House Approves 25-Cent Cigarette Tax Increase

The House of Representatives, in a series of tight votes Thursday, approved a 25-cent cigarette tax increase and other revenue bills as a plan to help close a budget gap slowly inched forward.

Republicans were narrowly able to muster the votes within their own party to approve the cigarette tax, an increase in the car title fee and an increase in the car rental tax and other measures to collectively raise about $100 million. House Ways and Means Committee Chairman Steve Clouse said the money would help prevent cuts to Medicaid, public health, mental health and child welfare services.

“All these agencies are dealing with people who just can’t function on a day-to-day basis without these services. That is why it’s so important,” Clouse, R-Ozark, said after the votes.

The votes were a sign of tentative agreement among lawmakers who had been deadlocked for months over a projected $200 million shortfall. But the plan also showed signs of unraveling. House members punted on one tax proposal after it came under opposition from the Alabama Farmers Federation. And the Republican leader of the Alabama Senate said the House-passed bills had an uncertain outlook.

“Right now I wouldn’t bank on any revenue measures,” said Senate President Pro Tem Del Marsh, R-Anniston. The Senate broke down in squabbles over a bill prescribing a formula on how to split state revenue between the education and general fund budgets and another bill to redistribute judgeships.

Marsh asked senators to go home for the night and regroup.

Representatives in the House voted 52-46 for the bill that would place an additional 25-cent tax on each pack of cigarettes. The cigarette tax, which would raise $66 million, anchored a $130 million revenue package in the House.

“This is part of a solution to keep our state government operating,” said the bill’s sponsor, Rep. Connie Rowe, R-Jasper. “October First is just around the corner and the clock is ticking.”

Democrats largely voted against the bill — despite supporting a cigarette tax in past sessions— saying that Republicans were looking to consumer taxes to fix the state’s budget problem.

“We are riding yet again on the backs of poor people,” said Juandalynn Givan, D-Birmingham. Democrats said they wanted to see tax reform, Medicaid expansion and a state lottery established.

The House also narrowly approved bills to raise the car title fee from $15 to $28 and to raise the car rental tax from 1.5 to 2 percent. Representatives also approved Medicaid provider taxes on pharmacies and nursing homes.

The tax and fee bills approved Thursday would collectively raise about $100 million. Representatives also voted to transfer $50 million from education funds to the cash-strapped general fund budget.

The bills now move to the Alabama Senate.

The tight House votes highlighted divisions among Republicans, who control both chambers of the Alabama Legislature, over raising taxes.

Opposed Republicans said the state should look to state savings accounts for the education budget or reshuffling existing state funds.

“I believe we haven’t done anything to streamline our government or effect any type of meaningful reform,” said Rep. Ed Henry, R-Hartselle.

House members delayed a vote on a proposal to adjust the state’s business privilege tax — so larger businesses pay more and smaller ones pay less. The Alabama Farmers Federation lobbied against the bill on Thursday. The bill would have raised $22 million.

“It would hurt Alabama businesses and we feel like it would discourage economic recovery,” ALFA spokesman Jeff Helms said.

In Vermont, small town meetings grapple with debate on big issues

Typically concerned with local issues, residents at town meetings in Vermont and elsewhere increasingly use the forum to debate polarizing national and international events.

Alabama man, on death row since 1990, to get new trial

The U.S. Supreme Court on Monday declined to review the summer ruling from the 11th U.S. Circuit Court of Appeals. The decision paves the way for Michael Sockwell to receive a new trial.

Supreme Court blocks redrawing of New York congressional map, dealing a win for GOP

At issue is the mid-term redrawing of New York's 11th congressional district, including Staten Island and a small part of Brooklyn.

U.S. states take steps to guard against any potential threat from Iran

Iran has made prior attempts to launch terrorist attacks on U.S. soil, but all have been thwarted in recent years. States are bracing for a heightened threat after the war.

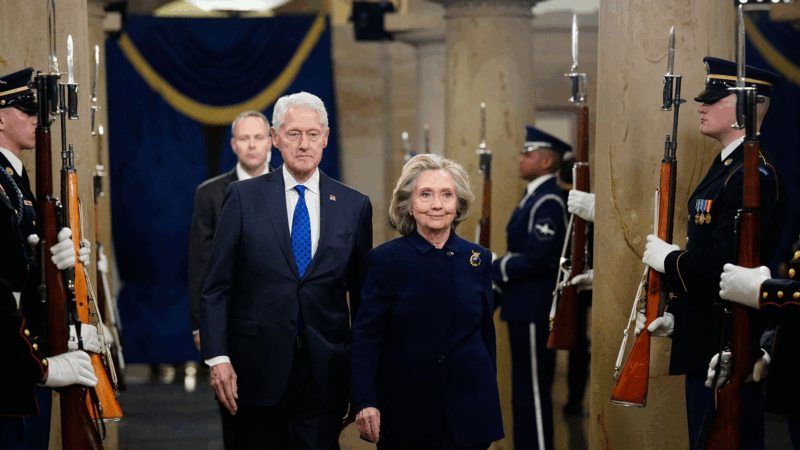

Video of Clinton depositions in Epstein investigation released by House Republicans

Over hours of testimony, the Clintons both denied knowledge of Epstein's crimes prior to his pleading guilty in 2008 to state charges in Florida for soliciting prostitution from an underage girl.

Some Middle East flights resume, but thousands of travelers are still stranded by war

Limited flights out of the Middle East resumed on Monday. But hundreds of thousands of travelers are still stranded in the region after attacks on Iran by the U.S. and Israel.