The U.S. economy is growing solidly. Here’s what’s working — and what’s not

With just days before Election Day, the U.S. just got its latest economic report card — and it’s good, even if many people don’t feel that way.

The U.S. economy grew at a solid annual rate of 2.8% in July, August and September, with consumer spending leading the way, according to the Commerce Department on Wednesday.

Here are four things to know about the latest report on gross domestic product (GDP), which provides the broadest measure of the economy.

Consumers are spending freely

Consumers have long been the engine of the U.S. economy, and that engine revved up in the third quarter.

People opened their wallets to buy cars, restaurant meals and vacations. Consumer spending rose at an annual rate of 3.7% — an acceleration from the previous quarter.

“The consumer is driving the train, as she has been doing, and the consumer continues to power the economy forward,” says Mark Zandi, chief economist at Moody’s Analytics.

To be sure, not all consumers are spending so freely. Price-conscious shoppers are increasingly looking for bargains. This week, McDonalds reported strong demand over the summer for its $5 value meals. And the personal savings rate continues to fall, dropping to 4.8% during the third quarter.

A strong job market helps

Consumer spending is largely bankrolled by a healthy job market and solid wage gains, which have been outpacing inflation for well over a year.

Employers added more than a half-million jobs during the quarter and unemployment is hovering at a low 4.1%.

“As long as people have a job and their wages are rising, that’s the basis for continued strong spending,” Zandi says.

The healthy labor market and stronger spending bode well for the economy — even if polls show some people feeling down about the economy.

“Despite the hand-wringing that many consumers have when they respond to surveys or polls and say, ‘I’m worried about the economy,’ and they may well be, but it’s not showing up in their behavior,” Zandi says. “They’re still spending.”

But housing remains a weak spot

Not all parts of the economy are doing well.

High home prices and high interest rates have been a drag on the housing market. Residential investment was a weak spot in the GDP report, shrinking at an annual rate of 5.1%.

Sales of existing homes have been sluggish all year, with sales in September falling to their lowest level in nearly 14 years. Construction of new homes — especially multi-family apartment buildings — has also fallen into a slump after a brief boom in 2023. Both housing starts and permits were down in September from the previous year.

Consumer confidence is improving — somewhat

The latest economic report card for the country comes at the conclusion of a presidential race in which many voters have identified the economy as a top issue.

There are some signs that people’s attitudes about the economy are improving, as inflation falls from a four-decade high that was reached two years ago.

A survey released by the Conference Board this week showed the biggest jump in consumer confidence in more than three-and-a-half years. Attitudes improved about both the current economic situation and the outlook for the next six months.

Analysts were cautious about calling this a turnaround in sentiment.

“There was a big pop in October,” says Dana Peterson, chief economist at the Conference Board. “But I would warn that the measure itself has been moving sideways in a pretty tight range for the last two to three years.”

While inflation has cooled, shoppers are still wrestling with the cumulative effect of recent price hikes.

“People still feel the sting of high inflation of two or three years ago, and that’s hard to get over,” Zandi says.

Harris will spend election night at Howard University, the HBCU that helped shape her

Harris is the first vice president to be an alum of a historically Black college, and if she wins, would make history as the first president to be an HBCU graduate.

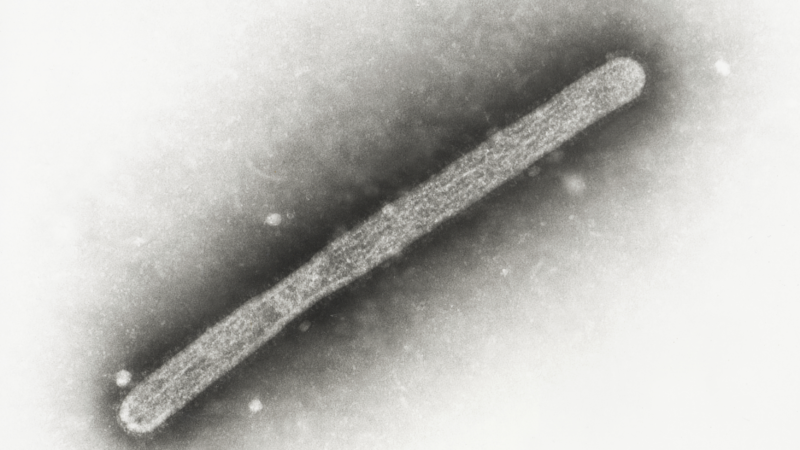

Bird flu has been found in a pig for the first time in the U.S.

The discovery of an infected pig at a backyard farm in Oregon raises concerns about bird flu's potential to become a human threat.

Enforcement was considered discriminatory. Now New Yorkers can jaywalk legally

The NYPD can no longer ticket jaywalkers, after years of protest that enforcement unfairly targeted Black and Hispanic New Yorkers.

What could happen at the Supreme Court under Harris and Trump

Depending on who wins the presidential election and the Senate, the conservative supermajority could remain the same, be trimmed or expand to an even larger and more lopsided conservative majority.

Worried about your 2024 ballot being counted? These states let you track it online

“There's no need to panic,” an elections expert tells NPR. All but three states have free tracking sites that send updates to voters as their ballot goes through the system.

Handsy fans disrupted a World Series game. Here are 5 notable MLB interference cases

Two Yankees fans were ejected from Game 4 of the World Series for trying to pry a ball out of a Dodgers player’s glove. It's a particularly brazen instance of fan interference, but far from the first.