Where is my tax refund?

The IRS started accepting tax returns on Jan. 27 — and by the April 15 federal deadline, the agency expects to receive more than 140 million individual tax returns. That means millions of people will be asking one question: When will I get my refund money?

About 28% of the 11.7 million returns processed by the IRS resulted in direct-deposit refunds in the first week of filing, according to the IRS.

When the current filing season began, “the IRS was coming in in a strong position. That’s good for taxpayers,” Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center, tells NPR, citing the agency’s recent investments in customer service.

Of course, many federal agencies are now roiled by the Trump administration’s controversial goals of shrinking staff size and eliminating programs (more on that below).

Here’s a quick guide to navigating the 2025 tax filing season:

Check your tax return’s status

If you’re about to file, or have already done so, you can track the progress of your return for tax year 2024 online. The IRS has a dedicated Where’s My Refund page that will show the status of your tax return by around 24 hours after you file electronically.

To check your refund’s status, you’ll need to know the “exact whole dollar refund amount shown on your tax return,” the IRS says, so make sure you have that on hand.

The tracking tool helps you follow your return through three main phases: when your return has been received (and is being processed); when your refund is approved (and the expected date of its issue); and confirmation that the refund has been sent.

Your refund should come within three weeks

The IRS says most refunds will be issued within 21 days of your filing date. As in recent years, the IRS recommends filing electronically and using direct deposit to get refunds more quickly.

But if you filed early and are looking for refunds related to two situations — the Earned Income Tax Credit and the Additional Child Tax Credit — you might have to wait a bit longer. That’s because the IRS can only issue those refunds after mid-February, under a requirement in the PATH Act of 2015.

The delay “was an effort to prevent, or to limit, identity fraud,” Holtzblatt tells NPR.

In those cases, she adds, “the refunds would not begin to be paid until after Feb. 15, which translates into people not getting it until early March.”

