Tesla won the plug war. Enter the age of the EV charging adapter

For some U.S. drivers, this year’s hottest car accessory is a chunk of black plastic.

Ford and Rivian gave one to each of their EV owners for free. General Motors is selling one for more than $200. And drivers of other brands will have to wait until they, too, can obtain an adapter — and unlock access to the promised land of Tesla EV chargers.

Much like the “videotape format wars” Betamax and VHS fought in the 1970s and ’80s, in the new millennium automakers have vied for dominance over ways to charge EVs. Tesla created a proprietary, compact plug design; most other automakers used a shared design for a larger plug.

That meant that only Tesla owners could plug into the expansive Tesla Supercharger network, which is available in every state and offers about 30,000 high-speed chargers. Everyone else relied on a patchwork of other, much smaller networks, with fewer ports, inconsistent charging speeds and a reputation for unreliability.

Tesla won. Within the last 18 months, every other EV maker in the U.S. has agreed to switch to Tesla’s technology, in large part because that gives drivers access to the industry-leading charging network that Tesla built.

Now starts a transitional phase, which is simultaneously slow and fast.

Slow, because it will take many years for existing cars with the rival plugs to be replaced, given how long cars last. And fast, because Tesla incentivized the switch by promising access to its Superchargers. As brands tap into that once-exclusive network, it means an immediate, massive increase in the number of chargers available for their customers.

That’s no small thing. The auto industry, climate advocates and lawmakers have all bet heavily on the prospect that drivers will embrace EVs as superior to gas-powered cars. They are — as auto executives will eagerly tell you — cheaper to own,easier to maintain, quieter and speedier, and charging at home is downright convenient. But drivers’ anxiety about charging on the go is a top reason — arguably the number one reason — why demand for EVs is falling short of automakers’ expectations.

The federal government is spending billions to build new chargers to address that anxiety. But it’s off to a slow start.

Meanwhile, Tesla’s network is right there, waiting.

So how to get the drivers of all of Tesla’s competitors onto Tesla’s network?

Enter … the adapter.

Superchargers: An enviable walled garden

When Tesla set out to make a mass-market electric vehicle, the company knew drivers would want to easily charge on road trips, and invested heavily in its own network of high-speed chargers. Together, the car and the charger became what some call a “walled garden” — a standalone, proprietary ecosystem.

In earnings calls over the years, CEO Elon Musk has repeatedly said the system was not intentionally designed as a “walled garden” to keep rivals out — as Apple has been accused of doing. Instead, he said, Tesla’s design was simply superior, and other automakers were welcome to get on board.

But companies balked at adopting a competitor’s technology.

Most American and European carmakers used a shared system called CCS, which stands for Combined Charging System. (To make things even more complicated, some Japanese vehicles used a third standard.)

Qiong Sun is a charging expert at TE Connectivity, which designs and manufactures electrical components. To explain the difference between Tesla’s system and CCS, Sun holds up a chunk of black plastic with round holes in it — the charging inlet of a vehicle on the CCS system. It has two sections: top and bottom. One is used for slower, everyday charging, like at home or work. Both sections are used together for fast charging. Tesla’s design has just one smaller shape for both types of charging.

This illustrates a fundamental problem: To make a Tesla Supercharger plug fit into a CCS inlet, you need an adapter. It’s another chunk of black plastic, about 5 inches long, which clicks into the Tesla charging plug on one end, and the car’s charging port on the other. (And because the CCS plug is different shapes depending on the kind of charging, you need a separate adapter to use a slower charger with a Tesla-style plug).

And the problem is not just as simple as getting the pieces to fit together, Sun says. “Not only does this hardware need to be changed, but also now the software needs to be able to distinguish which mode it is at,” she says, referring to the vehicle software that manages battery charging.

Last but not least, Tesla needs to give drivers access to the charging system.

Until recently, without access to Superchargers, drivers have relied on open networks like Electrify America and EVgo, among others. Surveys from J.D. Power, the automotive market research firm, have consistently found that drivers are less satisfied with non-Tesla networks, which have far fewer chargers and have struggled with reliability.

A spokesperson from Electrify America wrote in a statement to NPR that the charging industry is still in its “early stages,” and that the company “has remained focused on driving customer satisfaction,” including by replacing more than 800 chargers in 2024. And a representative from EVgo wrote that it has several initiatives to “enhance the overall customer experience,” including building larger stations and higher-powered chargers. “Since the start of 2022, EVgo has upgraded, replaced or decommissioned legacy equipment at more than 500 stalls across over 20 states to better serve our customers,” the statement said.

J.D. Power’s data shows satisfaction with non-Tesla chargers is improving — although so far, not enough to catch up with Tesla.

For a long time, this problem didn’t affect many people, because Tesla sold the vast majority of EVs in the U.S. But as other automakers scaled up production, a growing number of people have been buying those brands. There are now some 1.5 million non-Tesla EVs on the road, according to Experian — and many of those drivers have been eying Tesla’s walled garden with envy.

