What a Trump presidency might mean for student loan forgiveness

Millions of federal student loan borrowers are facing uncertainty — or, rather, even more uncertainty — after last week’s presidential election.

President Biden will leave office with much of his student loan agenda tied up in the courts — and Donald Trump has been actively hostile to the kind of broad-based student loan forgiveness that Biden has championed.

Not only that, millions of borrowers aren’t even sure what their monthly loan payments will be, as they’re enrolled in a repayment plan that’s in legal jeopardy, raising big questions about if or when they could see their loan costs spike.

What do borrowers need to know? Here’s a look at where things stand.

Trump will inherit the court battle over President Biden’s SAVE plan

Biden’s largest effort at loan forgiveness was rejected by the Supreme Court, which ruled that such a sweeping — and costly — forgiveness plan exceeded his legal authority.

Since then, the Biden administration has floated several other student loan proposals. But that legal question, of whether the president has any power to broadly cancel student loan debt, has dogged every effort.

“Most fifth-graders who are taking their first government course, they know… it’s Congress who’s supposed to spend the money,” says Michael Brickman, an adjunct fellow at the American Enterprise Institute, AEI, who worked on higher education policy in the first Trump administration.

So far, the courts have largely agreed — with a big test yet to come.

Biden’s signature student loan repayment plan, the Saving on a Valuable Education (SAVE) Plan, slashed borrowers’ monthly payments (to as little as $0) while also preventing interest from growing what they owe. It even offers a new fast-track to loan forgiveness for borrowers with lower balances.

But SAVE’s price tag (roughly $455 billion over 10 years, by one estimate) – and the fact that the Biden administration used the rulemaking process to essentially circumvent Congress – opened SAVE to the same legal critique that upended Biden’s first big forgiveness pitch.

Republican attorneys general challenged SAVE’s legality too, and the courts were sufficiently skeptical to freeze most of the plan.

For months, 8 million borrowers enrolled in SAVE have been in a kind of limbo, not being asked to make payments while the courts slowly decide whether the plan is legal. If it is eventually deemed legal, the Trump administration could still simply phase it out. And if SAVE is struck down, only a sympathetic Education Department would appeal.

If the SAVE plan disappears, it’s not clear how the Trump administration will handle all those borrowers. Other repayment plans that take a borrower’s income into account and include the promise of forgiveness are also in various stages of legal limbo.

There is at least one exception. An older, income-based repayment plan, known as IBR, that has not been challenged and still offers limited loan forgiveness. IBR was created by Congress; only Congress can change or end it (stay tuned for this line to reappear!).

But borrowers should know: SAVE’s generous terms (which Republicans have argued are so generous they’re illegal) are the reason monthly payments were often much lower than on previous plans. An end to SAVE would mean a return to higher payments.

“The Trump administration is going to have to return these 8 million people into repayment,” says Persis Yu of the Student Borrower Protection Center, which has been pushing for debt relief. “And it’s incredibly unclear as to what affordable pathway these 8 million people will have once [the current payment pause] expires.”

AEI’s Brickman agrees the path away from SAVE would be complicated, though he believes the courts will leave the Trump administration no choice.

“The next administration is going to have to get realistic that these programs are probably not legal, and figure out where these students belong,” Brickman says.

Trump will also inherit a pair of unfinished student loan proposals

Biden’s second attempt at broad loan forgiveness, often referred to as Plan B, is a smaller effort, at least relative to the plan the Supreme Court scuttled. Still, it’s estimated to cost roughly $150 billion. It would, among other things, cancel the debts of borrowers with older loans and erase accrued interest for the millions of people who owe more than they borrowed.

Plan B was challenged by Republican state attorneys general and paused by the courts in September, before the rule could be finished, let alone rolled out. It’s not clear when we should expect a final legal ruling.

Another Biden proposal would provide loan forgiveness to people in extreme financial hardship, like those caring for a loved one or struggling with high child care costs.

This proposed rule is still in-process and has not yet been challenged in court. It has also been open for public comment, giving borrowers a chance “to talk about how this would impact their lives,” says Yu. “It is important for borrowers to tell this administration – and the next one – what student loans are doing to them.”

It’s doubtful Plan B’s court battle – or the hardship proposal’s rulemaking process – will end before Inauguration Day, which means the Trump administration will likely decide the fates of both.

And while there’s no way to know for sure how the next administration will handle these pending efforts, Trump has been very clear that he dislikes the idea of broad loan forgiveness, making it hard to imagine his administration moving forward with either.

