Occupational Tax: An Overview

Jefferson County department heads have until June 1st to come up with a plan to cut their budgets by 33%. This comes on top of 10% they cut last month. The belt-tightening is all because of the occupational tax. And if that makes your eyes glaze over, you’re not alone. The occupational tax and its legal limbo is complicated. We thought we’d break it down for you. We’ve got three reports — the first, from WBHM’s Tanya Ott.

Recently, I asked a couple of friends if they could explain Jefferson County’s occupational tax. One – a humor writer – said “Sure. It’s been keeping everyone occupied for weeks, and it’s taxing our patience!” Nice cover, Don, but I suspect many folks just don’t know what it is or why they should care, other than the doomsday news headlines.

The occupational tax is a half-percent tax on the wages of most people who work in Jefferson County. It was created 22 years ago to fund construction of the Jefferson County Jail. But since then it’s ballooned. Today, the tax is the county’s third-largest source of revenue, generating $75 million a year.

But here’s the rub. There are exceptions to who pays the tax. Doctors and lawyers, who already pay a state license fee, don’t have to pay the occupation tax. It gets pretty complicated. But critics of the tax say one line from a Birmingham News article last year really captures the problem: Fortune tellers are exempt; bank tellers aren’t. Private detectives are exempt. Police detectives aren’t. Critics say the tax just isn’t fair – and they’ve filed multiple lawsuits that kept the occupational tax in legal limbo for the better part of two decades. With details on that, here’s WBHM’s Bradley George.

The first serious blow to the occupational tax came in 1998. That’s when a judge struck down the tax and ordered a new version without the exemptions. The next year, the state legislature voted to repeal the tax altogether. Jefferson County officials and employees sued. They argued there weren’t enough legislators present for the vote on the repeal. A judge agreed and reinstated the tax with the exemptions in place.

Then, four years in a different case, the state Supreme Court ruled that the legislature doesn’t need a specific quorum to do business. Attorney Sam Hill used this as the basis of his lawsuit against Jefferson County, which he filed in 2007.

“If the ruling in 2005 was void, then so was the ruling in 2000 because it violated the constitution, then so was the ruling in 2000 that struck down the repeal. So it was our argument that the judge’s ruling in 2000 was void and the repeal was valid.”

Confused? Just know that after years of wrangling, the Judge agreed. In January of this year he voided the tax, but allowed Jefferson County to continue collecting it until the last day of the legislative session – last Friday. County officials had hoped the Jefferson County legislative delegation would create a new version of the tax. But state lawmakers got tangled up in the original mess of who, if anyone, should be exempt from the occupational tax. So now, Jefferson county leaders are back at square one, facing the possibility of losing $75 million a year in revenue. WBHM’s Andrew Yeager has that part of the story.

“You can’t get blood out of a turnip.”

That’s Jefferson County Commission President Bettye Fine Collins. Earlier this week, she ordered county department heads to come up with a plan to cut one-third of their budget. Collins says up to 1,200 jobs could be at risk.

Other commissioners argue for furloughs and salary cuts, before layoffs. But Collins says she doesn’t see how they can trim the budget by 33% without letting people go, shutting satellite courthouses, and canceling unnecessary contracts.

“I don’t mind telling you, I think there’ll be a lot of lawsuits filed about some of this, but we have no choice. It’s either close our doors or go ahead and take drastic measures.”

Collins could ask Governor Bob Riley to call a special legislative session on the occupational tax. But she says she doesn’t see the point because state lawmakers can’t agree on what action to take. Riley echoes that sentiment saying the legislature could design whatever solution they want…

“But again you’ve got to have a consensus among the legislative body. I haven’t seen that any time during the last legislative session.”

Meanwhile, the showdown continues. Commissioner Collins says the county can continue collecting the occupational tax while the lawsuit is on appeal. Opponents say ‘no way’ and they’ve filed their own motion. So right now, all eyes are on June 1st, the day those proposed budgets cuts are due.

