She served the American people for 35 years. Now her retirement income is on the line

Michele Santa Maria was 18 and a year out of high school when she landed a job at the Social Security Administration’s field office in Chula Vista, Calif., in May 1990.

She started out answering phones and sorting mail. From there, she worked her way up to customer service, helping people resolve problems with their payments or get new cards. Later, she learned how to process all kinds of claims — retirement claims, survivor claims, family claims, disability claims.

Eventually, she became a claims technical expert, training others and working on complicated cases. She says the work was hard, and the antiquated computer systems added to the tedium.

“It’s a thankless job sometimes, but we’re going to stick it out because we believe in what we do,” says Santa Maria. “And yes, we want to get to that finish line.”

The finish line being retirement. The government’s formula for retirement benefits is complicated, but typically, federal workers who have put in at least 30 years can retire at age 57 with their full pensions.

“It was the reason why I stayed so long,” she says.

But now, Congress looks to be chipping away at those benefits. A provision in the version of President Trump’s “Big, Beautiful Bill” passed by the House last month would cut deeply into the retirement income she’s been counting on.

“It puts me in a really bad situation,” says Santa Maria.

Staying for the benefits

Federal employees across the country perform complex, critical work that Americans depend on. The jobs are not the most exciting, nor the best paid. Still, many federal workers stay for decades, in part because of the government’s retirement package, which far outpaces what most companies provide.

The Federal Employees Retirement System, known as FERS, is often described as a three-legged stool. It includes a pension, a Thrift Savings Plan akin to a 401(k), and — like nearly all U.S. workers — Social Security benefits.

In addition, those who retire before they’re old enough to collect Social Security can receive a special retirement supplement between the ages of 57 and 62. It’s a portion of what they’ll be eligible to receive at 62, meant to be a financial bridge for those five years.

That supplement would disappear under the House-passed bill. Federal employees who are younger than 57 on Jan. 1, 2028 would be out of luck.

“I was in shock,” says Santa Maria. “I thought to myself, ‘There’s no way they’re going to do this to us.'”

She retired because she feared she’d be laid off

Like so many federal workers, Santa Maria’s career was thrown into upheaval after Trump took office.

She had not planned to retire until she turned 57. But fearing she’d be fired amid Trump’s massive government downsizing, she took an early out.

“Nobody knew anything. Management didn’t know anything. Nobody really knew if your job was safe,” she says. “I thought, better just to take it voluntarily than being forced out.”

The Social Security Administration gave her a $20,000 voluntary separation incentive and full retirement benefits at age 53. Her last day was April 19, just three weeks shy of her 35-year mark.

Only after she had made that irrevocable decision did she learn of the retirement supplement’s impending demise. Now, if the Senate agrees to the cut, Santa Maria estimates she’ll lose close to $110,000 over five years, money she was counting on to support her in retirement.

“I just can’t understand why at the end of someone’s career, they would take that away,” she says.

“A pure windfall benefit”

Originally, the legislation moving through Congress included bigger cuts to the government’s retirement benefits, including changing how retirement income is calculated. Instead of basing it on an employee’s highest three consecutive years of pay, the earlier proposal would have changed that to the highest five. That was dropped before the bill went to a vote.

Earlier permutations of the bill also would have eliminated the special retirement supplement as early as this summer, before the date was pushed to 2028.

“What ended up getting passed was really watered down from the original version,” says Rachel Greszler, a senior research fellow with the conservative Heritage Foundation. She has long argued that federal retirement benefits are unnecessarily generous, far outstripping what most Americans get.

She was glad to see the House act on the special retirement supplement, calling it “a pure windfall benefit.”

“It essentially gives them access to Social Security benefits long before every other American has access to Social Security benefits,” she says.

Tens of thousands could lose out

John Hatton, staff vice president for policy and programs at the National Active and Retired Federal Employees Association (NARFE), says it’s hard to calculate how many people would lose retirement income under the House version of the bill. He estimates it could be in the tens of thousands.

“It impacts a lot of people,” he says, including many like Santa Maria who are taking early outs now because of the threat of mass layoffs.

NARFE has strongly opposed cuts to federal benefits, calling the clawback of benefits earned from past work “a real red line.”

“I find it analogous to if you had a 401(k), and your employer put in contributions toward the 401(k), and they vested it as part of that vesting schedule,” says Hatton. “Then after the fact, they start pulling back some of your 401(k) balance because they decided, ‘I didn’t really want to give you that much money.'”

The White House did not answer NPR’s questions about the proposed cut or its impact on longtime federal employees.

An important retention tool or golden handcuffs?

