He spoke of his fondness for the Magnolia Mother’s Trust and said he frequently brags about the program being in his city.

Lumumba said he hopes to create a city-led guaranteed income program as well, but so far has failed to secure funding. Jackson’s city council rejected his proposal to spend American Rescue Plan funds on such a program last August. Stories like the one McNair shared at the event, Lumumba said, can be used to help change the city council’s mind.

“What you learned here, we’re going to [use it to] put pressure on our city council so that we can sustain this and expand this as a city program,” Lumumba said.

But even cities with secured funding still face roadblocks. New Orleans and Shreveport announced their grants back in 2020, but the programs have taken a long time to get up and running.

Shreveport spent time fundraising additional money to spend and both cities had to fulfill obligations associated with the $500,000 grants.

MGI partner cities are expected to run their pilot programs as research studies so the nonprofit has data to help build its case for a national guaranteed income.

This story was produced by the Gulf States Newsroom, a collaboration among Mississippi Public Broadcasting, WBHM in Alabama and WWNO and WRKF in Louisiana and NPR.

This quiet epic is the top-grossing Japanese live action film of all time

The Oscar-nominated Kokuho tells a compelling story about friendship, the weight of history and the torturous road to becoming a star in Japan's Kabuki theater.

The Live Nation trial could reshape the music industry. Here’s what you need to know

On Tuesday opening statements will begin for the federal antitrust trial against Live Nation, one of the largest entertainment companies in the world.

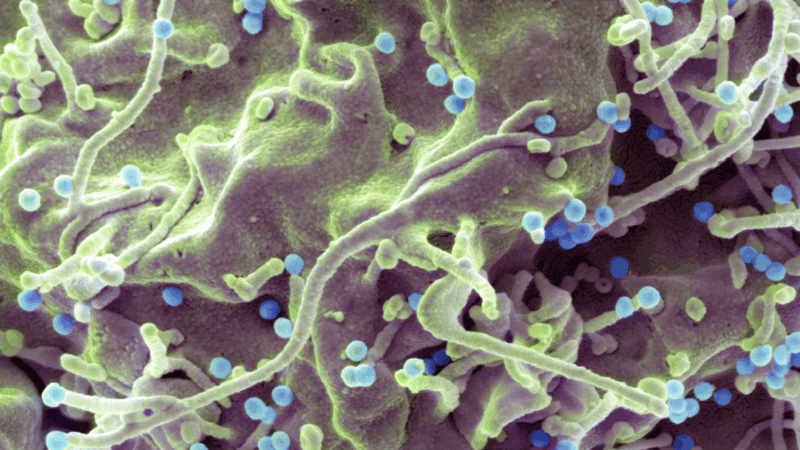

A new one-a-day-pill holds promise for HIV’s ‘forgotten population’

It's designed to take the place of complicated, multiple drug regimens that many people with HIV need to follow. And it's also beneficial because the HIV virus is always evolving.

For filmmaker Chloé Zhao, creative life was never linear

Director Chloé Zhao used meditation, somatic exercises and dance to inspire the cast and crew of this Oscar-nominated story about William Shakespeare's family.

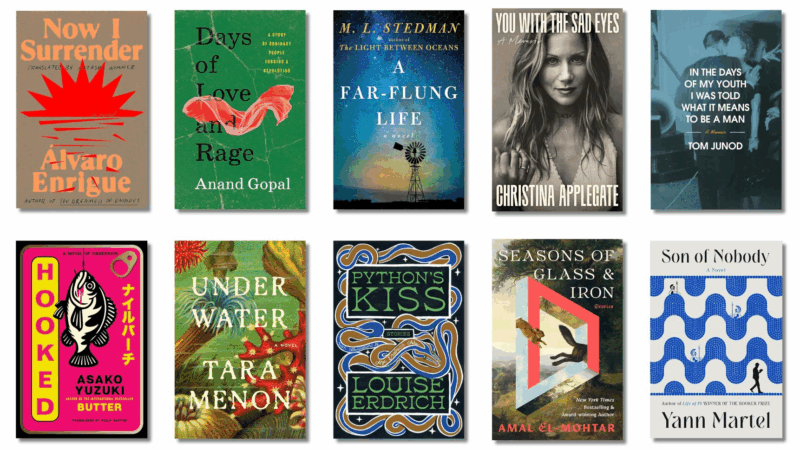

10 new books in March offer mental vacations

March is always a big one for books – this year is no different. We call out a handful of upcoming titles for readers to put on their radars — offering a good alternative to doomscrolling.

Sen. Chris Coons, D-Del., talks about the war with Iran and upcoming war powers vote

NPR's A Martínez asks Delaware Democrat Chris Coons, a member of the Senate Foreign Affairs Committee, about the war with Iran.