Who Benefits in Repealing Sales Tax on Groceries?

Alabama is one of a handful of states that applies sales tax to groceries. Last month Gov. Robert Bentley created a task force that will study exempting groceries from that tax. Both Democrat and Republican lawmakers who support it say it would help low-income Alabamians and fuel economic growth.

When Bentley signed the order creating the task force, he said it was not about politics. It was about people.

“My goal for this task force is actually to take 4-percent off of food items and put that money back in the pockets of Alabamians who need it the most,” Bentley says.

This move is often touted as a way to help low-income families. Rep. Matt Fridy of Montevallo also argues it can spur growth in the economy.

“That empowers our citizens. That helps our citizens,” says Fridy. “It means they can spend more of their paycheck on things that they want.”

But Nicole Kaeding says eliminating sales tax on groceries is politically popular although not necessarily the best economic policy. Kaeding, an economist at the Tax Foundation, a nonpartisan think tank, says no taxes on groceries could mean higher sales taxes on non-grocery items.

“What happens when you start carving out items from your sales tax base is that to generate the same amount of revenue, you actually have to charge a higher rate because there are fewer items to which the sales tax can apply,” says Kaeding.

Alabama state sales tax goes to schools. So eliminating the sales tax from groceries could create an up to $400 million hole in the Education Trust Fund.

Kaeding says low-income families who buy groceries through federal assistance programs such as SNAP or WIC already don’t pay sales tax on those items. Eliminating the tax disproportionately benefits higher-income families who tend to buy more food and more expensive food. She says it won’t likely stimulate the economy because those higher-income households generally save or invest extra cash.

Alabama is one of seven states that charges sales tax on groceries. But five of those states offer tax credits or rebates as an offset.

“They tend to then limit them to less than $50,000 in income or some other measure so that they’re still generating the revenue from higher income individuals in the state,” says Kaeding.

Overall, Kaeding says there are better ways than eliminating sales tax on groceries to lessen the tax burden on low-income people or generate economic growth.

Alabama’s grocery tax task force will make its recommendation to the governor by June 1st.

‘Songs from the Hole’: The story behind JJ’88’s documentary and visual album

The visual album and documentary Songs from the Hole tells the story of James Jacobs, the hip-hop artist JJ'88, as he reflects on his coming-of-age within California's state prison system.

Oil price surges as Iran steps up attacks on ships in the Persian Gulf

Markets seesawed on Day 13 of the war in the Middle East, as two oil tankers were struck by projectiles near Iraq's southern ports and attacks between Israel and Hezbollah intensified.

Easy-to-use solar panels are coming, but utilities are trying to delay them

Utilities are convincing lawmakers around the U.S. to delay bills that would allow people to buy solar panels, plug them into an outlet and begin generating electricity.

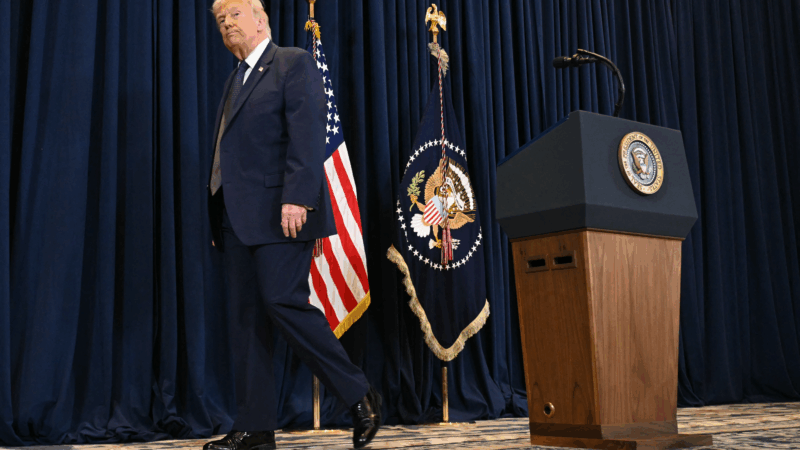

Trump’s war with Iran is angering some swing voters who want money spent at home

Swing voters who helped reelect President Trump in 2024 don't support his decision to go to war in Iran and instead want to see U.S. tax dollars spent tackling economic pressures facing Americans.

5 ways to resist the urge to keep looking at your phone

So you want to spend less time on your phone. How do you do that when it's designed to suck you in? Life Kit spoke to experts in behavioral science, psychology and technology for real-world advice.

The Trump administration’s crackdown on immigrant truckers shifts into higher gear

The White House wants tougher rules for commercial licenses after several high-profile crashes involving foreign-born drivers. But critics say that would do little to make the nation's roads safer.