The Fed will likely hold interest rates steady as Trump’s tariffs spark uncertainty

The Federal Reserve is likely to hold interest rates steady later on Wednesday amid fears that President Trump’s tariffs will rekindle inflation and slow economic growth.

The decision to keep the Fed’s benchmark borrowing rate between 4.25% and 4.5% is widely expected by financial markets despite the president’s repeated demands for the Fed to lower interest rates.

Since the central bank’s last rate-setting meeting in March, Trump has imposed 10% tariffs on nearly everything the U.S. imports, along with 145% import taxes on goods from China. On average, Americans are now paying higher taxes on imported products than at any time since at least the 1930s, when a global trade war deepened the Great Depression.

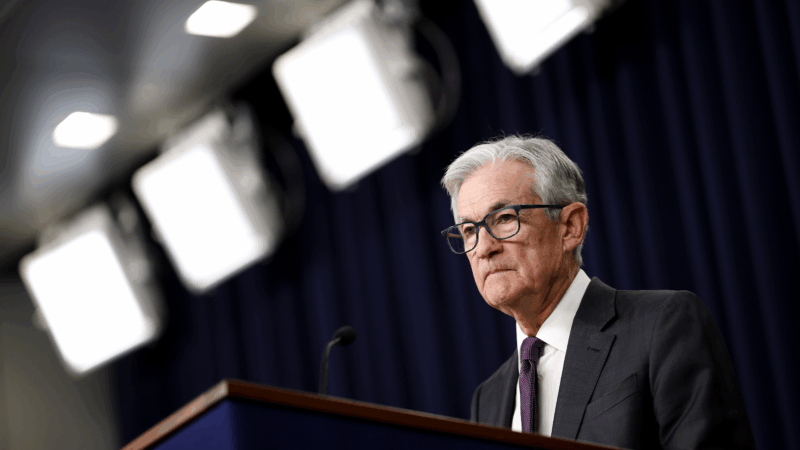

“The level of the tariff increases announced so far is significantly larger than anticipated,” Fed Chair Jerome Powell told the Economic Club of Chicago last month. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

Trump pressures the Fed

Trade tensions have led to a sharp drop in consumer confidence. But they’ve yet to put much of a dent in the job market. Hiring in April was down only slightly from the month before.

Inflation was also fairly tame in the month leading up to the new tariffs. Prices in March were up 2.3% from a year ago, according to the Fed’s preferred inflation yardstick.

Trump highlighted the recent drop in gasoline prices as he called on the Fed to cut interest rates.

“Energy down, mortgage rates down, employment strong, and much more good news,” the president wrote in a social media post last week. “NO INFLATION, THE FED SHOULD LOWER ITS RATE!!!”

Trump has frequently criticized Powell and his Fed colleagues for not cutting interest rates, even suggesting he might try to fire the Fed chair. The president appeared to back down from that threat, however, after a sharp drop in the stock market last month.

“Why would I do that?” Trump told NBC News in an interview broadcast on Sunday. “I get to change him very quickly anyway. You know, it’s in a very short period of time.”

Powell’s term as Fed chair expires in May of next year.

The Fed could be caught in a bind

Business surveys by the Institute for Supply Management found widespread alarm that Trump’s tariffs are disrupting supply chains and driving up prices.

“There is a lot of concern about the inflationary impacts from tariffs in our industry,” said the manager of a metal fabricating factory. “Domestic producers are charging more for everything because they can.”

So long as tariffs threaten to put upward pressure on prices, the Fed will be inclined to keep interest rates relatively high, in an effort to prevent inflation from spiking again. That calculation could change, however, if the job market softens and unemployment starts to climb. Ordinarily, that would push the central bank toward lowering interest rates.

The worst-case scenario for the Fed would be if tariffs push both inflation and unemployment up. Then the central bank would be torn between trying to keep prices in check with higher interest rates or fighting job losses with rate cuts.

Lack of transportation keeps many Alabamians from working. Rural public transit programs are trying to help

While lack of transportation is a major employment barrier in Alabama, few people take public transit to work. That dynamic is even more pronounced in rural areas.

When a horse whinnies, there’s more than meets the ear

A new study finds that horse whinnies are made of both a high and a low frequency, generated by different parts of the vocal tract. The two-tone sound may help horses convey more complex information.

Trump’s many tariff tools mean consumer prices won’t go down, analysts say

The Supreme Court struck down President Trump's signature tariffs. But the president has other tariff tools, and consumers shouldn't expect cheaper prices anytime soon, economists say.

Hundreds of American nurses choose Canada over the U.S. under Trump

More than 1,000 American nurses have successfully applied for licensure in British Columbia since April, a massive increase over prior years.

Tax credits for solar panels are available, but the catch is you can’t own them

Rooftop solar installers are steering customers toward leases instead of purchases. Federal tax credits for purchased systems have ended but are still available for leased ones.

5 takeaways from Trump’s State of the Union address

President Trump hit familiar notes on immigration and culture in his speech Tuesday night, but he largely underplayed the economic problems that voters say they are most concerned about.