What if Trump tries to close the Education Department?

Yes, in an interview on X, Trump told Elon Musk that, if elected, “I want to close up the Department of Education, move education back to the states.”

Can he do that? Not the president, no. The department was created by Congress; only Congress can end it (told you it’d reappear!).

What matters most for our purposes (talking about student loans!), is that no one, not even the conservative Republicans behind Project 2025, are calling for an end to the federal student loan program, whatever happens to the Education Department.

What Project 2025 does recommend is that Congress “spin off” the student loan program “to a new government corporation,” with the Treasury Department managing collections and defaults. The idea being, to make the student loan program more of an island independent of the political whims of any single administration.

President Trump has disavowed Project 2025, though it included input from Trump loyalists.

President Biden was able to forgive student loans for some borrowers – can that be reversed?

Despite all the lawsuits, Biden still provided loan forgiveness to roughly 5 million Americans, and Brickman says it’s “unclear” if that relief could be clawed back.

“I don’t think it can be ruled out, if loans were forgiven illegally,” Brickman says, “but that is certainly harder than loans not yet forgiven.”

Multiple sources, polled by NPR, all agreed: Clawing back loans that have already been discharged would be difficult, not just politically but operationally.

Biden’s loan forgiveness successes came largely by expanding access to pre-existing, Congressionally approved programs – programs that, for example, offer forgiveness to people who work 10 years in public service or who struggle with a severe disability.

Can those programs be shut down?

During his first term, Trump tried to eliminate Public Service Loan Forgiveness (PSLF), but he didn’t succeed. Congress created PSLF, and only Congress can end it (I did it again!).

With Republicans looking to control Congress, lawmakers could conceivably vote to end Public Service Loan Forgiveness, though it’s not clear there’s enough desire to.

More likely is a kind of reining in of PSLF’s expanded generosity.

See, the Biden administration used the regulatory process to dramatically increase access to PSLF, making it easier to qualify for and receive forgiveness. But, like many of Biden’s efforts, those changes can be unwound by the next Trump administration.

Does the public want loan forgiveness?

As the U.S. Department of Education prepares for a radical shift in its agenda, it’s worth taking a look back at a poll, from June, that tried to capture how Americans feel about loan forgiveness.

The poll, from the Associated Press and the University of Chicago, found that, overall, 39% of adults think it’s extremely or very important for the U.S. government to provide student loan relief. More adults — 51% — say the government should relieve medical debt.

Democrats (58%) were far more likely than Independents (44%) or Republicans (15%) to back student loan relief, which means, post-election and with Republicans ascendant in Washington, borrowers will need to get used to a new normal and new priorities.

Transcript:

ARI SHAPIRO, HOST:

Millions of federal student loan borrowers are facing more uncertainty after last week’s election. President Biden will leave office with big parts of his student loan agenda stuck in the courts, and Donald Trump has been actively hostile to the idea of loan forgiveness. To explain what this all means for borrowers, NPR’s Cory Turner is here in the studio. Hey, Cory.

CORY TURNER, BYLINE: Hey, Ari.

SHAPIRO: There have been so many lawsuits around Biden’s student loan proposals. Where do things stand right now as Trump prepares to take office?

TURNER: Yeah. It can be a little confusing. We all know that Biden’s biggest effort at loan forgiveness was rejected by the U.S. Supreme Court, which said he had clearly exceeded his legal authority. But there are a few smaller efforts that are right now in various stages of limbo. So one would erase any interest that has accrued for borrowers who owe more now than they did when they first took out their loan. It’s technically a rule, but it was paused by the courts before it could actually be finished, which means it’s likely going to fall to the Trump administration to decide its fate.

There is another proposal that would provide loan forgiveness to people in extreme financial hardship, like folks caring for a loved one, for example. Now, we don’t know for sure how the next administration would handle these pending efforts, but Trump has been pretty clear for many years now about how much he dislikes the idea of loan forgiveness. And polls show that so do many Republicans. So it’s pretty hard to imagine at this point the Trump administration moving forward with any of these.

SHAPIRO: And what about the Biden administration’s SAVE plan, which is also tied up in the courts?

TURNER: Yeah. For me, this is maybe the biggest and most interesting question mark, Ari, because SAVE is essentially a repayment plan. But it is so generous offering a fast track to loan forgiveness that it, too, was challenged in court by Republican state attorneys general. And the courts paused it. The thing is, though, millions of people enrolled in SAVE, and they’re in a kind of limbo, not being asked to make payments while the courts sort out whether or not their plan is legal.

