Intrigued by buy-now, pay-later loans? Experts break down 6 pros and cons

You’re shopping online. You’re about to make a purchase. Then you see an option you’ve started to see more frequently on checkout pages: “Pay in four easy installments.”

You’re intrigued. But you also might be thinking: What’s the catch?

“Buy-now, pay-later” loans, as they’re called in the financial industry, are an alternative form of credit and essentially work the way they sound. Shoppers borrow money to buy goods instantly and then pay those loans back over time, often interest-free, says Ed deHaan, a professor at Stanford University’s Graduate School of Business.

Over the past decade or so, retailers have been partnering with financial technology companies like Klarna, Affirm and Afterpay to offer shoppers this service both online and in stores for everything from groceries to grand pianos.

If you’re curious about buy now, pay later (BNPL) and can spend within your means, give it a shot, says deHaan, who has studied the effect of BNPL on users’ financial health. “Just be very careful in the same way you would for any credit product.”

Here are a few pros and cons to consider before taking out a buy-now, pay-later loan.

PRO: You can get a quick loan without having to do a hard credit check.

For people with no or limited credit history, or those who are worried about dinging their credit score, BNPL loans can be a convenient way to free up cash flow, deHaan says.

Unlike credit cards and bank loans, BNPL loans don’t often require a hard credit check, deHaan says. Instead, financial companies may use alternative data to determine loan eligibility. They may look at your browsing habits or shopping profile or do a soft credit check, which is a review of your credit history that doesn’t impact your credit score.

You usually know whether you’re approved for a loan in seconds, he says. In many cases, the application process involves providing little more than basic contact information, your birthday and a form of payment.

CON: It may lead to overspending and “debt stacking.”

The downside of quick, easy access to loans? It may lead to overspending and impulse purchases, says Jennifer Streaks, senior personal finance reporter at Business Insider.

“People don’t see these loans as real money,” she says. “If I was going to pay $100 today, but then I only have to pay $10, then I’ve got $90 today to do something else. It almost feels like you got some money back.”

Another significant factor for borrowers is that BNPL companies don’t generally report to the credit bureaus, deHaan says. This means that financial lenders won’t have a full picture of your debt. So on top of not being able to build your credit score with these purchases, this can make it easy for users to “debt stack,” or take out multiple lines of credit and get overextended on their debt, he says.

PRO: Many loans are interest-free and come with flexible repayment plans.

Unlike credit cards that can lock consumers into high interest rates and a recurring monthly bill, many BNPL companies offer zero-interest loan options with varying repayment schedules, Streaks says.

When used wisely, an interest-free loan can make large or unexpected purchases more manageable, Streaks says. For instance, if you drop your phone in a puddle and put a brand-new replacement on your credit card, the interest you’d have to pay on top of that surprise expense could hurt your wallet. With a BNPL loan, you could potentially space out the price of that new phone over the course of a few months for no additional cost, giving you time to budget accordingly.

CON: There may be hidden fees.

Read the fine print before you sign up. Not every loan option is interest-free, Streaks says. Some companies might offer a sliding cost scale depending on the length of repayment, or no interest only up to a certain dollar amount. Many companies will charge a late fee for missed payments, but those fees can vary anywhere from a few dollars to up to 25% of your purchase for a single late payment.

PRO: No long-term commitment.

BNPL loans are “one and done” transactions, says Austin Kilgore, an analyst at the digital finance company Achieve. So once you’ve paid off your loan, your relationship to that BNPL company is over.

That’s a helpful feature for anyone with a fear of commitment to a particular financial lender, he says. Since most loans have a set number of payments, debt-conscious shoppers have the freedom to try different credit providers while avoiding “the constant temptation of an ongoing open line of credit.”

CON: Your bank account may be at risk of overdrafts.

Many companies may encourage or even require borrowers to set up automatic payments for their loans, so if you’re not vigilant, it can be easy to overdraft your bank account, deHaan has found in his research.

Stay on top of your spending by sticking with just one BNPL provider or setting payment reminders on your phone or a financial planning app, Kilgore says.

You may also consider the timing of your payment schedule, Streaks says. It might help to match up your payments with your paychecks.

