The Fiscal Cliff Deal And Your Taxes

Short Answer: Your Taxes Will Go Up

The new deal to avoid the fiscal cliff means the average Alabamian will pay an additional $579 dollars a year in taxes, but some will pay much more. The tax package passed by Congress yesterday prevents one set of tax increases from hitting most Americans, but it won’t stop them all. A temporary Social Security payroll tax reduction will expire, meaning nearly every wage earner will see taxes go up. The wealthy also face higher income taxes.

The median household income in Alabama is just under $43,000. How the tax increases will affect households at different income levels:

Annual income: $20,000 to $30,000

Average tax increase: $297

Annual income: $30,000 to $40,000

Average tax increase: $445

Annual income: $40,000 to $50,000

Average tax increase: $579

Annual income: $50,000 to $75,000

Average tax increase: $822

Annual income: $75,000 to $100,000

Average tax increase: $1,206

Annual income: $100,000 to $200,000

Average tax increase: $1,784

Annual income: $200,000 to $500,000

Average tax increase: $2,711

Annual income: $500,000 to $1 million

Average tax increase: $14,812

Annual income: More than $1 million

Average tax increase: $170,341

Team USA faces tough Canadian squad in Olympic gold medal hockey game

In the first Olympics with stars of the NHL competing in over a decade, a talent-packed Team USA faces a tough test against Canada.

PHOTOS: Your car has a lot to say about who you are

Photographer Martin Roemer visited 22 countries — from the U.S. to Senegal to India — to show how our identities are connected to our mode of transportation.

Looking for life purpose? Start with building social ties

Research shows that having a sense of purpose can lower stress levels and boost our mental health. Finding meaning may not have to be an ambitious project.

Danish military evacuates US submariner who needed urgent medical care off Greenland

Denmark's military says its arctic command forces evacuated a crew member of a U.S. submarine off the coast of Greenland for urgent medical treatment.

Only a fraction of House seats are competitive. Redistricting is driving that lower

Primary voters in a small number of districts play an outsized role in deciding who wins Congress. The Trump-initiated mid-decade redistricting is driving that number of competitive seats even lower.

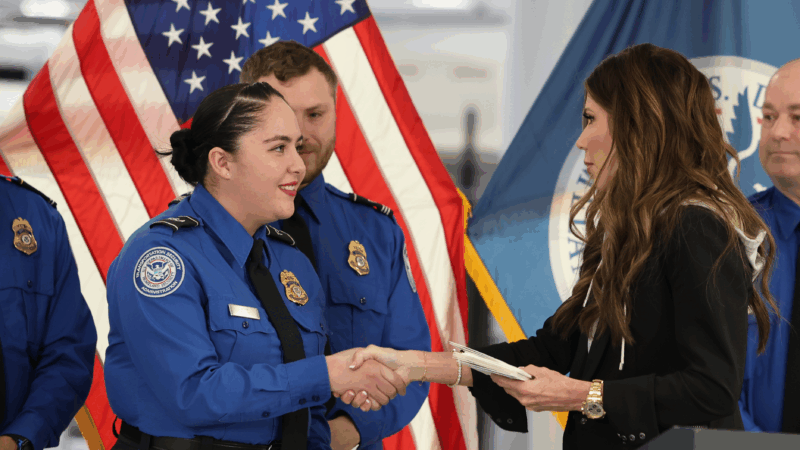

Homeland Security suspends TSA PreCheck and Global Entry airport security programs

The U.S. Department of Homeland Security is suspending the TSA PreCheck and Global Entry airport security programs as a partial government shutdown continues.