In 2023, a door appeared in the walled garden. The White House negotiated with Tesla to open a small number of Supercharger stations to the general public. Tesla came up with an adapter integrated into those Superchargers so drivers could charge vehicles with CCS ports without needing to bring their own adapter. In exchange, Tesla became eligible for some of the billions in federal funds pouring into expanding the nation’s fast-charger network.

A few months later, the garden walls started to fall. Ford’s CEO appeared on what was then Twitter (now X) with Elon Musk — the owner of both X and Tesla — to make the surprise announcement that Ford was adopting Tesla’s charging technology … and in exchange, getting drivers access to Superchargers. “I’m really excited about what this means for customers,” Ford CEO Jim Farley said. “Our goal, really, is to be as helpful as possible in accelerating towards sustainable transport,” Musk said later.

GM followed soon after with a similar announcement. And then, so did all the other automakers.

At last, the plug war was over.

The Tesla advantage in action

Why would companies abandon a standard they had all been using for years, and give a major coup to their rival?

The answer, mostly, is that car buyers are anxious about road trips. The majority of the time, people who own an EV plug it in at home or work and charge at slower speeds. It’s cheaper, easier on the car, and more convenient than stopping to charge. And of course, most drivers spend a lot more time commuting than they do driving long distances.

But on road trips, you need to charge much faster. That’s where Tesla’s supercharger network, designed to address this precise anxiety, promises to help.

Rivian, an all-electric automaker based in Normal, Illinois, is one of the first companies to get access to Tesla’s chargers. “Building out an ecosystem of charging locations to allow drivers to get to where they need to go is a cornerstone of increasing EV adoption,” Rivian vice president Paul Frey told NPR in a statement. He called accessing the Tesla Supercharger network “an important step in this journey.”

So I put the network’s promise to the test by driving through Pennsylvania and Ohio on a round trip of nearly 900 miles in a borrowed Rivian R1S SUV. While the R1S is still being built with a CCS charging port, the company supplied me with an adapter, and I programmed the infotainment system to route me to whatever chargers made sense, Tesla included.

My first Pennsylvania charging stop — not at a Tesla station — had four chargers. As I pulled up, a repairman was already there (in an electric pickup truck, naturally), at work troubleshooting. He didn’t want to give his name because he wasn’t authorized to talk to the press, but did tell me that the chargers were a little “finicky.” Three out of four weren’t working properly.

Later on in the trip, I stopped at a different competitor’s charging station, also with four chargers. Three of them were occupied. The last one? Out of order.

Every Supercharger I visited, in contrast, had at least 12 chargers, at least 8 of them open. Every one I tried worked. They were fast. And there were so many of them. Having Superchargers available tripled the number of 150 kw chargers available to me on one 7-hour stretch of my drive. In this case, the grass really was greener on the other side of that garden wall.

Syncing up across companies

I’ve charged Teslas at Superchargers before, and plugging the Rivian in wasn’t quite as seamless. Of course, there’s an adapter to wrangle. I also encountered some trouble starting the charge just by plugging in, and had to ultimately use the Tesla app. Rivian says that was an isolated glitch, possibly tied to me using a loaner vehicle.

Parking non-Tesla vehicles can also be tricky, or at least an etiquette minefield. The charger ports are in a different spot on different vehicles, and the Tesla chargers were designed, well, for Teslas. That means you often have to take up two spaces to charge one car.

And not every EV can use Superchargers yet: So far, only Ford, Rivian and GM vehicles have widespread access to the network. Even for those brands, some of the very oldest Superchargers remain Tesla-only.

My experience wasn’t unique. According to J.D. Power, non-Tesla drivers who access Superchargers are not quite as happy with them as Tesla drivers are, with the biggest frustrations being ease of payment and of charging. But they are still significantly happier with the Superchargers than they are with fast chargers overall.

There’s an advantage to a “walled garden” — it’s easier to troubleshoot a system in which just one company controls both sides, whether it’s iPhones talking to MacBooks, or a Tesla vehicle connecting to a Tesla charger. More companies, with different hardware and software that have to communicate, means more friction. Tesla typically does not respond to requests for comment, and did not reply to inquiries for this story. But Paul Suhey, the cofounder of Revel — a charging network whose locations are all equipped with both kinds of ports — said that it’s “undeniable” that opening up a charger network to more brands adds complexity.

“I think, 100%, you have advantages when you have compatibility between the charger and the vehicle itself,” said Suhey. But, he said, companies have made a lot of progress addressing this through standardization. It’s in their best interests to work together.

“It’s not just lip service,” Suhey said. “When you think about the companies’ incentives, the biggest thing that we want is more EVs. The biggest thing that EV manufacturers want is more charging. So all of that just gets easier the more that we standardize.”

For Tesla, opening up the system means a new revenue source. But will it benefit Tesla drivers?

In the long run, this pivot will mean more chargers that they can easily use, as their port becomes the standard everywhere. In the near term, though, it means a little more competition for chargers. J.D. Power found that since the start of 2024, Tesla owners have become less satisfied with the availability of chargers, albeit still very happy with their charging experience.

Bill Lowe, a Model 3 owner, was finishing his fast charge at a Supercharger in Ohio when I pulled up. I asked him what he thought about the system opening up.

