Questions Surround JeffCo Bankruptcy Deal

The largest municipal bankruptcy in U.S. history could be coming to an end. Jefferson County has been saddled with more than $4.2 billion of debt. Wednesday a federal bankruptcy judge began reviewing a tentative agreement in the case.

It’s a deal County Commissioner Joe Knight is pretty upbeat about.

“You know, I think we’ve finally got the rudder set now. We’ve got the compass in the right direction and now we’re gonna work to get out of this thing.”

That deal would erase about $1.2 billion dollars from the debt. Meanwhile, county residents would see their sewer rates rise 7.4% a year for four years and 3.5% a year after that. Getting to this point was years in the making.

A Brief History of the Bankruptcy

The whole situation began when the county borrowed money to fix an aging sewer system. Those deals were rolled into complex financial transactions which left the county unable to pay when the economy soured. Corruption surrounded the agreements, with several county officials going to prison. After years of negotiating with creditors, county leaders felt municipal bankruptcy was the only option.

Since the filing, Commissioner Joe Knight says the county has spent around $20 million in legal fees. But he says the county comes out $250 million ahead of what was being discussed pre-bankruptcy. He says paying those legal bills was worth it.

The agreement still must be approved by creditors and the bankruptcy judge. The county’s lead attorney Kenneth Klee hopes that’ll happen this fall with Jefferson County leaving bankruptcy in December. He believes the county won’t have any problem refinancing the remaining debt.

“This case will have more data than any other prospectus on Wall Street. The numbers will have been vetted six ways from Sunday.”

JP Morgan Chase’s Role

One of the biggest names on Wall Street is already involved in the deal. JP Morgan Chase holds about $1.2 billion of the disputed sewer debt. They’re giving up almost 70% of that in the plan. But former bank officials there were involved in questionable financing that contributed to the bankruptcy.

Robert Brooks is a finance professor at the University of Alabama.

“I think any reasonable person would, would not come to the conclusion they’re just really nice people. When you inflict harm you have to, have to make it right.”

Jefferson County still has a lawsuit against JP Morgan Chase in state court, but Brooks says that would probably end with this bankruptcy deal. So while county officials went to jail, no one from the financial industry has.

“I don’t think we need to have a too big to go to jail institution in our country.”

Brooks says if the bank’s financial harm to the county totals more than its concession, today’s deal might not look good enough. But we’ll probably never know.

Oil prices rise sharply in market trading after attacks in Middle East disrupt supply

The high prices came as U.S. and Israeli attacks on Iran and retaliatory strikes against Israel and U.S. military installations around the Gulf sent disruptions through the global energy supply chain.

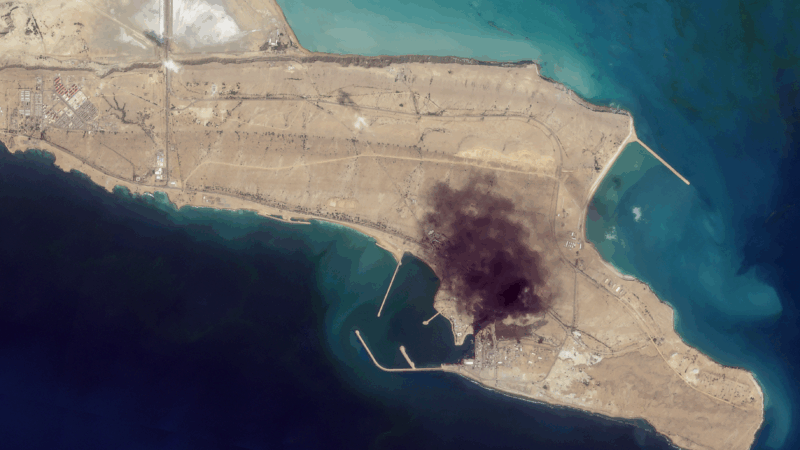

Satellite images provide view inside Iran at war

Satellite images from commercial companies show the extent of U.S. and Israeli strikes, and how Iran is responding.

Mideast clashes breach Olympic truce as athletes gather for Winter Paralympic Games

Fighting intensified in the Middle East during the Olympic truce, in effect through March 15. Flights are being disrupted as athletes and families converge on Italy for the Winter Paralympics.

A U.S. scholarship thrills a teacher in India. Then came the soul-crushing questions

She was thrilled to become the first teacher from a government-sponsored school in India to get a Fulbright exchange award to learn from U.S. schools. People asked two questions that clouded her joy.

U.S.-Israeli strikes in Iran continue into 2nd day, as the region faces turmoil

Israel said on Sunday it had launched more attacks on Iran, while the Iranian government continued strikes on Israel and on U.S. targets in Gulf states, Iraq and Jordan.

Trump warns Iran not to retaliate after Ayatollah Ali Khamenei is killed

The Iranian government has announced 40 days of mourning. The country's supreme leader was killed following an attack launched by the U.S. and Israel on Saturday against Iran.