Changes to Historic Tax Credits May Put Legislation on Shaky Ground

Twenty million dollars. That’s how much Alabama would award each year in historic tax credits with the latest bill under consideration. There are two versions: One in the House and one in Senate. Some have concerns over how the Senate proposes to divide the money statewide, and the potential effect on Civil Rights landmarks. Virginia Martin wrote about the tax credits for the non-profit news site BirminghamWatch. And she tells WBHM’s Gigi Douban what’s new in this version of the bill.

The Highlights

The state’s historic tax credit program helped make old buildings new again by providing financing many developers said was crucial. The historic preservation tax credit expired in 2016 after a three-year run. Commercial projects were eligible for up to $5 million in credits under the program that lapsed.

There’s strong support in the legislature to revive the historic tax credits program, with a few key changes:

A new committee, the Historic Tax Credit Evaluating Committee, would decide which historic renovation projects will receive tax credits. This used to be decided by the Alabama Historical Commission.

The state’s $20 million tax credit money would be divided among Alabama’s seven congressional districts. If they’re not claimed in three months, the money returns to the big pot. That’s an amendment proposed by the Senate.

Birmingham and Mobile benefitted the most from the state’s historic tax credits. Twenty of 51 historic tax credit projects were in Birmingham, including the Florentine Building, the Thomas Jefferson Hotel, and the Pizitz Food Hall.

How old a building needs to be to qualify for credits is at issue with one proposed change to the legislation. The Senate wants to increase the age requirement so that a building must be at least 75 years old to receive the tax credits; the previous bill and national guidelines have a 50-year rule. The change would mean buildings with historic significance tied to the Civil Rights era aren’t old enough to qualify for historic tax credits.

U.K. leader’s chief of staff quits over hiring of Epstein friend as U.S. ambassador

British Prime Minister Keir Starmer's chief of staff resigned Sunday over the furor surrounding the appointment of Peter Mandelson as U.K. ambassador to the U.S. despite his ties to Jeffrey Epstein.

Trump administration lauds plastic surgeons’ statement on trans surgery for minors

A patient who came to regret the top surgery she got as a teen won a $2 million malpractice suit. Then, the American Society of Plastic Surgeons clarified its position that surgery is not recommended for transgender minors.

Sunday Puzzle: -IUM Pandemonium

NPR's Ayesha Rascoe plays the puzzle with KPBS listener Anthony Baio and Weekend Edition Puzzlemaster Will Shortz.

Thailand counts votes in early election with 3 main parties vying for power

Vote counting was underway in Thailand's early general election on Sunday, seen as a three-way race among competing visions of progressive, populist and old-fashioned patronage politics.

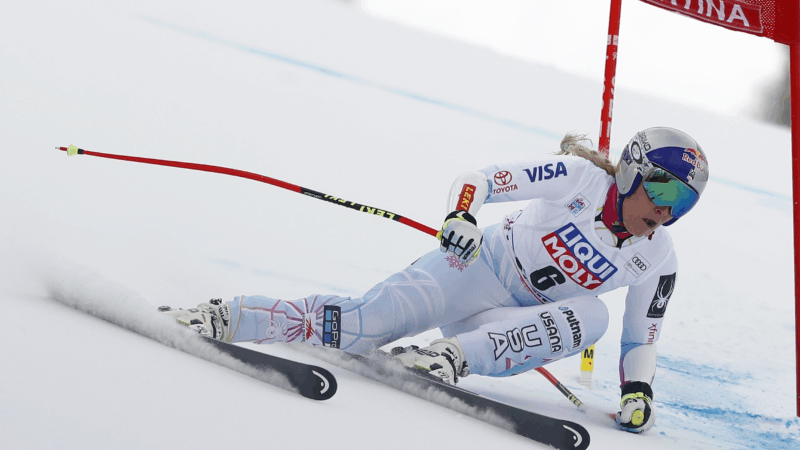

US ski star Lindsey Vonn crashes in Olympic downhill race

In an explosive crash near the top of the downhill course in Cortina, Vonn landed a jump perpendicular to the slope and tumbled to a stop shortly below.

For many U.S. Olympic athletes, Italy feels like home turf

Many spent their careers training on the mountains they'll be competing on at the Winter Games. Lindsey Vonn wanted to stage a comeback on these slopes and Jessie Diggins won her first World Cup there.