“I think it’s good,” he said. “The Supercharger network is, in my opinion, Tesla’s secret sauce.” As long as access to the chargers is fair and the stations “don’t get all clogged up” with long lines of cars, he said, he thinks it’s a positive change.

That said, for Lowe, long lines are only a hypothetical problem. He lives in Tennessee, a part of the country where EV adoption is low. “I’ve never had a problem with pulling up to a Supercharger that’s been full yet,” he said.

Drivers in California might have a very different experience. As of mid-2024, 34% of all the nation’s registered EVs were in California, and 25% of the nation’s charging infrastructure. As a result, the state has one of the worst ratios of EVs to chargers in the country.

Tesla is addressing some of these challenges as it tries to welcome new customers to the network without alienating current drivers. The company is adding longer charging cables at new or upgraded Supercharger sites to accommodate other models. And while it has slowed plans to add more Supercharger stations, it has also promised to focus more on expanding existing ones.

The age of the adapter

Switching over to the new standard — which is now called NACS, the North American Charging Standard, since it is no longer Tesla-exclusive — will take time. A lot of time.

Adapters are only a temporary solution until automakers start rolling out new EVs that are designed to charge at Tesla’s network. “We work virtually with every [automaker] in the world,” says Sun, of TE Connectivity. “Whoever wants to sell their vehicle in North America, they are on this journey to converting to NACS.”

Over the next year or two, companies will start delivering cars with NACS ports built in.

Meanwhile, the rival charging companies — like Electrify America and others — are adding NACS plugs to their ports. Some companies have them already, others are promising them within the next couple of years.

Rick Wilmer, the CEO of charging company Chargepoint, says having to bring your own adapter is a hassle for drivers. That’s one reason Chargepoint has designed chargers with a built-in adapter that can work for both CCS and NACS vehicles.

But, he said, it’s worth it for the industry to switch to a single standard. “However many years it takes from now, when all the cars on the road are all the same and all the chargers are the same, that’s going to be a better place,” he said.

And how many years will that be?

“A long time,” he said. “How long do people keep cars?”

Wilmer, for example, drives a Ford F-150 Lightning with a CCS port, “and I’m not getting rid of it any time soon,” he pointed out. Vehicles like his will stay on streets for “eight, ten, 12, 15 years,” Wilmer guesses.

“We’re going to be living in a world of two connectors for a good long time,” he said.

After all, rival technologies don’t fade away immediately. Fun trivia fact: The last Betamax tape was produced in 2016.

The Assad regime’s fall has freed displaced Syrians stuck in a remote desert camp

More than 7,000 people had taken shelter in the Rukban camp, near the border with Jordan, many of whom fled the regime and ISIS attacks almost a decade ago.

Mariah Carey and K-pop group Stray Kids rule this week’s charts

Holiday music rules the pop charts once again this week, as Mariah Carey's "All I Want for Christmas Is You" scores its 17th nonconsecutive week at No. 1 — the third longest run of all time.

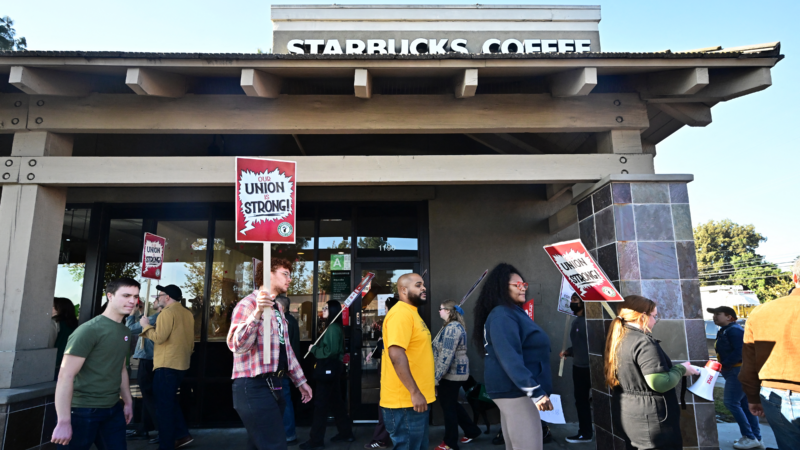

Starbucks baristas’ ‘strike before Christmas’ has reached hundreds of U.S. stores

Starbucks' union says workers are walking off the job at some 300 — out of over 10,000 — stores across the U.S. as contract negotiations falter. The company urges it to return to the bargaining table.

American Airlines lifts ground stop that froze Christmas Eve travelers

American Airlines passengers across the U.S. endured a sudden disruption of service on Christmas Eve as a "technical issue" forced the airline to request a nationwide ground stop of its operations.

We needed comic relief in 2024. Here are 5 stand-up specials where we found it

Hasan Minhaj, Ronny Chieng, Mike Birbiglia, Hannah Einbinder and Michelle Buteau all delivered specials that cracked us up this year.

An Indian movie, loved abroad, is snubbed at home for Oscar submission

All We Imagine as Light explores the lives of working-class women in Mumbai and won the Grand Prix at Cannes. But it was deemed not Indian enough to submit to the Oscars.