Trump is looking to use the IRS for his own political ends. Nixon tried it too

From utilizing tax data to trace immigrants without legal status to threatening Harvard University’s tax exemption, President Trump has been trying to use the IRS for his own political purposes, in ways that may seem unprecedented.

But they’re not. Former President Richard Nixon laid the groundwork more than four decades ago, when he tried to use the tax collector to punish his enemies and assist his friends.

“One of the things that Nixon did consider was threatening the tax-exemptions of universities,” says Joseph Thorndike, director of the Tax History Project at Tax Analysts. “And that sounds very familiar if you’re reading the paper these days.”

Nixon was angry at universities for not cracking down on Vietnam war protesters. Trump has similarly complained about Harvard and other Ivy League schools not doing more to silence protests against the war in Gaza, amid an administration crackdown on antisemitism on college campuses.

“We are going to be taking away Harvard’s Tax Exempt Status,” Trump wrote in a social media post. “It’s what they deserve!”

Trump is drawing on Nixon’s old playbook, despite laws put in place after Watergate to prevent that kind of meddling by the White House.

Congress has protections in place for the IRS

Oval Office recordings from 1971 reveal how Nixon sought to install a hand-picked enforcer at the IRS to do his political bidding.

“I want to be sure he’s a ruthless son of a bitch,” Nixon told aides about a potential IRS nominee. “That he will do what he’s told. That every income tax return I want to see, I see. That he’ll go after our enemies and not go after our friends. It’s as simple as that.”

Nixon’s plans to snoop on tax returns, or have the IRS investigate targets from his “enemies list,” were not always successful, Thorndike says.

But not for lack of trying.

“Nixon tried very hard to misuse the IRS,” Thorndike says. “Congress certainly saw that as a danger afterwards. If the president is developing enemies lists and sending them to the IRS and essentially saying, ‘I want you to audit all these people I don’t like,’ that’s worrisome. And so Congress was very interested in preventing that.”

After Nixon left office, Congress passed laws to protect the IRS — and taxpayers — from political interference from the White House. Those laws are now being tested by the Trump administration.

Sharing tax information with agencies outside the IRS

For example, Congress passed a law to strictly limit who can access information that taxpayers voluntarily provide to the IRS.

But last month, the tax collection agency struck a deal to share some of that taxpayer data with immigration officials to help find and deport people who are in the country illegally.

Immigration advocates are seeking a court order to block the IRS from sharing data with other government agencies.

In response to an inquiry from NPR about the data-sharing agreement, a Treasury Department spokesperson defended the initiative as “breaking down data silos.” But critics say those silos were put there for a reason after the Nixon era.

“If the IRS is now forced to share data with people who it’s not supposed to, that increases the risks of political targeting,” says Mike Kaercher, deputy director of the Tax Law Center at New York University.

An acting commissioner at the IRS resigned shortly after the data-sharing agreement was reached. Trump is now on his fourth acting commissioner since taking office less than four months ago. His nominee for the permanent job, former Rep. Billy Long, R-Mo., is still awaiting a confirmation hearing.

Seeking to use the IRS to target groups

Congress also tried to prevent a rerun of Nixon’s enemies list by prohibiting the president and people around him from requesting or interfering with an IRS investigation.

“I used to work at the IRS,” Kaercher says. “If you’re an IRS person and you’re on the receiving end of an improper request from a political official to use the IRS as a weapon, you’re supposed to go to the inspector general and report that, right away.”

That hasn’t stopped Trump from insisting the IRS should strip Harvard and other non-profit groups of their tax-exempt status — which would presumably require an investigation.

Losing the tax break would be a severe blow to Harvard, which depends on tax-free gifts and its tax-free endowment for nearly half its annual budget.

“I think Harvard is a disgrace,” Trump told reporters last month. “Tax-exempt status, I mean, that’s a privilege. That’s really a privilege. And it’s been abused.”

