The Trump administration has stopped work at the CFPB. Here’s what the agency does

The main U.S. agency tasked with overseeing the financial products and services used by everyday Americans — from credit cards to checking accounts to home loans — is the latest target of the Trump administration’s effort to remake the federal government.

The Consumer Financial Protection Bureau’s new leader has shuttered the agency’s headquarters and told staffers to stay at home and refrain from doing any work.

The Trump administration team run by tech billionaire Elon Musk is also focusing some of its efforts on the CFPB. The Department of Government Efficiency — or DOGE — has accessed the CFPB’s internal computer systems and deleted its public-facing social media accounts. In recent weeks Musk has criticized the CFPB in posts on X, the social media site he owns, at one point posting: “CFPB RIP.”

Here’s what to know about the CFPB.

It was created in response to the 2008 financial crisis

Washington was looking for solutions after the devastating collapse of the U.S. banking system in 2008, which left many Americans with financial losses and raised questions about the operations of the country’s financial institutions.

One year later, then-President Obama proposed creating a new federal agency focused exclusively on protecting consumers from dubious financial products.

Backers of the idea argued that because several federal agencies were regulating the consumer banking system, there were gaps in oversight that left consumers vulnerable or confused. The new agency would consolidate those regulatory responsibilities in one place.

Some Republicans and banks opposed the idea, but its creation was included in the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was passed by Congress and signed by Obama in 2010.

What does the CFPB do?

An independent bureau within the Federal Reserve, the CFPB’s job is to ensure that the financial products and services offered to American consumers are fair and transparent.

It implements U.S. consumer finance laws and issues new rules for lenders and other financial institutions, such as one announced last year to wipe medical debt from credit reports. The CFPB also goes after companies it suspects of dishonest or illegal activity.

“At its core, it’s a law enforcement agency,” Rohit Chopra, the former director of the CFPB appointed by President Biden, told NPR on Monday. “It takes big financial institutions to court who cheat consumers, whether it’s a credit reporting agency or a large bank or a credit card giant.”

In December, the CFPB sued Bank of America, JPMorgan Chase and Wells Fargo for allegedly failing to protect customers from fraud on the payment app Zelle. Last month it sued Capitol One for failing to pay more than $2 billion in interest to its customers for advertising a high-yield checking account that actually paid an interest rate close to zero.

The agency says that, since its inception, it’s helped consumers to the tune of $21 billion through monetary compensation, loan principal reductions, canceled debt and more.

The CFPB had a budget of $823 million in the 2025 fiscal year. Its funding comes through quarterly transfers from the Fed itself, which the CFPB requests.

The CFPB has faced criticism for years — including from Trump

The agency has long faced pushback from the banking industry and some Republicans, including Trump himself.

During Trump’s first term, his administration took steps to weaken the CFPB, after the Republican vowed during his 2016 presidential campaign that he would “get rid” of Dodd-Frank.

Office of Management and Budget director Mick Mulvaney said in 2018 that the administration would “fulfill the Bureau’s statutory responsibilities, but go no further.”

Kathy Kraninger, one of the CFPB directors during Trump’s first term, was criticized for relaxing certain rules for financial institutions. Trump also proposed slashing CFPB’s funding.

In a post on X on Sunday, acting CFPB director Russell Vought said the CFPB had been “a woke & weaponized agency against disfavored industries and individuals for a long time. This must end.”

What’s next for the CFPB?

In addition to shuttering CFPB offices and telling staff to remain at home, Vought said in a post on X over the weekend that the agency would “not be taking its next draw of unappropriated funding because it is not ‘reasonably necessary’ to carry out its duties.”

For now, CFPB can use the money it has in its reserve fund to continue to pay salaries and operating expenses.

The Republican staff of the U.S. Senate Committee on Banking, Housing, and Urban Affairs said in a post on X that “[a]ccountability at the CFPB is long overdue” and that Vought would “bring responsibility back to the CFPB & refocus its mission to serve the American people.”

Democratic Sen. Elizabeth Warren of Massachusetts, who helped launch the CFPB, said in a series of posts on X that the CFPB was created by Congress and that no one in the Trump administration “can illegally shut down its work.”

Warren warned that gutting the CFPB would mean that “CEOs on Wall Street will once again be free to cheat you out of your savings.”

Auburn tabs USF’s Alex Golesh as its next coach, replacing Hugh Freeze on the Plains

The 41-year-old Golesh, who was born in Russia and moved to the United State at age 7, is signing a six-year contract that averages more than $7 million annually to replace Hugh Freeze. Freeze was fired in early November after failing to fix Auburn’s offensive issues in three seasons on the Plains.

Alabama Power seeks to delay rate hike for new gas plant amid outcry

The state’s largest utility has proposed delaying the rate increase from its purchase of a $622 million natural gas plant until 2028.