~ Tanya Ott, Bradley George and Andrew Yeager, May 19, 2009

Oil prices rise sharply in market trading after attacks in Middle East disrupt supply

The high prices came as U.S. and Israeli attacks on Iran and retaliatory strikes against Israel and U.S. military installations around the Gulf sent disruptions through the global energy supply chain.

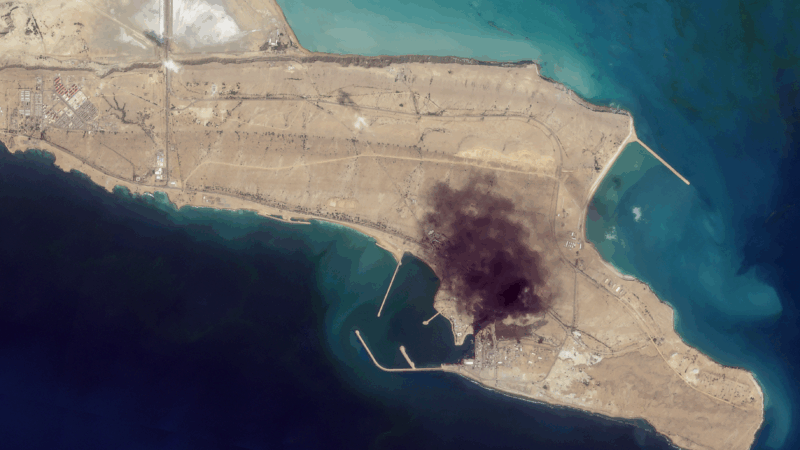

Satellite images provide view inside Iran at war

Satellite images from commercial companies show the extent of U.S. and Israeli strikes, and how Iran is responding.

Mideast clashes breach Olympic truce as athletes gather for Winter Paralympic Games

Fighting intensified in the Middle East during the Olympic truce, in effect through March 15. Flights are being disrupted as athletes and families converge on Italy for the Winter Paralympics.

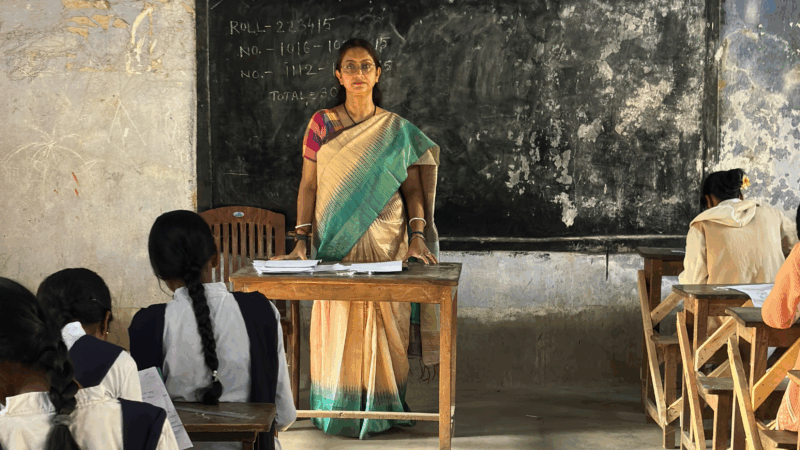

A U.S. scholarship thrills a teacher in India. Then came the soul-crushing questions

She was thrilled to become the first teacher from a government-sponsored school in India to get a Fulbright exchange award to learn from U.S. schools. People asked two questions that clouded her joy.

U.S.-Israeli strikes in Iran continue into 2nd day, as the region faces turmoil

Israel said on Sunday it had launched more attacks on Iran, while the Iranian government continued strikes on Israel and on U.S. targets in Gulf states, Iraq and Jordan.

Trump warns Iran not to retaliate after Ayatollah Ali Khamenei is killed

The Iranian government has announced 40 days of mourning. The country's supreme leader was killed following an attack launched by the U.S. and Israel on Saturday against Iran.