Changes to Historic Tax Credits May Put Legislation on Shaky Ground

Twenty million dollars. That’s how much Alabama would award each year in historic tax credits with the latest bill under consideration. There are two versions: One in the House and one in Senate. Some have concerns over how the Senate proposes to divide the money statewide, and the potential effect on Civil Rights landmarks. Virginia Martin wrote about the tax credits for the non-profit news site BirminghamWatch. And she tells WBHM’s Gigi Douban what’s new in this version of the bill.

The Highlights

The state’s historic tax credit program helped make old buildings new again by providing financing many developers said was crucial. The historic preservation tax credit expired in 2016 after a three-year run. Commercial projects were eligible for up to $5 million in credits under the program that lapsed.

There’s strong support in the legislature to revive the historic tax credits program, with a few key changes:

A new committee, the Historic Tax Credit Evaluating Committee, would decide which historic renovation projects will receive tax credits. This used to be decided by the Alabama Historical Commission.

The state’s $20 million tax credit money would be divided among Alabama’s seven congressional districts. If they’re not claimed in three months, the money returns to the big pot. That’s an amendment proposed by the Senate.

Birmingham and Mobile benefitted the most from the state’s historic tax credits. Twenty of 51 historic tax credit projects were in Birmingham, including the Florentine Building, the Thomas Jefferson Hotel, and the Pizitz Food Hall.

How old a building needs to be to qualify for credits is at issue with one proposed change to the legislation. The Senate wants to increase the age requirement so that a building must be at least 75 years old to receive the tax credits; the previous bill and national guidelines have a 50-year rule. The change would mean buildings with historic significance tied to the Civil Rights era aren’t old enough to qualify for historic tax credits.

Parents, are you sure your kid’s car seat is installed right? Here’s how to know

In this visual guide, certified car seat experts walk through common installation mistakes and how to fix them. Learn what a secure car seat base and a tightly fastened tether look like and more.

Trump announces ‘major combat operations’ in Iran

Israel and the U.S. have launched strikes against Iran, with explosions reported in Tehran and air raid sirens sounding across Israel.

Trump says he is ‘not happy’ with the Iran nuclear talks but indicates he’ll give them more time

U.S. President Donald Trump said Friday he's "not happy" with the latest talks over Iran's nuclear program but indicated he would give negotiators more time to reach a deal to avert another war in the Middle East.

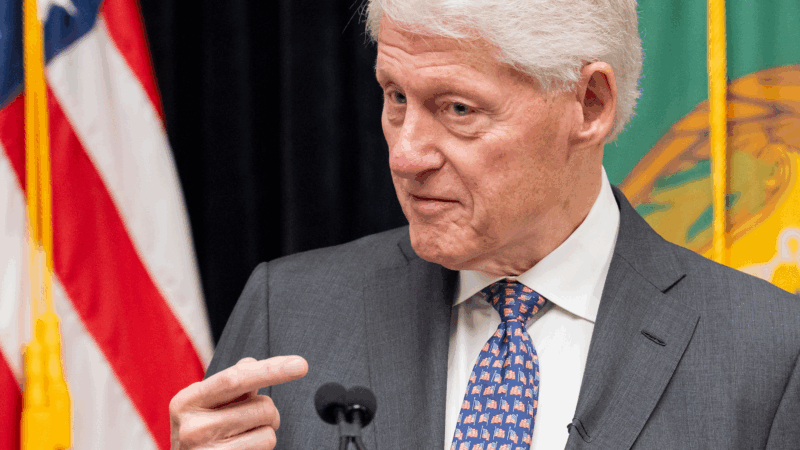

Bill Clinton says he ‘did nothing wrong’ with Epstein as he faced grilling over their relationship

Former President Bill Clinton told members of Congress on Friday that he "did nothing wrong" in his relationship with Jeffrey Epstein and saw no signs of Epstein's sexual abuse as he faced hours of grilling from lawmakers over his connections to the disgraced financier from more than two decades ago.

How the federal government is painting immigrants as criminals on social media

Experts say this kind of media campaign is unprecedented and paints a distorted picture of immigrants and crime

Pentagon puts Scouts ‘on notice’ over DEI and girl-centered policies

After threatening to sever ties with the organization formerly known as the Boy Scouts, Defense Secretary Hegseth announced a 6-month reprieve