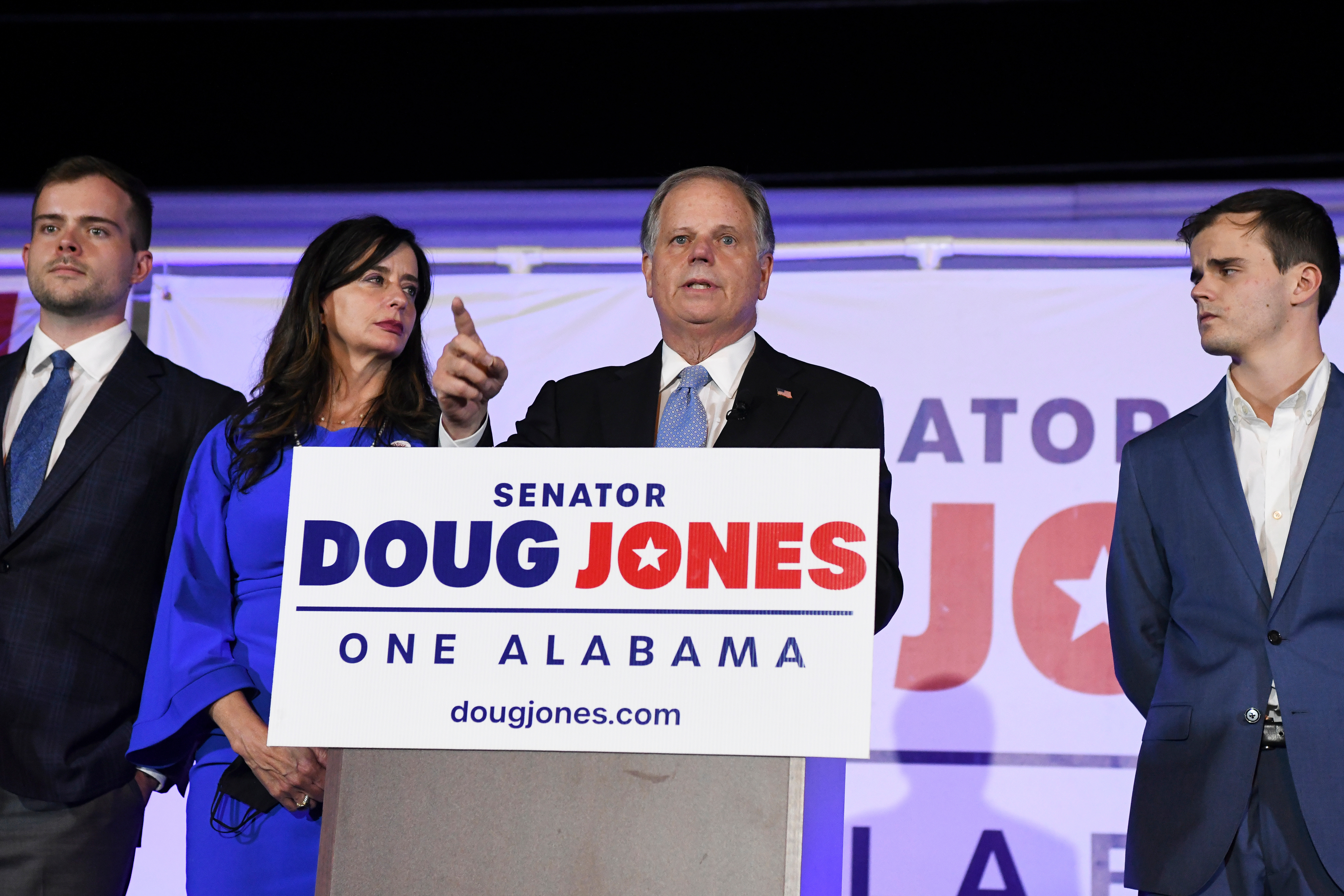

Former U.S. Sen. Doug Jones announces run for Alabama governor

Jones announced his campaign Monday afternoon, hours after filing campaign paperwork with the Secretary of State's Office. His gubernatorial bid could set up a rematch with U.S. Sen. Tommy Tuberville, the Republican who defeated Jones in 2020 and is now running for governor.

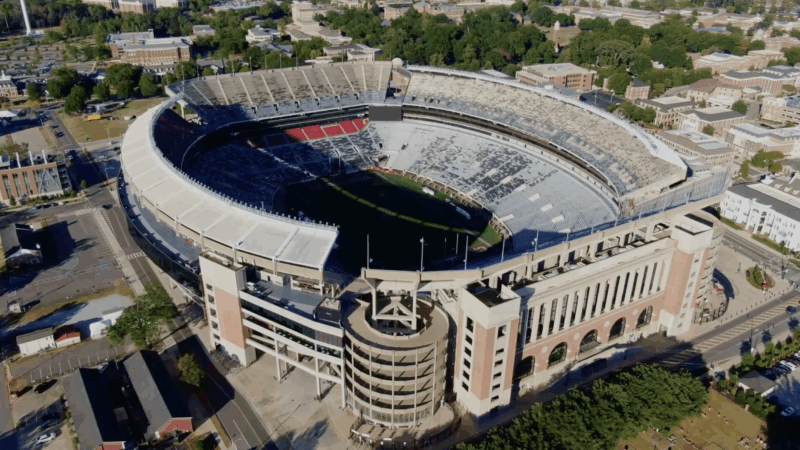

Scorching Saturdays: The rising heat threat inside football stadiums

Excessive heat and more frequent medical incidents in Southern college football stadiums could be a warning sign for universities across the country.

The Gulf States Newsroom is hiring an Audio Editor

The Gulf States Newsroom is hiring an Audio Editor to join our award-winning team covering important regional stories across Mississippi, Alabama and Louisiana.

Judge orders new Alabama Senate map after ruling found racial gerrymandering

U.S. District Judge Anna Manasco, appointed by President Donald Trump during his first term, issued the ruling Monday putting a new court-selected map in place for the 2026 and 2030 elections.