While Nixon’s plans for the IRS were secretly recorded in the Oval Office, Trump unveils his on social media and live television.

“Donald Trump just says it right out loud,” Thorndike says. “Talking about politicizing the agency quite visibly — I guess I’d say that’s a choice. I don’t think it’s a good choice for the president.”

Trump told reporters last month that he’s not personally involved in the decision over revoking Harvard’s tax exemption. But leading Democratic senators have called for an investigation of the president’s actions by the inspector general who oversees the IRS.

The inspector general did not respond to NPR’s request for comment.

“The fact that there’s even a question of whether the administration is violating these laws that prevent weaponization of the IRS is deeply troubling,” says Kaercher.

Gutting tax enforcement at the IRS

At the same time the administration is calling for the IRS to investigate individual targets, it is also severely limiting the agency’s ability to go after wealthy tax cheats more generally.

According to an inspector general’s report, the administration has cut more than 11,000 jobs at the IRS, including nearly a third of the tax auditors. More downsizing is expected in the months to come, as part of a widespread effort to shrink the federal government.

That’s likely to hurt the federal budget, since every dollar spent on tax enforcement more than pays for itself in increased tax collections.

“A functioning, effective IRS is in all of our interests,” Thorndike says. “And just starving the agency of staff, that really blows back immediately on taxpayers.”

GOP Rep. Tony Gonzales of Texas ends reelection bid after admitting to affair with aide

Republican Rep. Tony Gonzales of Texas said late Thursday he was withdrawing from his reelection race, after having admitted an affair with a former staff member.

Pentagon labels AI company Anthropic a supply chain risk

The Pentagon said in a statement Thursday that it has "officially informed Anthropic leadership the company and its products are deemed a supply chain risk, effective immediately."

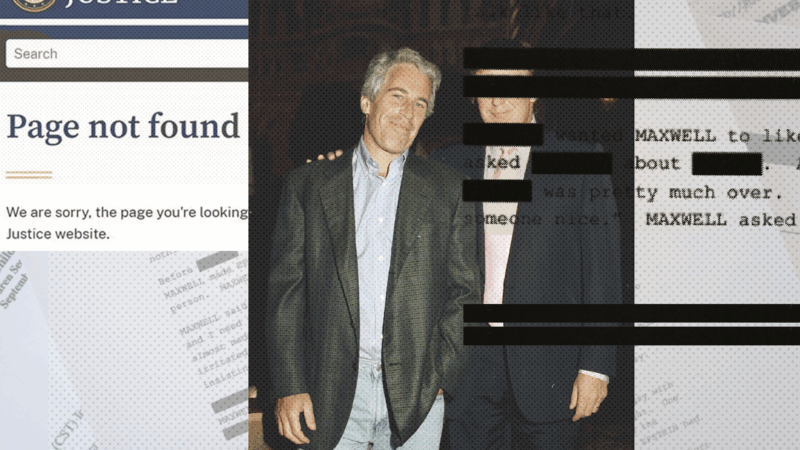

Justice Department publishes some missing Epstein files related to Trump

The Justice Department has published additional Epstein files related to allegations that President Trump sexually abused a minor after an NPR investigation found dozens of pages were withheld.

Pregnant women in ERs took less Tylenol after Trump autism warning

A study in The Lancet finds that pregnant women in emergency rooms used less Tylenol after President Trump said it could raise their babies' risk of autism. Scientists say there is no proven link.

Mixed reactions, including relief, greet news the Coast Guard is buying BSC campus

The U.S. Coast Guard will take possession of the 192-acre campus in the northeast corner of Birmingham’s Bush Hills Neighborhood and will begin work to refit it as a training center for officers and enlisted personnel.

What you need to know about Sen. Markwayne Mullin, Trump’s new pick to lead DHS

President Trump announced Thursday that Sen. Markwayne Mullin, R-Okla., is his pick to replace Kristi Noem as the head of the Department of Homeland Security.