Woman Pleads Guilty to Tax Fraud, Files More False Refunds While Awaiting Sentencing

A Demopolis woman was sentenced to nearly four years in prison for filing more than $250,000 in false tax returns, and continued to break the law after pleading guilty last year.

Eunice F. Plummer pleaded guilty in October to eight counts of filing false tax returns for other people and three counts of attempting to evade or defeat a large portion of the income tax she owed, .U.S. Attorney Joyce White Vance announced today.

Plummer operated a tax preparation business, Plummer Tax Services, in Birmingham from 2010 to 2014, according to her plea agreement. During that time, she routinely inflated customer tax refunds by using fraudulent information and she also substantially under-reported her own income, documents say.

Earlier this year, while awaiting sentencing, Plummer reopened her tax business under a new name – Unique Tax Services – at the same location and filed more fraudulent tax returns. At sentencing, U.S. District Judge L. Scott Coogler told Plummer that by continuing to break the law after pleading guilty, she showed “disdain and disrespect” to the court and called her “a thief” and “a con artist.”

The Winter Olympics gets 8 new events, including its first new sport in decades

Ski mountaineering will make its Olympic debut this year, the first winter sport to do so since 2002. Skeleton, luge, ski jumping and moguls are also getting new events.

Team USA settles in to athletes’ villages, ‘smash’ pizzas

US Olympic athletes are arriving and settling into their digs for the next couple of weeks in Italy. Curlers are amazed by the mountain scenery in Cortina; figure skaters are plant fostering in Milan; and the big air slopestyle women are "smashing pizzas" in Livigno.

As Trump reshapes foreign policy, China moves to limit risks, reap gains

President Trump's focus overseas may spare China for now, but Beijing still worries that his "America First" rhetoric hasn't softened what it calls U.S. "military adventurism."

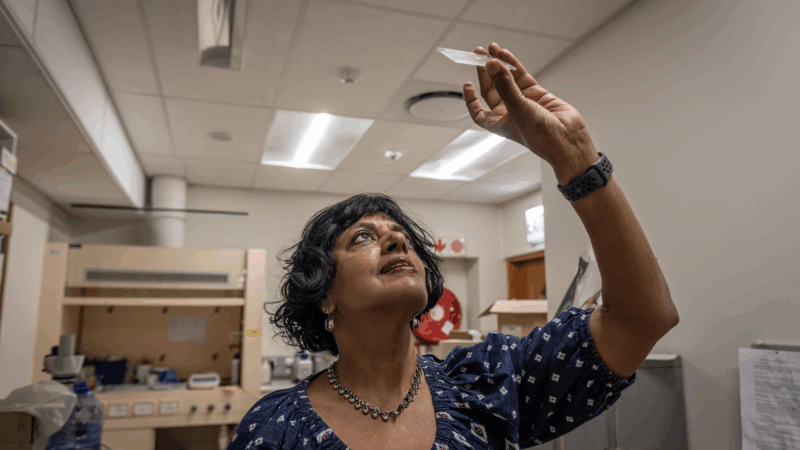

Searching for dinosaur secrets in crocodile bones

Until now, estimating how old a dinosaur was when it died has been a fairly simple process: Count up the growth rings in the fossilized bones. But new research into some of dinosaurs' living relatives, like crocodiles, suggests that this method may not always work.

How the new dietary guidelines could impact school meals

Cutting back on ready-to-eat meals won't be easy, and whole milk may make a comeback. One thing that's certain: It'll be a while before the new guidelines trickle down to schools.

Poll: Two-thirds of Americans say ICE has ‘gone too far’ in immigration enforcement

A new NPR/PBS News/Marist poll finds a jump in disapproval of the agency among Democrats and independents, but Republicans are standing by ICE and the president.