For more pros and cons of buy now, pay later, listen to our podcast episode.

The producer is Clare Marie Schneider. This digital story was edited by Malaka Gharib. The visual editor is Beck Harlan. We’d love to hear from you. Leave us a voicemail at 202-216-9823, or email us at [email protected].

Listen to Life Kit on Apple Podcasts and Spotify, and sign up for our newsletter. Follow us on Instagram: @nprlifekit.

Indiana completes undefeated season and wins first national title, beating Miami

Indiana bullied its way into the history books Monday night, toppling Miami 27-21 to put the finishing touch on a rags-to-riches story, an undefeated season and the national title.

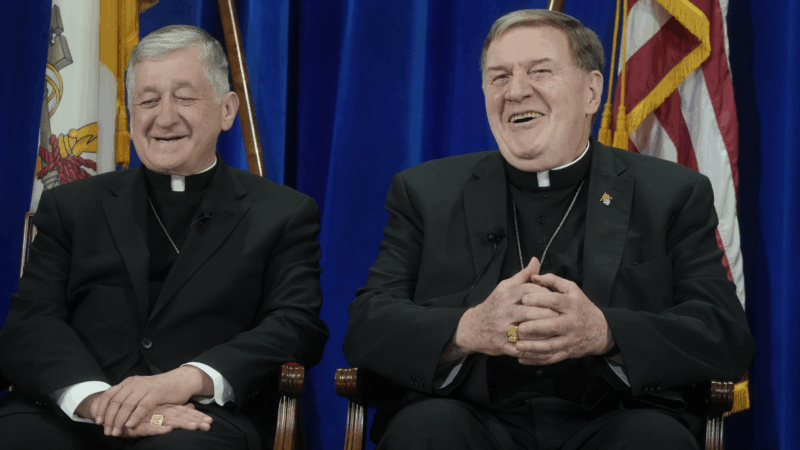

Top U.S. archbishops denounce American foreign policy

The three most-senior cardinals leading U.S. archdioceses issued the rebuke in a joint statement on Monday, saying recent policies have thrown America's "morale role in confronting evil" into question.

Italian fashion designer Valentino dies at 93

Garavani built one of the most recognizable luxury brands in the world. His clients included royalty, Hollywood stars, and first ladies.

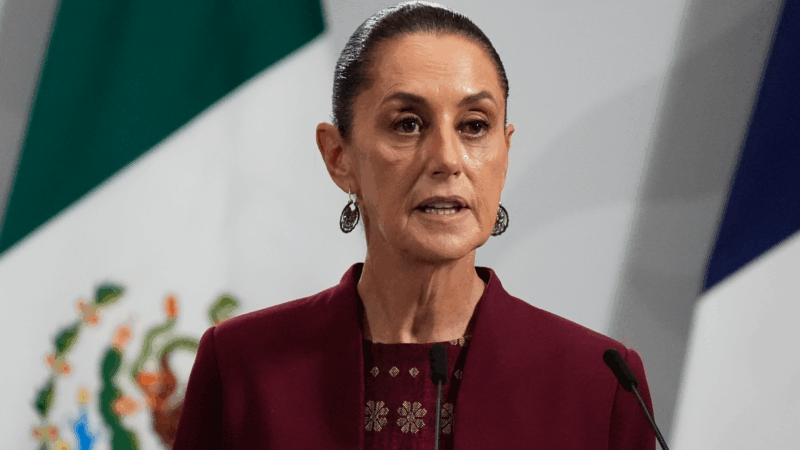

Sheinbaum reassures Mexico after US military movements spark concern

Mexican President Claudia Sheinbaum quelled concerns on Monday about two recent movements of the U.S. military in the vicinity of Mexico that have the country on edge since the attack on Venezuela.

Trump says he’s pursuing Greenland after perceived Nobel Peace Prize snub

"Considering your Country decided not to give me the Nobel Peace Prize… I no longer feel an obligation to think purely of Peace," Trump wrote in a message to the Norwegian Prime Minister.

Can exercise and anti-inflammatories fend off aging? A study aims to find out

New research is underway to test whether a combination of high-intensity interval training and generic medicines can slow down aging and fend off age-related diseases. Here's how it might work.