5 financial habits to leave behind for a more prosperous new year

At this moment, right at the start of the new year, you may be looking at your credit card bills or bank statements and thinking: Oh boy. I really need to get my finances in order.

Maybe you were a little too click-happy with your online shopping in 2024. Maybe you missed a few credit card payments. Or maybe you got stuck with a medical bill you can’t pay off, and it’s having a domino effect on your finances.

If you want to get a better handle on your spending in 2025, Life Kit’s experts are here to help. They share five financial habits to leave behind in 2024 — so you can save money and have a more prosperous new year.

Habit to leave behind: Getting influenced into buying things you don’t need (and can’t afford)

This section comes from a story published on Sept. 5, 2024, by Stacey Vanek Smith

In a world of flash sales and ads that follow you from site to site, the temptation to shop online is everywhere. To curb your impulse spending, limit your exposure to shopping deals and “get a grip on your social media,” says sustainable fashion writer Aja Barber.

- Unfollow any social media accounts that persuade you to spend money, says fashion industry professional Elysia Berman. That includes fashion influencers, stylists and clothing brands.

- Unsubscribe from the email lists of your favorite brands, says Barber. Getting daily or weekly updates about sales and price reductions is not helpful.

- Follow mindful consumption influencers and groups. Berman made a point to follow people who were also working on changing their spending habits. “They became almost like a support group,” she says.

- Block websites where you tend to impulse-shop. Berman did this with some of her top fashion sites. “That way, I wasn’t even tempted to browse,” she says.

Find out how the “no-buy challenge” can save you money.

Habit to leave behind: Feeling like you need more expensive things

This section comes from a story published on July 15, 2022, by Ruth Tam and Michelle Aslam

When people get a raise or a new job and start making more money, their spending often starts ticking up. “They immediately look around at other people making six figures and say, ‘Oh, this is the level we’re at now. I have to get a bigger house. I have to upgrade my home,'” says financial educator Yanely Espinal.

This spending behavior — called “lifestyle creep” or “lifestyle inflation” — can start to snowball. It’s why some people who earn hundreds of thousands of dollars a year find themselves living paycheck to paycheck, says Espinal.

If you’re making more money, your savings rate should also increase. Adjust how much you save based on what you earn. If you have the option, ask your employer to make a direct deposit into your high-yield savings account so that the saved money is automatically set aside. You don’t need to deprive yourself of everything you want. Just be aware of your spending and whether those habits are working for you.

Learn more about lifestyle creep here.

Habit to leave behind: Paying for subscriptions you don’t need or use

This section comes from an episode that aired Feb. 12, 2024, and was hosted by Liliana Maria Percy Ruiz

The first thing you’re going to do is check your credit card statements, your bank statements and the subscriptions tab on services like Google and Apple. Make a list of what you are paying for and when each one expires or renews, and then figure out what you use. If you don’t use a service at all and don’t expect to, that’s easy — get rid of it.

But what do you do about the subscriptions you sometimes use? Make a TV diary, says NPR TV critic and media analyst Eric Deggans. It can help you decide on whether those apps stay or go.

“Take two weeks or even a month, and just monitor what you watch and what you like,” he says. “Don’t change your habits at all.”

You may discover that “you’re spending a lot more time on YouTube than you thought. So maybe you want to get the ad-free version,” says Deggans. To pay for it, you may decide to jettison another premium subscription or get the standard plan with ads.

Listen to our episode on how to save money on streaming services.

Habit to leave behind: Ignoring your credit card debt

This section comes from a story published on Sept. 11, 2024, by Marielle Segarra

If you find yourself routinely missing credit card payments, come up with a plan to pay down your debt, says Espinal.

Free online calculators can help you do that. Let’s say you have a $500 balance on a 0% card. If you make monthly payments of $50, it will take you 10 months to pay off your debt.

Make sure you factor those payments into your monthly budget. Take a look at your savings, assets and income, as well as your debt, fixed expenses like rent and fluctuating monthly expenses, and then figure out how and when you can pay that credit card bill off.

Espinal says that she was struggling with credit card debt in 2014 and that having a plan to pay it off gave her a way forward. “I knew that by October 2015, I was going to make my last payment. I was going to be debt-free.”

