Still in Vacation Mode? Tax Holiday Aims to Snap You Out of It

Alabama’s back-to-school sales tax holiday begins tomorrow and runs through the weekend. It’s a chance to get folders and highlighters and a lot of clothing tax-free. If it seems awfully early, it’s because it is. Part of the reason is in the past, some school systems started back before the tax holiday, which meant a lot of families had to miss out on the savings. The Alabama Retail Association says this is the first year the tax holiday will take place in July. The legislature last session approved moving it from August.

In about three weeks, Laura Gallitz’s daughter starts her first day as a fourth-grader at Birmingham’s Avondale Elementary School. And like a lot of parents, Gallitz has already had to look at the dreaded school supplies list. Fortunately, she says, there’s nothing on there that would send her on a wild goose chase looking for that one weird item on the list.

“It’s not like the year when we had to bring a pack of one color of construction paper when she was in kindergarten. That was pretty difficult to find,” she says.

This year, she says it’s all pretty standard. And for parents venturing out for the state sales tax holiday, it’ll be cheaper. All weekend, items from belts to backpacks will be tax-free. Even diapers will be tax-free all weekend. Here’s a handy little infographic on the tax holiday.

Melissa Warnke, a spokeswoman for the Alabama Retail Association, says the tax holiday helps parents. But retailers love it, too, especially in July when a lot of people travel or their brains are still at the beach. “It kind of helps bring in some extra foot traffic during a time when they’re not typically as busy,” she says.

It also helps that Georgia is skipping its sales tax holiday this year. Warnke expects to get some Georgia shoppers crossing over into east Alabama.

More than 300 Alabama cities and counties will participate in the sales tax holiday. You might think it’s not to a municipalities’ benefit to offer a three-day tax break. After all, that’s money on the table. But Warnke says while people are buying tax-exempt items, they’re also picking up a lot of taxable things. “They’re eating out in restaurants while they’re out shopping, they’re purchasing gas, so it really is kind of a spending boost that weekend,” Warnke says.

State sales tax revenues have gone up year over year in August during the school tax holiday most years.

But the savings aren’t worth braving the crowds for some parents. Gallitz tried it, and she says it’s too much like Black Friday. “It’s just been a nightmare,” she says. “I mean I’m steering clear of Walmart and Office Depot. I hope I don’t need anything for my house.”

Instead, this weekend, most of her back to school prep will be mentally preparing for the big shift in routine on that first day of school.

Supreme Court blocks redrawing of New York congressional map, dealing a win for GOP

At issue is the mid-term redrawing of New York's 11th congressional district, including Staten Island and a small part of Brooklyn.

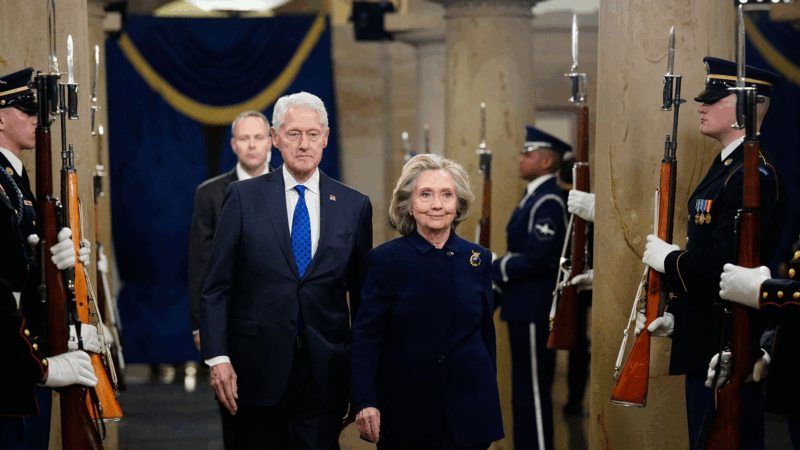

Video of Clinton depositions in Epstein investigation released by House Republicans

Over hours of testimony, the Clintons both denied knowledge of Epstein's crimes prior to his pleading guilty in 2008 to state charges in Florida for soliciting prostitution from an underage girl.

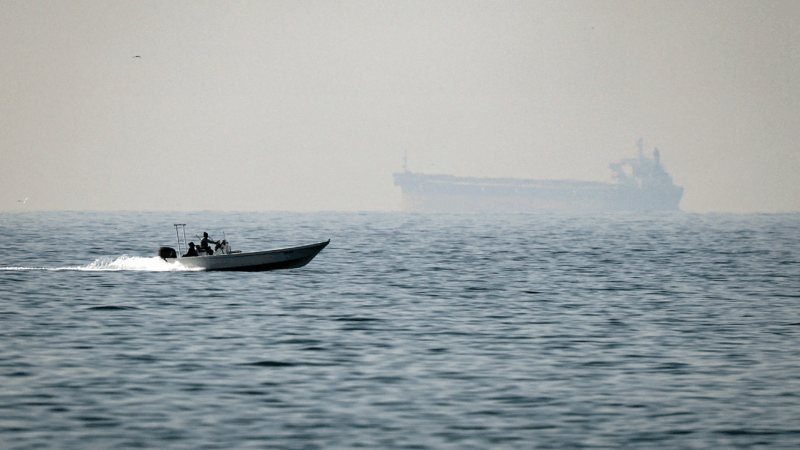

Some Middle East flights resume, but thousands of travelers are still stranded by war

Limited flights out of the Middle East resumed on Monday. But hundreds of thousands of travelers are still stranded in the region after attacks on Iran by the U.S. and Israel.

‘Hamnet’ star Jessie Buckley looks for the ‘shadowy bits’ of her characters

Buckley has been nominated for a best actress Oscar for her portrayal of William Shakespeare's wife in Hamnet. The film "brought me into this next chapter of my life as a mother," Buckley says.

How, who, and why: NPR flips its famous letters to defend the right to be curious

NPR is standing up for the public's right to ask hard questions in a national campaign dubbed "For your right to be curious." At NPR's headquarters, on billboards in New York City, Chicago, and Washington, D.C., and across social media, NPR's three iconic letters transform into "how," "who," and "why" — a bold declaration of its commitment to fight for Americans' right to ask questions both big and small.

Oil prices surge, but no panic yet, as Iran war continues

Global oil prices are in the high $70s as traffic through Strait of Hormuz comes to a halt. Some analysts have warned they could top $100 a barrel if the stoppage is prolonged.