State’s Historic Tax Credit Expires this Month

From the Lyric Theater in downtown Birmingham to the Howell School in Dothan, a number of renovations have been supported by the state’s historic tax credit. It offered developers financial incentives to take on projects that might have come with big risks. But the bill to renew those tax credits has died this legislative session, and the tax will expire this month.

Opponents to the tax credit say extending it would strain the state budget. The state for the last three years had set aside up to $60 million for different renovation projects. If all the developers who have put in for the tax credit claim their share all at once, it could be a financial burden, Senator Del Marsh is reported to have said. He didn’t return calls for comment.

Former Representative Paul DeMarco worked on the original bill. He doesn’t buy the argument the bill amounts to a government subsidy for developers who should be using their own money for these projects.

“What we have seen is it is private dollars,” DeMarco says. “They’re just seeing a benefit by having this credit, and you’re incentivizing businesses to look at buildings that were sitting empty.”

The bill had strong support in both the House and the Senate. But Senate leaders put the brakes on it. Some have called it welfare for rich people. David Fleming, president and CEO of REV Birmingham says that’s unfair, as both small and large projects have benefited. “Even individual homeowners in historic houses have the opportunity to take advantage of this on a very, very small scale,” Fleming says.

He says every developer takes a risk, especially in areas that have been neglected for decades. And historic buildings come with a lot of construction risk.

“You really don’t know what you’re getting into ’til you get into it,” Fleming says. “And you have a lot of expense that comes up that’s unexpected. Ask anyone who’s ever done a historic building.”

That tax credit helped offset some of those risks. Fleming says the tax credit has also brought more than $400 million of investment across the state. And there was a waiting list for developers planning more projects. He and other supporters of the bill are afraid that now that those credits will expire, those projects might not move forward.

Prediction market trader ‘Magamyman’ made $553,000 on death of Iran’s supreme leader

It's the latest trade drawing scrutiny on the popular prediction market site for appearing to show an insider making profits on military secrets.

Oil prices rise sharply in market trading after attacks in Middle East disrupt supply

The high prices came as U.S. and Israeli attacks on Iran and retaliatory strikes against Israel and U.S. military installations around the Gulf sent disruptions through the global energy supply chain.

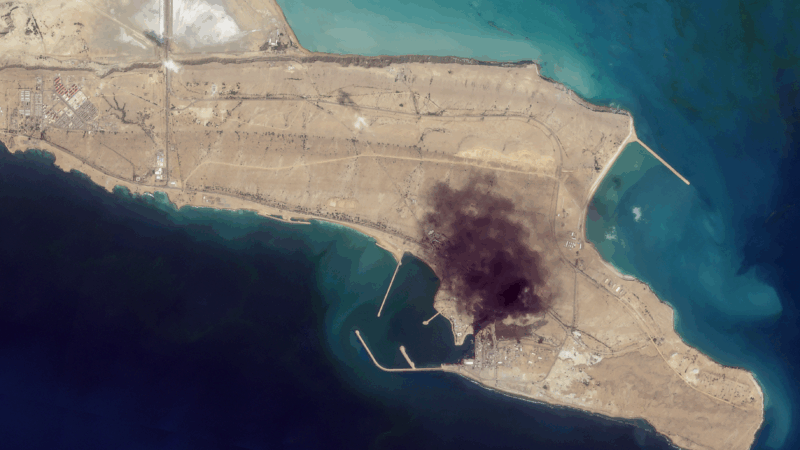

Satellite images provide view inside Iran at war

Satellite images from commercial companies show the extent of U.S. and Israeli strikes, and how Iran is responding.

Mideast clashes breach Olympic truce as athletes gather for Winter Paralympic Games

Fighting intensified in the Middle East during the Olympic truce, in effect through March 15. Flights are being disrupted as athletes and families converge on Italy for the Winter Paralympics.

A U.S. scholarship thrills a teacher in India. Then came the soul-crushing questions

She was thrilled to become the first teacher from a government-sponsored school in India to get a Fulbright exchange award to learn from U.S. schools. People asked two questions that clouded her joy.

Sunday Puzzle: Sandwiched

NPR's Ayesha Rascoe plays the puzzle with WXXI listener Jonathan Black and Weekend Edition Puzzlemaster Will Shortz.