It’s not clear how the Trump administration is going to handle all of these borrowers if or presumably when the SAVE plan disappears. It might need to go through a whole new rule-making process to create some kind of new, less generous repayment plan. There is one older income-based plan that has not been challenged and does still offer limited loan forgiveness. It’s called IBR. And it’s still around because it was created by Congress, and it will be around unless Congress decides to change it.

SHAPIRO: What about all of the people who have received loan forgiveness? Is there any chance they could be back on the hook for the loans that were forgiven once Trump takes over?

TURNER: Yeah. I mean, it’s easy to forget, among all of these lawsuits, that President Biden still provided loan forgiveness to roughly 5 million Americans. I don’t have any reason to believe, at this point, that that debt relief can be undone. Biden’s few successes over the past few years really did come largely by expanding access to preexisting, congressionally approved programs, which gives them a kind of strength that his other their efforts don’t have – for example, offering forgiveness to folks who work 10 years in public service or who struggle with a severe disability.

Can those programs be shut down? Yes, but it seems unlikely. You know, during his first term, Trump tried to eliminate public service loan forgiveness, but he didn’t because that requires Congress. Now, lawmakers could vote to end PSLF, but it’s not clear they have any desire to.

SHAPIRO: What are the bigger lessons here from the Biden administration’s efforts at loan forgiveness?

TURNER: Yeah, that’s what – I’ve been thinking a lot about this, Ari. One, for me, is governments have a finite amount of energy. And so when they choose to do one thing, they’re also choosing not to do other things. I have a bunch of conversations with higher ed experts – not all of them conservatives – who said, look. By going all in on loan forgiveness and doing it without Congress, the Biden administration missed a real chance to meaningfully expand access to college. And they’re disappointed by that.

SHAPIRO: That’s NPR education correspondent Cory Turner. Thank you.

TURNER: You’re welcome.

Party City files for bankruptcy and plans to shutter nationwide

Party City was once unmatched in its vast selection of affordable celebration goods. But over the years, competition stacked up at Walmart, Target, Spirit Halloween, and especially Amazon.

Sudan’s biggest refugee camp was already struck with famine. Now it’s being shelled

The siege, blamed on the Rapid Support Forces, has sparked a new humanitarian catastrophe and marks an alarming turning point in the Darfur region, already overrun by violence.

FDA approves weight loss drug Zepbound to treat obstructive sleep apnea

The FDA said studies have shown that by aiding weight loss, Zepbound improves sleep apnea symptoms in some patients.

Netflix is dreaming of a glitch-free Christmas with 2 major NFL games set

It comes weeks after Netflix's attempt to broadcast live boxing between Jake Paul and Mike Tyson was rife with technical glitches.

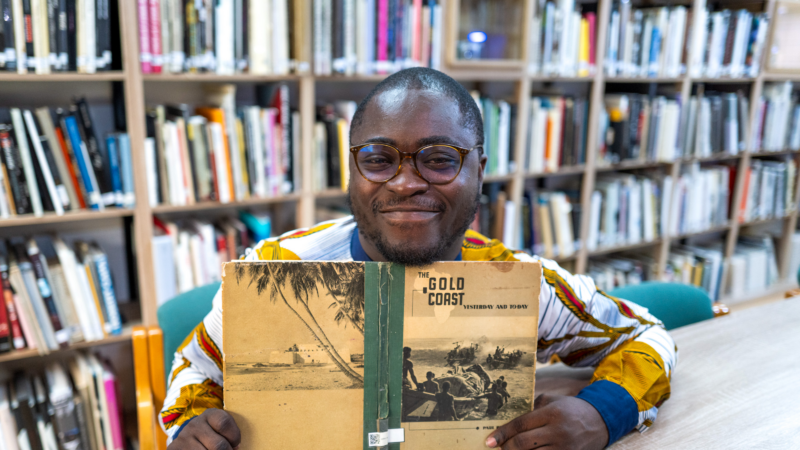

Big dreams: He’s the founder of a leading African photobook library

Paul Ninson had an old-school, newfangled dream: a modern library devoted to photobooks showing life on the continent. He maxed out his credit cards, injured his back — and made it happen.

Opinion: The Pope wants priests to lighten up

A reflection on the comedy stylings of Pope Francis, who is telling priests to lighten up and not be so dour.