Hatton argues that the retirement benefits serve as an important retention tool for the government. But Greszler says the perks may be keeping too many federal workers locked in.

“That might be a good thing if you’re retaining the right workers, but it might not be a good thing if you’re preventing people from pursuing something that they would be better at,” she says, adding that churn in the workforce can be helpful.

Santa Maria disagrees. She says Americans need civil servants who can expertly navigate the government’s complicated systems. And that expertise takes years to build.

“If people are going to come in for three to five years, the quality is just — it’s not going to be there,” she says.

She voted for Trump, hoping for positive change

Santa Maria, who voted for Trump in the 2024 election, says she’d hoped that his Department of Government Efficiency would bring technical expertise and upgrades to the Social Security Administration.

“But what they’re doing now is just eliminating the people and leaving the rest with the outdated computer system,” she says.

And now, with part of her retirement on the chopping block, she’s even more disappointed.

“I can understand new people – new hires. People who haven’t spent a decade with the government. You can make changes at that point. People have the ability to adjust,” she says. “But when you have someone who’s been there for 34 years and then just to pull the rug out from under you, that’s devastating.”

She’s shared her concerns with California’s Democratic Senators Alex Padilla and Adam Schiff but knows there’s little they can do to stop the budget bill, given Democrats are in the minority on Capitol Hill. Under the reconciliation process Republicans are taking to get the measure passed, they need only a simple majority of votes.

Santa Maria also started a Change.org petition asking lawmakers to grandfather in those who, like her, made the decision to retire based on the promise they’d have the supplemental income at 57.

“Do not betray the public servants who gave decades of their lives to this country,” she wrote in the petition.

Transcript:

MARY LOUISE KELLY, HOST:

Federal workers do critical work that Americans depend on – think taxes, Medicare, Social Security. Now, these are not always the most exciting jobs, nor the best paid. Still, many stay for decades because of what comes at the end – excellent retirement benefits. Now Congress may be chipping away at those, as NPR’s Andrea Hsu reports.

ANDREA HSU, BYLINE: Michele Santa Maria was 18 when she landed a job with the Social Security Administration in 1990.

MICHELE SANTA MARIA: I started pretty much right out of high school, so about a year out of high school.

HSU: She answered phones, sorted the mail, then worked her way up to customer service and then claims specialist, where she helped people with all kinds of claims.

SANTA MARIA: Retirement claims, survivor claims, family claims, disability claims.

HSU: Eventually, she became a claims technical expert, training others and working on complicated cases. The work, she says, was hard. Antiquated computer systems added to the tedium.

SANTA MARIA: You know, it’s a thankless job sometimes, but we’re going to stick it out ’cause we believe in what we do. And yes, we want to get to that finish line.

HSU: The finish line being retirement – typically, after 30 years, federal workers who are at least 57 can retire with excellent benefits for life.

SANTA MARIA: It was the reason why I stayed so long.

HSU: But now, as part of President Trump’s tax and spending bill, the House has voted to end one part of the government’s retirement package – something called the special retirement supplement. It’s aimed at federal workers who retire before they’re old enough to collect Social Security. The way it works is, at 57, they start collecting a portion of the Social Security they’d be entitled to at 62. But now that could be gone. Santa Maria heard about this last month.

SANTA MARIA: I was in shock, and I thought to myself, there’s no way they’re going to do this to us.

HSU: Especially to those in her shoes. She just retired in April at age 53, earlier than she’d wanted to, after being offered an early out. She feared getting fired in President Trump’s downsizing of the government. Now, if the Senate agrees to this benefit cut, Santa Maria estimates she’ll lose a total of $110,000 that she’d been counting on for her retirement.

SANTA MARIA: So it puts me in a really bad situation.

HSU: The White House did not answer NPR’s questions about the proposed cut. On the other side of this debate is Rachel Greszler with the conservative Heritage Foundation. She’s long argued that the government’s retirement package is unnecessarily generous, far outstripping what most Americans get. And the special retirement supplement…

RACHEL GRESZLER: This really is a purely windfall benefit.

HSU: In her view, why should taxpayers give federal employees access to Social Security benefits long before everyone else? And Greszler also thinks maybe those retirement perks are keeping too many federal workers locked in.

GRESZLER: That might be a good thing if you’re retaining the right workers, but it might not be a good thing if you’re preventing people from pursuing something that they would be better at.

HSU: Greszler says, having people cycle in and out can be helpful. It certainly happens in the private sector. Maybe it’d be good for government. Michele Santa Maria disagrees. She says Americans need civil servants who can expertly navigate the government’s complicated systems.

