Small Banks

Mike Washburn, president and CEO OF Red Mountain Bank, says that his bank’s iconoclastic delivery of financial services and customer service is no fluke. It’s a natural outgrowth of his own experience working for a major holding company.

“I started looking around and realized that I felt that we could do some things different, do some things better.”

Such as providing specialized products and services for smaller businesses.

“And, then we also, on the other side have an emphasis on the high touch retail that you’ll find in our lobby. Where again, warm and inviting environment, a place where you’ll spend or want to spend more time then you typically do when you enter a bank.”

Washburn is part of a small, but growing trend: career bankers who choose to open their own “community banks.” As a group, bankers aren’t known for their entrepreneurial spirit. Still, the number of “denovo” banks – new banks that have applied for charters in the last few years – has skyrocketed, according to Camden Fine, president and CEO of the Independent Bankers of America.

“To give you an idea, since January 1, 2001 there were 677 denovo community banks chartered.”

Fine says many bankers, who are in the middle and upper levels of mega banks, begin to feel like a cog in a big machine. They want to know their customers, provide more specialized services, and generally do it their way.

“You’re getting highly experienced bank management chartering these denovo banks. These 20, 25, 30 year veteran bankers, and you have a nice mix of the newer bankers just coming into the business with the experienced bankers. So, what you see is these denovo banks coming right out of the chute. I mean they hit the ground running and they are effective competitors in their local areas very rapidly.”

For example, Steve Smith, president and CEO of SouthPoint, a small privately owned bank in Inverness, says, his staff is not comprised of young renegade bankers, thumbing their nose at the establishment. When recounting his staff’s experience.

“One has 31 years. I have 23. Most are in the twenties, twenty years of experience. We tell people, all the time, that we have a group of bankers who can, in essence, deliver to the market the same thing a big bank does, and it’s in a better way. It’s a better mousetrap, we think.

At Noble Bank in Anniston, that better mousetrap means having the ability to think creatively, be more nimble, and color outside the lines. Anthony Humphries is president and CEO.

“We’re able to take a situation, that may not be able to fit exactly in somebody’s box, but we know these people, we’ve known them for twenty years, we know they’re a good risk, there’s things that we can do.”

According to Keith Leggett, Senior Economists for the American Banking Association, it’s this ability to actually know and trust the customers and simplify basic services that separates the David’s from the Goliaths, especially if the customer is a small business.

“I think small businesses like doing business with other small businesses. And, when you look at a locally owned community bank, one of the things that are important to locally owned small businesses is that the decisions that are being made are local. The community banker is there during good time and bad. They’re going to stick through a relationship. And, that’s very important to a small business owner, is that they know they can count on this relationship.”

Small bank customer, Keith Waltcheck agrees. He’s owner of Shannon Waltcheck Investment Real Estate, located in Homewood.

“The key is trust. And, for the banker who you’ve developed a relationship with, you know what to expect from him, he knows what to expect from you. Probably like a family doctor. If you’ve been to a doctor for a number of years, and that doctor knows you. Like he knows that you get frequent sinus infections. And, so instead of having to go in and see a doctor who doesn’t know you to get the prescription that you need, you can call and say, doc, I have a sinus infection, and he calls in an antibiotic, and you don’t have to go in and see him.”

Mega holding companies are taking note. The big banks are becoming more nimble, more focused on trying to provide better service. Charles McCombs is Wachovia’s Community Bank Executive for the MidSouth, and Texas. He says that in the past, Wachovia was losing market share in small communities … often because decisions were made far from the communities where the banks were located. However, now…

“We realize in our community markets that every market is different. So, we don’t have a strategic plan set from Charlotte saying this is how you run your market. We do have a market plan, that we let them develop, and help them develop, but it’s unique to each market.”

These individualized marketing plans include specialized advertising.

“…to give the hometown feel. We do advertising in newspapers. And, we have our bankers’ pictures in the paper. Because a lot of people know who our bankers are. We’ve also done some ads talking about what they are involved in, in the community. Because we want our bankers not only to have a job, and work at Wachovia, we want them to be involved in the community, be known, be in civic organizations, coach little league team, etc.”

