At a housewares expo in Chicago, talk keeps turning to price hikes from tariffs

Housewares industry insiders had hoped to spend their time at the International Housewares Association’s big annual Inspired Home Show in Chicago this week networking, making deals and showing off the latest gadgets and devices to make home life more convenient.

Instead, they’re making plans to cope with new, steep tariffs on products from this country’s three largest trading partners — Canada, Mexico and China.

The higher taxes on imports are already sending shockwaves through the U.S. economy, igniting fears about skyrocketing prices for consumers and businesses. The overwhelming concern among those in the housewares industry is that already tight margins will be squeezed even more and sales may slow down significantly.

“The concern is inflationary,” says Paul Cira, president of Proud Grill, a Canadian company that manufactures most of its grilling tools and accessories in China.

Many importers say tariffs will raise prices for consumers

Cira says the increased taxes on imports are too high for his company and his retail hardware store customers to absorb on their own.

(David Schaper | David Schaper)

“They’re going to take retail prices up in their stores,” Cira says. “They’re gonna have to.”

While most of his products sold to U.S. customers are shipped from China to the U.S., Cira says some inventory is transferred back and forth over the Canadian border and it’s not yet clear if they’ll be subjected to an additional 25% U.S. tariff or the retaliatory Canadian tariff.

The good news for Cira is that most of his inventory for the spring and summer grilling season has already arrived and is not subjected to the new tariffs.

“But I would think that by mid-year this year, that’s when the prices will go up,” he says.

Higher prices may slow sales

Cira is one of more than 1,600 exhibitors showing off the latest kitchen gadgets, home décor, pet products, travel gear, and other housewares at the industry’s trade show held in Chicago this week.

Jan Murtagh, president of CDN, which is based in Portland, Ore., was down the row on the exhibition center floor displaying the company’s digital thermometers, scales and timers for home kitchens, restaurants and the food service industry.

“Well, you know, it’s already a problem with timers,” she says, pointing to a product made in Hong Kong, which was already subjected to a 25% tariff increase on products made in China during President Trump’s first term.

“If you think of a little timer and you add 25% to that, something that shouldn’t be that expensive now is.”

Murtagh worries the additional 20% tariff imposed by the Trump administration this year will drive her prices even higher and consumers won’t want to shell out the cash for such high-tech convenience items.

“It gets to the point, you don’t want to pay,” Murtagh says. “It’s just too expensive and you can live without it.”

“I think it’s going to make things trickier. I think we’re going to have to figure out ways to cut other costs,” says Bill McHenry, president and founder of Widgeteer, a Chicago-area company that sells high-end glassware, wooden cutting boards, ceramic and resin serving bowls and other decorative kitchenware.

Many of his products are manufactured in China, and McHenry says he thought about importing more and stocking up on inventory ahead of the tariffs taking effect, but it wasn’t an option for him.

“Some of my peers that have bigger companies, like the booth next to us, is over a billion dollar company, they did buy extra,” McHenry says. “But I’m not that big so I didn’t have the financial capability of buying a bunch of stuff and holding it.”

Some companies are moving factories elsewhere

Jordan Epstein is a designer and importer with his family-owned firm, Epstein Sourcing and Design, based in Petaluma, Calif. They design and import waste baskets, tissue holders, soap dishes and other goods used primarily in hotel rooms.

Their entire inventory is manufactured in China and India. Trump has vowed to increase tariffs on Indian imports, starting in April.

“So we’re getting hit [in] both places,” Epstein says, adding that he’s now looking to source from nations that are not subjected to such steep tariffs.

“I have been doing a lot of research trying to find other countries to import from and manufacture there, including Vietnam, Malaysia,” Epstein says. “We are moving some production over to India from China.”

At least one exhibitor at the housewares trade show this week, Creative Wagons, displayed signs promoting that its Vietnam-made products are tariff-free.

McHenry, of the kitchenware company Widgeteer, says he has some factories in countries with lower tariffs, including Thailand and India. And he says he’s considered moving more of his manufacturing out of China.

“But the Chinese, frankly, make amazing glassware. And glassware is a big part of our business, says McHenry.

“They really do make a very, very nice product and even with the tariff, their cost is still better than going to India or another country.”

U.S. exporters worried too

For Doug and Lori Cohen, who own and run Regency Wraps, it’s not the Trump tariffs they’re worried about per se.

“The problem is the reciprocal tariffs,” Doug Cohen says.

They make and source their fabric and cloth kitchen products here in the U.S.

“This lemon wrap is made in Dallas,” he explains. “And we export it every day, to Germany, to Canada, to France, all over the world.”

Canada has already announced it will charge U.S. manufacturers reciprocal 25% tariffs. China is imposing new tariffs on American products too and others will likely follow suit.

“I mean the other countries are not going to absorb the tariffs, I am. And we have to pass them on or at least a portion of them to our customers,” says Cohen.

He is also very concerned the family-run company may lose much of its overseas business which could be devastating for it and the approximately 35 employees that work at Regency Wraps.

“Because in reality, nobody needs anything we sell. They want it, they buy it, but they don’t need it,” Cohen says. “And we are concerned that if the prices go up exponentially, then we’ll have some problems.”

Transcript:

ARI SHAPIRO, HOST:

President Trump is imposing steep tariffs today on products that come from this country’s three biggest trading partners – Mexico, Canada and China. And those higher taxes on imports are sending shock waves through the U.S. economy. One sector bracing for impact is the housewares industry – companies that make kitchen gadgets, travel gear and pet supplies, as David Schaper reports from Chicago.

