Who Benefits in Repealing Sales Tax on Groceries?

Alabama is one of a handful of states that applies sales tax to groceries. Last month Gov. Robert Bentley created a task force that will study exempting groceries from that tax. Both Democrat and Republican lawmakers who support it say it would help low-income Alabamians and fuel economic growth.

When Bentley signed the order creating the task force, he said it was not about politics. It was about people.

“My goal for this task force is actually to take 4-percent off of food items and put that money back in the pockets of Alabamians who need it the most,” Bentley says.

This move is often touted as a way to help low-income families. Rep. Matt Fridy of Montevallo also argues it can spur growth in the economy.

“That empowers our citizens. That helps our citizens,” says Fridy. “It means they can spend more of their paycheck on things that they want.”

But Nicole Kaeding says eliminating sales tax on groceries is politically popular although not necessarily the best economic policy. Kaeding, an economist at the Tax Foundation, a nonpartisan think tank, says no taxes on groceries could mean higher sales taxes on non-grocery items.

“What happens when you start carving out items from your sales tax base is that to generate the same amount of revenue, you actually have to charge a higher rate because there are fewer items to which the sales tax can apply,” says Kaeding.

Alabama state sales tax goes to schools. So eliminating the sales tax from groceries could create an up to $400 million hole in the Education Trust Fund.

Kaeding says low-income families who buy groceries through federal assistance programs such as SNAP or WIC already don’t pay sales tax on those items. Eliminating the tax disproportionately benefits higher-income families who tend to buy more food and more expensive food. She says it won’t likely stimulate the economy because those higher-income households generally save or invest extra cash.

Alabama is one of seven states that charges sales tax on groceries. But five of those states offer tax credits or rebates as an offset.

“They tend to then limit them to less than $50,000 in income or some other measure so that they’re still generating the revenue from higher income individuals in the state,” says Kaeding.

Overall, Kaeding says there are better ways than eliminating sales tax on groceries to lessen the tax burden on low-income people or generate economic growth.

Alabama’s grocery tax task force will make its recommendation to the governor by June 1st.

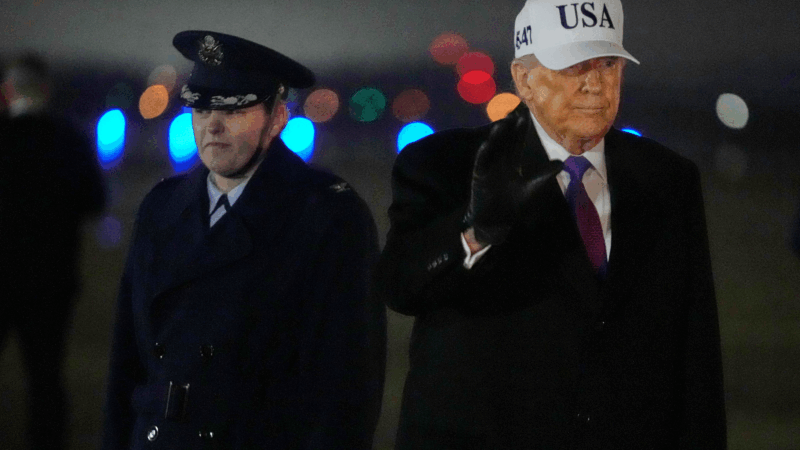

Trump says he doesn’t know if aliens are real but directs government to release files on UFOs

President Donald Trump said Thursday that he's directing the Pentagon and other government agencies to release files related to extraterrestrials and UFOs because of "tremendous interest."

Trump warns of ‘bad things’ if Iran doesn’t make a deal, as second U.S. carrier nears Mideast

Iran held annual military drills with Russia on Thursday as a second American aircraft carrier drew closer to the Middle East.

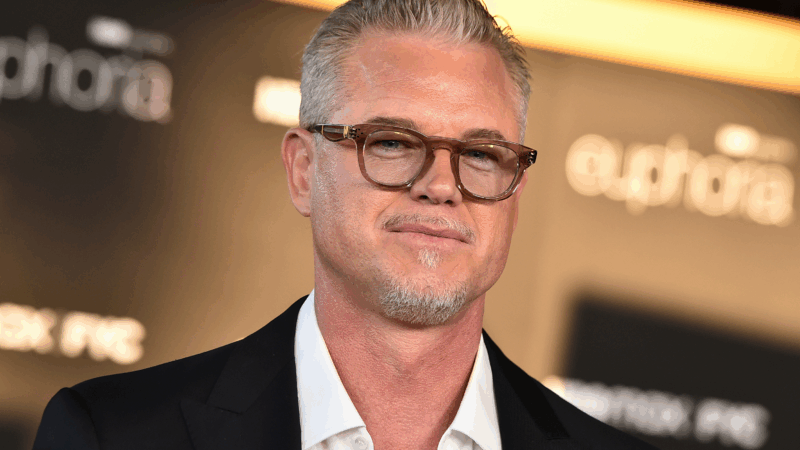

Eric Dane, ‘Grey’s Anatomy’ star and ALS awareness advocate, dies at 53

Eric Dane, the celebrated actor best known for his roles on "Grey's Anatomy" and "Euphoria" and who later in life became an advocate for ALS awareness, died Thursday. He was 53.

Venezuela approves amnesty that may release of hundreds detained for political reasons

Venezuela's acting president has signed into law an amnesty bill that could lead to the release of politicians, activists, lawyers and many others. The approval marks a stark turn for the nation.

In a historic vote, Tennessee Volkswagen workers get their first union contract

Two years ago, the successful union drive at this plant was expected to spark victories throughout the South. But now, as members vote to make their contract official, momentum has fizzled.

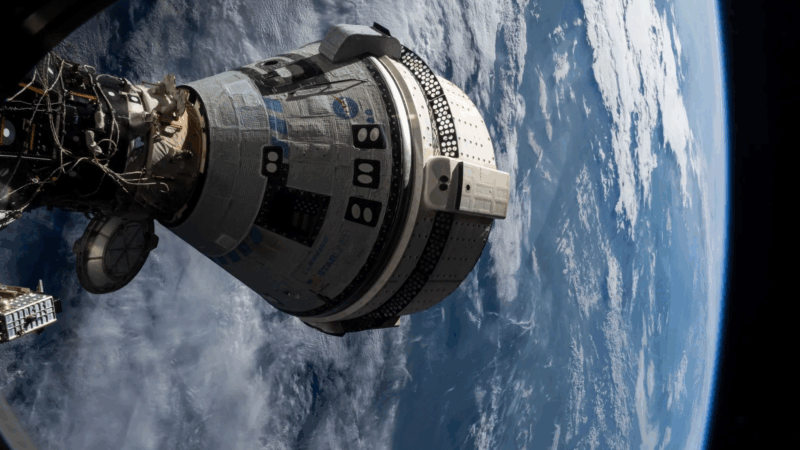

NASA chief blasts Boeing, space agency for failed Starliner astronaut mission

NASA's Jared Isaacman slammed Boeing for failures with its Starliner spacecraft, which was deemed unsafe to return its crew of two astronauts from the International Space Station