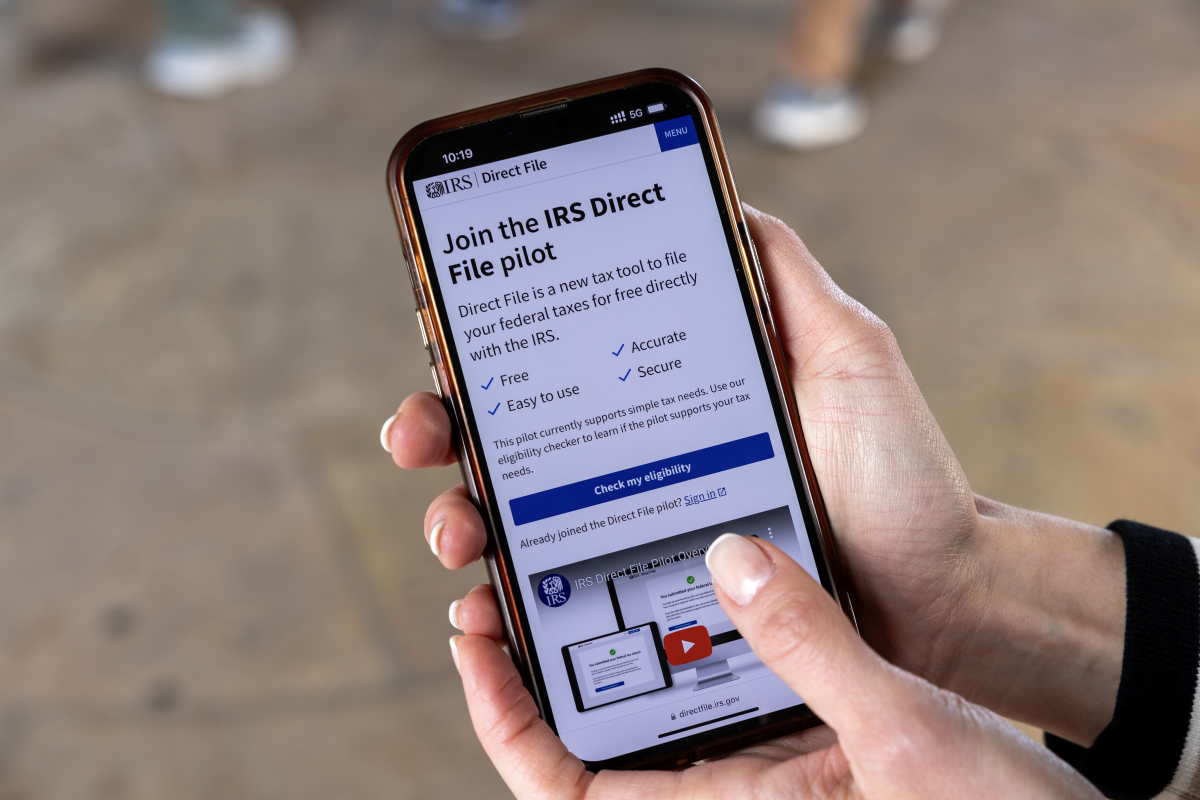

Millions more people can file for free online

The free Direct File system has expanded since last year’s 12-state pilot program, growing to 25 participating states this year. It’s aimed at people with relatively straightforward tax returns.

“When they did the pilot, they found that a large percentage of those who used it and finished it were very satisfied,” Holtzblatt says of the tool on the IRS website.

The expansion of the program is “a big step for the IRS and for taxpayers,” Holtzblatt says, noting that it offers online guidance to help people file electronically at no charge.

Direct File is available in several big states, such as New York, Texas, Florida and California. But filers in other states and the District of Columbia are out of luck (although all 50 states were invited to participate).

There are also limits on the types and amount of income you can report. Direct File can’t handle gig work or rental income, for instance. And wages for a single filer can’t be more than $200,000.

You can check your eligibility here.

The IRS faces changes

The IRS got long-awaited relief in 2022, in the form of $80 billion from the Inflation Reduction Act, along with its regular appropriations. The money followed years of reports that the agency was underfunded and understaffed; among other things, it was meant to help the agency update its computer systems, boost customer service and improve tax enforcement.

A 2021 study found the U.S. government misses out on around $600 billion in unpaid taxes each year. The IRS had also been reporting long telephone wait times and a growing backlog of unprocessed returns.

When the IRS got the first infusion of money in 2022, “they immediately went out and hired some 5,000 new people who could assist taxpayers,” Holtzblatt says. “They’re there to make the filing season more smoother.”

But Congress has clawed back some $40 billion of IRS funding — first in a budget deal in 2023, and again in December.

“The shortfalls in IRS appropriations are likely to continue and maybe even increase,” Holtzblatt says, adding that hiring freezes would also hamper the agency.

As for Direct File, the IRS has said the program is permanent. But its fate became clouded earlier this month, when Elon Musk, the billionaire head of the new Department of Government Efficiency (DOGE), tweeted that he “deleted” the agency that worked on the online tool.

Taiwan’s president pledges to defend island’s sovereignty after Chinese military drills

Taiwanese President Lai Ching-te vowed to defend the self-ruled island's sovereignty in the face of what he termed China's "expansionist ambitions," days after Beijing wrapped up live-fire military drills near its shores.

Deaths reported during widening protests in Iran sparked by ailing economy

The protests began due to economic pressures, with Iran's currency rapidly depreciating. Demonstrators have also chanted against the country's theocracy.

Congress failed to extend Obamacare subsidies. This Democrat says Trump can save them

Sen. Peter Welch, D-Vt., says he thinks the Senate can pass a "retroactive" Affordable Care Act subsidy extension, but "we need President Trump."

Rideshare union rights, social media limits and other state laws taking effect Jan. 1

Every new year, public media reporters across the country bring us some of the new state laws taking effect where they are. Here are six in 2026.

Guides to help you tackle your New Year’s resolutions

From building your strength to tackling credit card debt, NPR's Life Kit has a newsletter journey to help you tackle your New Year's resolution.

Guides to help you tackle your New Year’s resolutions

From building your strength to tackling credit card debt, NPR's Life Kit has a newsletter journey to help you tackle your New Year's resolution.