SANTA MARIA: If people are going to come in for three to five years, the quality – it’s not going to be there.

HSU: Santa Maria actually voted for Trump. She’d hoped that DOGE would come in and upgrade their computer systems, help them work more efficiently.

SANTA MARIA: But what they’re doing now is just eliminating the people and leaving the rest with the outdated computer system.

HSU: And now, with part of her retirement on the chopping block, she’s even more disappointed. She says, if this administration wants to change things up for newer hires, OK. Those people have time to adjust their plans. But for the thousands of people like her, who’ve served for decades…

SANTA MARIA: The government should keep its promise to us.

HSU: She says, we’ve dedicated our lives to the American people. Give us what we’ve earned.

Andrea Hsu, NPR News.

(SOUNDBITE OF MUSIC)

Iran and the U.S. lean into gunboat diplomacy as nuclear talks hang in balance

Iran and the United States leaned into gunboat diplomacy Thursday, with Tehran holding drills with Russia and the Americans bringing another aircraft carrier closer to the Mideast.

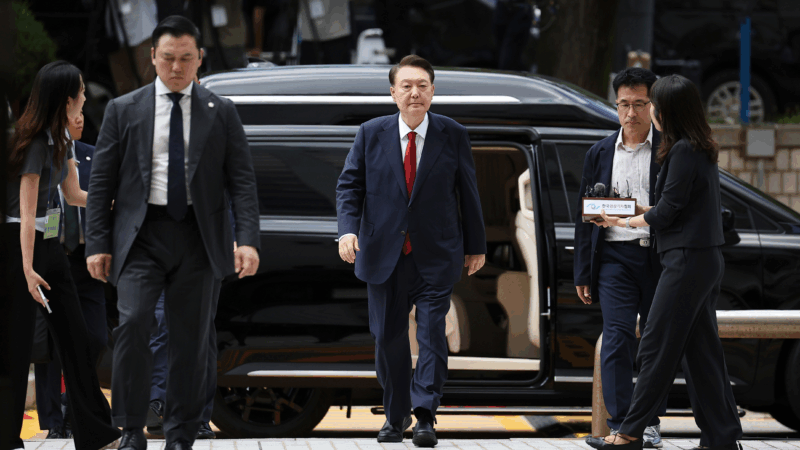

Former South Korean President Yoon receives life sentence for imposing martial law

Former President Yoon Suk Yeol was sentenced to life in prison for his brief imposition of martial law in December 2024.

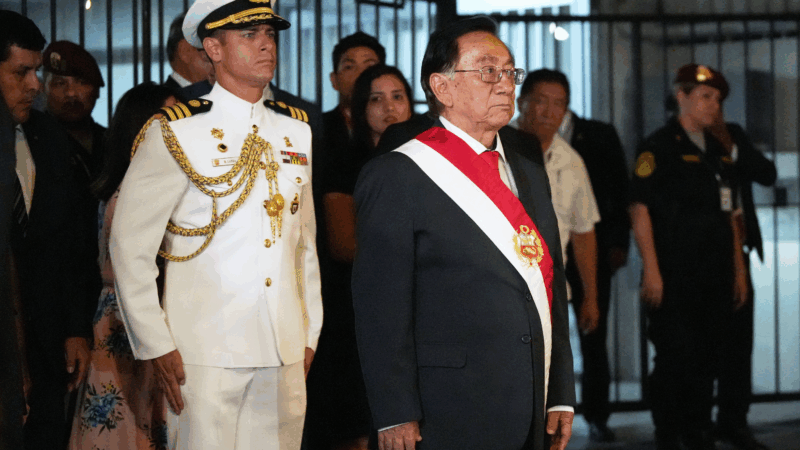

José María Balcázar becomes Peru’s eighth president in a decade

José María Balcázar has become Peru's new interim president, replacing another interim leader who was removed over corruption allegations just four months into his term.

Trump gathers members of Board of Peace for first meeting, with some U.S. allies wary

President Donald Trump will gather Thursday with representatives from more than two dozen countries that have joined his Board of Peace, for a meeting that will focus on the reconstruction of Gaza.

With a win over Sweden, the U.S. men’s hockey team will play for an Olympic medal

A thrilling overtime goal by defenseman Quinn Hughes puts Team USA through to a semifinal game against Slovakia. On the other side of the bracket, Canada had its own close call, but moves on to face Finland.

Zuckerberg grilled about Meta’s strategy to target ‘teens’ and ‘tweens’

The billionaire tech mogul's testimony was part of a landmark social media addiction trial in Los Angeles. The jury's verdict in the case could shape how some 1,600 other pending cases from families and school districts are resolved.