DAVID SCHAPER, BYLINE: It’s not quite outdoor grilling season here in Chicago just yet, but Paul Cira has the products you need to get ready for it.

PAUL CIRA: Our flagship product is the Q-Swiper, and it’s just an easy way to clean your grill. It’s like a Swiffer for your barbecue grill.

SCHAPER: Cira is one of 1,600 exhibitors here at the big annual Inspired Home Show hawking products to upgrade home living.

CIRA: Then we have our grill basket, which is…

SCHAPER: Cira would love nothing more than to chat about his grilling tools all day. But the talk here among members of the International Housewares Association inevitably turns to tariffs.

CIRA: The concern is inflationary, right?

SCHAPER: Cira’s company, Proud Grill, is Canadian and manufactures most of its products in China, and they’re sold here in hardware stores.

CIRA: They’re going to take retail prices up in their stores. They’re going to have to.

SCHAPER: Down the row on the exhibition center floor is Jan Murtagh, president of Portland-based CDN, which makes digital thermometers, timers and scales for home kitchens and restaurants in many places, including Hong Kong.

JAN MURTAGH: Well, you know, it’s already a problem with timers – that 25% – because you think of a little timer, and you add 25% to that, something that shouldn’t be that expensive now is.

SCHAPER: And how might consumers react?

MURTAGH: It gets to the point you don’t want to pay. It is just too expensive, and you could live without it.

SCHAPER: The overwhelming concern here in the housewares industry is that already tight margins will be squeezed even more and sales may slow significantly.

BILL MCHENRY: I think it’s going to make things trickier. I think we’re going to have to figure out a way to maybe cut other costs.

SCHAPER: Bill McHenry is president and founder of Widgeteer, a Chicago area company that sells glassware, woodware and other kinds of kitchenware. I asked if he was able to stock up ahead of the tariffs.

MCHENRY: Some of my peers that have bigger companies – like the booth next to us is over a billion-dollar company – they did buy extra. But I’m not that big, you know? So I don’t have the financial capability of buying a bunch of stuff and holding it.

SCHAPER: McHenry says he has some factories in countries not facing the steep tariffs and is considering moving more of his manufacturing out of China.

MCHENRY: But the Chinese, frankly, make amazing glassware. And glassware is a big part of our business. And even with the tariffs, their costs are still better than going to India or another country.

SCHAPER: For Doug Cohen, it’s not the Trump tariffs per se.

DOUG COHEN: The problem is the reciprocal tariffs.

SCHAPER: Cohen’s company, Regency Wraps, makes and sources cloth kitchen products here in the U.S.

COHEN: This lemon wrap is made in Dallas, and we export it every day to Germany to Canada, to France – all over the world.

SCHAPER: Canada and China have already announced reciprocal tariffs on U.S. products, and others may follow suit.

COHEN: I mean, the other countries are not going to absorb the tariffs. I am. And we have to pass them on, or at least a portion of them.

SCHAPER: Cohen knows his products are not a necessity and if the price is too high, customers won’t buy them. And that could put his company and its 35 employees in Dallas in peril.

For NPR News, I’m David Schaper, in Chicago.

(HIT-BOY AND RAPSODY SONG, “ASTEROIDS”)

Offshore wind developer prevails in U.S. court as Trump calls wind farms ‘losers’

A federal judge ruled Monday that work on a major offshore wind farm can resume, handing the industry at least a temporary victory as President Trump seeks to shut it down.

Minnesota officials sue to block Trump’s immigration crackdown as enforcement intensifies

More than 2,000 federal immigration agents are in Minnesota, and that number is expected to increase. On Monday, an NPR reporter witnessed multiple instances where immigration agents drove around Minneapolis — and in parking lots of big box stores — and randomly questioned people about their immigration status.

Elon Musk’s X faces bans and investigations over nonconsensual bikini images

After the social media app's AI chatbot started generating sexualized images of women and children, two countries have blocked it and several more have launched investigations.

Trump administration tells states to end ‘orphan tax’ on foster kids

There's a growing move to end what some call "the orphan tax" and stop states from taking benefit checks from children and youth in foster care.

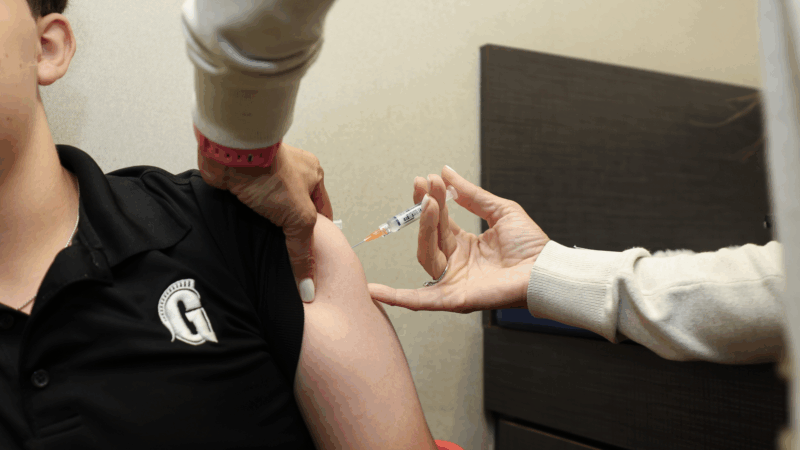

Flu shot recommendation for kids dropped just as the illness rages

The Centers for Disease Control and Prevention dropped its advice that kids get an annual flu shot at a time when flu cases and hospitalizations are surging.

Trump calls for a 10% cap on credit card interest rates

With credit card interest rates near modern highs, President Trump says he wants to cap the rates for one year.