Who Benefits in Repealing Sales Tax on Groceries?

Alabama is one of a handful of states that applies sales tax to groceries. Last month Gov. Robert Bentley created a task force that will study exempting groceries from that tax. Both Democrat and Republican lawmakers who support it say it would help low-income Alabamians and fuel economic growth.

When Bentley signed the order creating the task force, he said it was not about politics. It was about people.

“My goal for this task force is actually to take 4-percent off of food items and put that money back in the pockets of Alabamians who need it the most,” Bentley says.

This move is often touted as a way to help low-income families. Rep. Matt Fridy of Montevallo also argues it can spur growth in the economy.

“That empowers our citizens. That helps our citizens,” says Fridy. “It means they can spend more of their paycheck on things that they want.”

But Nicole Kaeding says eliminating sales tax on groceries is politically popular although not necessarily the best economic policy. Kaeding, an economist at the Tax Foundation, a nonpartisan think tank, says no taxes on groceries could mean higher sales taxes on non-grocery items.

“What happens when you start carving out items from your sales tax base is that to generate the same amount of revenue, you actually have to charge a higher rate because there are fewer items to which the sales tax can apply,” says Kaeding.

Alabama state sales tax goes to schools. So eliminating the sales tax from groceries could create an up to $400 million hole in the Education Trust Fund.

Kaeding says low-income families who buy groceries through federal assistance programs such as SNAP or WIC already don’t pay sales tax on those items. Eliminating the tax disproportionately benefits higher-income families who tend to buy more food and more expensive food. She says it won’t likely stimulate the economy because those higher-income households generally save or invest extra cash.

Alabama is one of seven states that charges sales tax on groceries. But five of those states offer tax credits or rebates as an offset.

“They tend to then limit them to less than $50,000 in income or some other measure so that they’re still generating the revenue from higher income individuals in the state,” says Kaeding.

Overall, Kaeding says there are better ways than eliminating sales tax on groceries to lessen the tax burden on low-income people or generate economic growth.

Alabama’s grocery tax task force will make its recommendation to the governor by June 1st.

US military used laser to take down Border Protection drone, lawmakers say

The U.S. military used a laser to shoot down a Customs and Border Protection drone, members of Congress said Thursday, and the Federal Aviation Administration responded by closing more airspace near El Paso, Texas.

Deadline looms as Anthropic rejects Pentagon demands it remove AI safeguards

The Defense Department has been feuding with Anthropic over military uses of its artificial intelligence tools. At stake are hundreds of millions of dollars in contracts and access to some of the most advanced AI on the planet.

Pakistan’s defense minister says that there is now ‘open war’ with Afghanistan after latest strikes

Pakistan's defense minister said that his country ran out of "patience" and considers that there is now an "open war" with Afghanistan, after both countries launched strikes following an Afghan cross-border attack.

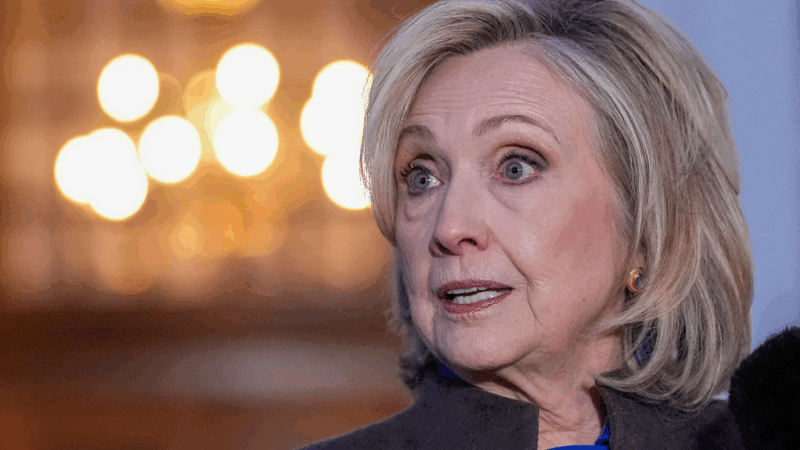

Hillary Clinton calls House Oversight questioning ‘repetitive’ in 6 hour deposition

In more than seven hours behind closed doors, former Secretary of State Hillary Clinton answered questions from the House Oversight Committee as it investigates Jeffrey Epstein.

Chicagoans pay respects to Jesse Jackson as cross-country memorial services begin

Memorial services for the Rev. Jesse Jackson Sr. to honor his long civil rights legacy begin in Chicago. Events will also take place in Washington, D.C., and South Carolina, where he was born and began his activism.

In reversal, Warner Bros. jilts Netflix for Paramount

Warner Bros. says Paramount's sweetened bid to buy the whole company is "superior" to an $83 billion deal it struck with Netflix for just its streaming services, studios, and intellectual property.