Find more smart credit card habits here.

Habit to leave behind: Settling with a medical bill you can’t afford

This section comes from a story published on March 30, 2023, by Marielle Segarra, Sylvie Douglis, Iman Young and Christina Shaman

If you get a medical bill you can’t afford, here’s what you can do to get rid of, reduce or negotiate the bill, according to Jared Walker, founder of Dollar For, a nonprofit that helps people eliminate their medical bills.

1. See whether you’re eligible for the hospital’s charity care program. Walker says nonprofit hospitals are required to provide free or reduced-cost care to patients within a certain income range, which varies from hospital to hospital. It’s not always advertised, so reach out and ask about it.

2. If you don’t qualify for financial assistance, ask the billing office for an itemized bill. This will show all the procedures you received and each one’s associated code, called a Current Procedural Terminology (CPT) code. Look over your bill (you may have to look up the CPT codes), and ensure the charges accurately reflect your treatment.

3. If your bill is technically correct, you can try to negotiate the amount owed. “I always tell people the numbers are fake. They don’t matter. It can always be lowered,” says Walker.

If you have some savings and you can afford to pay something up front, call the billing office and ask for a settlement amount, or what they’ll accept if you pay the bill that day. “Typically, we can get 30 to 50% off,” says Walker.

4. If paying something up front isn’t an option, you can ask the hospital to put you on a payment plan, which typically has lower interest rates than a credit card.

Find more tips on how to negotiate your medical bill here.

The digital story was edited by Meghan Keane. The visual editor is Beck Harlan. We’d love to hear from you. Leave us a voicemail at 202-216-9823, or email us at LifeKit@npr.org.

Listen to Life Kit on Apple Podcasts and Spotify, and sign up for our newsletter. Follow us on Instagram: @nprlifekit.

Reflections after 43 years in an Alabama prison

James Jones is one of thousands of men who served life without parole in an Alabama prison. He spent 43 years at the St. Clair Correctional Facility before being released at the age of 77.

U.S.-Russia ballerina freed in prisoner swap

Ksenia Karelina, jailed over a $50 donation to Ukraine, released after U.S.-Russia prisoner swap.

Healing soup recipes, Part 2: Definitely not your grandma’s chicken soup!

The second installment of our soup-a-thon. Vicky Hallett and Genevieve Villamora, correspondents. Marc Silver, digital editor. Radio interview ran last week. Digital publishing Thursday at 7 a.m.

‘The Amateur’ and 3 more buzzy movies in theaters this weekend

Rami Malek plays a CIA data analyst out of his depth in The Amateur, while Warfare depicts a real-life Iraqi mission, calibrated as a cinematic show-of-force.

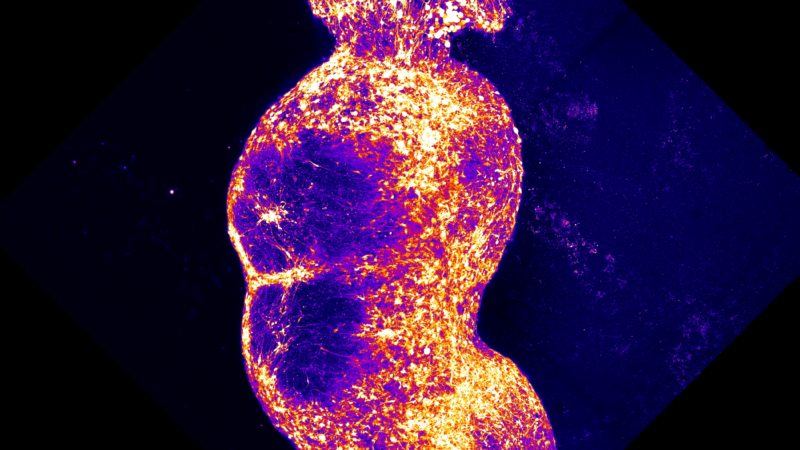

Pain pathway in a dish could aid search for new analgesic drugs

Scientists have recreated a pathway that senses pain, using clusters of human nerve cells grown in a dish.

Asia markets soar, after President Trump pauses global tariffs

Asia markets followed Wall Street's gains after Trump announced a pause on higher global tariffs, but investors are still looking to Beijing for reaction.