Keith Leggett, of the American Banking Association says there are no studies to prove customers prefer smaller communities banks. Some value the convenience of the more expansive geographic footprints of larger banks.

But Anthony Humphries, of Noble Bank, believes the creative culture of community banks will continue to draw experienced bankers, as well as customers who are looking for a financial institution.

“Where people will speak to them, take time with them, give them cold water when they come into the bank on a 95 degree day, and hot chocolate in the winter. So, yeah, ours is targeted for those that are big bank customers that want to experience what they did 10 and 15 years ago.”

As Mississippi waits to spend opioid settlement funds, children and families suffer

Mississippi will receive more than $400M to fight the opioid epidemic. So far, officials haven't directed it toward programs that support addiction recovery.

Alabama’s new state climatologist takes the reins

The controversial John Christy is retiring as Alabama’s state climatologist. Lee Ellenburg now assumes the role and is already making a few changes, including declaring that climate change is real and caused by humans.

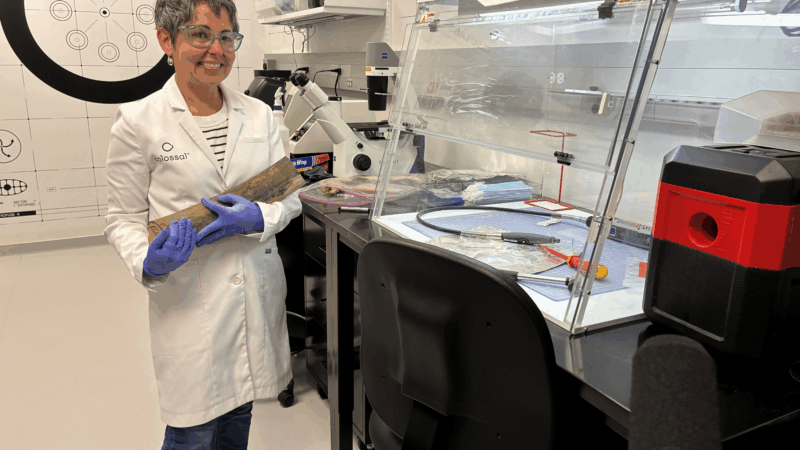

Colossal Biosciences breeds controversy while trying to revive mammoths

A Texas biotech company is trying to bring mammoths and other extinct creatures back to life. The science is as intriguing as the ethical questions are thorny.

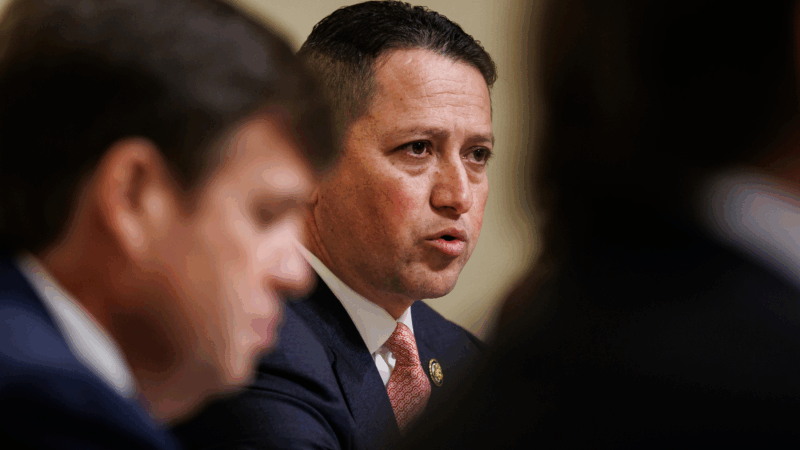

GOP Rep. Tony Gonzales heads to a runoff in Texas amid a new ethics probe in the House

Texas Republican Rep. Tony Gonzales has faced increasing pressure from his party to resign or drop out of his race after allegations of an affair with a staffer.

Satellite images show Iran school strike hit more targets than earlier reported

The images suggest that precision munitions struck other buildings, including a clinic that was also inside the complex.

A Biden-era rule sought to stabilize child care. Why Trump wants it gone

The Trump administration has proposed repealing a Biden-era rule that required states to change how they pay out child care subsidies, citing the potential for fraud.