Alabama senators back bill to cut state sales tax on food

MONTGOMERY, Ala. (AP) — Every member of the Alabama Senate on Thursday backed legislation to cut the state sales tax on groceries by half, as food bill relief emerges as a bipartisan issue for lawmakers in the face of rising prices.

The bill introduced by Republican Sen. Andrew Jones of Centre would gradually reduce the sales tax on food from 4% to 2% — taking off .5% each year — provided there is more than enough state revenue to offset the loss to the education budget, which relies on sales and income taxes. All 35 state senators have signed on as a sponsor, or cosponsor.

The broad support boosts the legislation’s chances of winning approval after similar bills have stalled in Montgomery for decades.

“This is going to help people afford groceries, put food on the table,” Jones said.

The legislation, which next heads to a Senate committee for debate, is less sweeping than other proposals that would eliminate the groceries sales tax. Jones said he is seeking a reduction in a way that won’t hurt funding for public schools.

Alabama Arise, an organization that lobbies for policies that would benefit low-income families, said the average Alabama family spends $600 a year on the state grocery tax.

Various lawmakers, mostly Democrats, have proposed removing the grocery tax since the early 1990s, but the proposals failed partly because of their impact on the education budget. But the idea has gained traction among lawmakers in both parties as the state sees both an unusual budget surplus and families experience rising food costs.

Removing the 4% tax on groceries would cost $608 million, according to the Legislative Services Agency. Jones’ bill would eliminate half that amount when fully implemented.

Competing proposals vary on if the tax would be removed entirely, what foods would be included and if the lost revenue would be replaced.

Sen. Merika Coleman, D-Pleasant Grove, said she supports Jones’ bill but prefers a version that offers more immediate relief to families and also replaces funding for public schools.

Coleman has sponsored legislation that would let voters decide whether to replace the money by ending a tax deduction that allows Alabamians to deduct federal income tax payments from their income before calculating their state income taxes. She said the tax break disproportionately lowers taxes for the wealthiest people.

“But again any type of relief that folks from the state of Alabama can get, I’m going to support,” Coleman said.

Viral global TikToks: A twist on soccer, Tanzania’s Charlie Chaplin, hope in Gaza

TikToks are everywhere (well, except countries like Australia and India, where they've been banned.) We talk to the creators of some of the year's most popular reels from the Global South.

Memory loss: As AI gobbles up chips, prices for devices may rise

Demand for memory chips currently exceeds supply and there's very little chance of that changing any time soon. More chips for AI means less available for other products such as computers and phones and that could drive up those prices too.

Brigitte Bardot, sex goddess of cinema, has died

Legendary screen siren and animal rights activist Brigitte Bardot has died at age 91. The alluring former model starred in numerous movies, often playing the highly sexualized love interest.

For Ukrainians, a nuclear missile museum is a bitter reminder of what the country gave up

The Museum of Strategic Missile Forces tells the story of how Ukraine dismantled its nuclear weapons arsenal after independence in 1991. Today many Ukrainians believe that decision to give up nukes was a mistake.

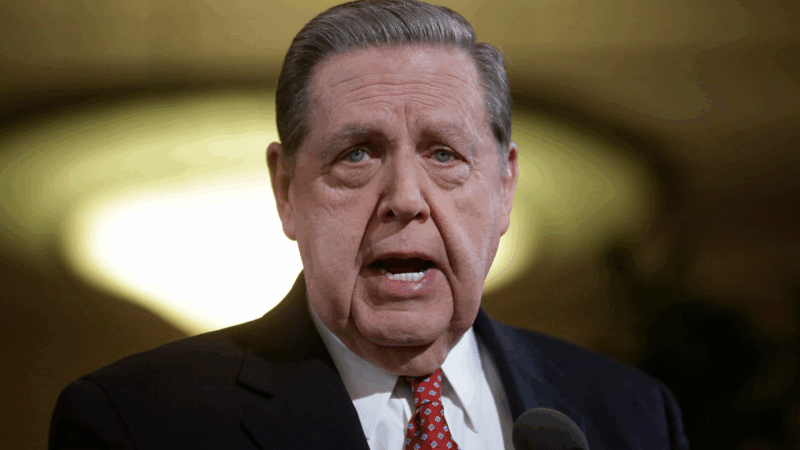

Jeffrey R. Holland, next in line to lead Church of Jesus Christ of Latter-day Saints, dies at 85

Jeffrey R. Holland led the Quorum of the Twelve Apostles, a key governing body. He was next in line to become the church's president.

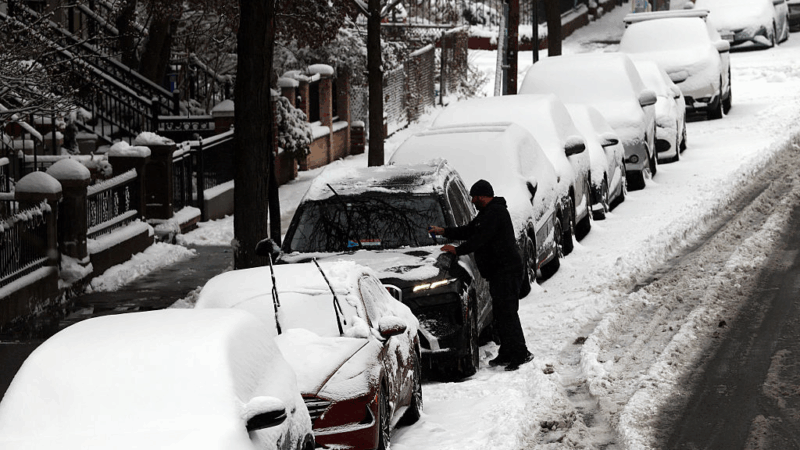

Winter storm brings heavy snow and ice to busy holiday travel weekend

A powerful winter storm is impacting parts of the U.S. with major snowfall, ice, and below zero wind chills. The conditions are disrupting holiday travel and could last through next week.