Alabama Eyes Homeowners Insurance Reform

Alabama Examines Insurance Industry After Natural Disasters

As the Northeast begins to rebuild after SuperStorm Sandy, some Alabamians probably can’t help but think: ‘been there, done that.” From Hurricane Katrina to last year’s deadly tornadoes, the state has taken a beating. And so has the insurance industry. And that’s caused insurers to drop many customers and increase rates for folks like Johnny Cheney.

“My insurance went up to $2,400. My home was paid off, so I just dropped mine,” said Cheney. “Now, I’m at the mercy of FEMA, so I won’t have to build it back, so I have to have some help, even though I’m trying to put some money back in case I have to put on a new roof or something like that.”

Cheney’s story isn’t unusual. Alabama-based insurance company ALFA announced in June, it won’t renew 73,000 home policies after tornadoes battered the state in April of last year. Several other companies are either eliminating wind damage coverage or raising rates considerably.

“At first, when the crisis started growing, I was trying to decide whether I should use the “C” word to describe the level of the problem we’re having. And, I do now. It is a crisis. Because when someone is at risk of losing their home, literally losing their home, that’s a crisis for that family. The problem is not going from $800 to $900, it’s going from $800 to $3,500 or $4,000, almost impossibility for many families in these tough times,” said State Senator Ben Brooks, who represents Mobile County.

The rate making process is complex

Chris Hackett is director of personal lines policy with the Property Casualty Insurers Association of America. He says insurance companies are just trying to apply good business practices.

“There’s a lot of different factors that go into rates. And insurers may look at their own claim history with their book of business you know, the severity of claims in different areas in order to develop rates,” he explains.

But many insurers got caught flat footed, according to Carl Schneider. He’s an insurance agent in Mobile and co-founder of SmartHome Alabama, a non-profit agency committed to helping families fortify their homes. He says when setting policy rates, insurance companies relied on a 50-year history of relatively calm weather. Then the state experienced a rash of major storms and “they weren’t charging sufficient rates, but the question is what is a sufficient rate? And, they weren’t aware of the quality of construction that was being built until after the fact that the houses were being blown down.”

Balancing the interests of homeowners and insurers

Homeowners need protection. Insurance companies need to make money to stay in business. Balancing those two is tricky. Governor Robert Bentley has formed the Alabama Affordable Homeowners Insurance Commission to study the issues and create tangible doable solutions. The 32-member group includes consumers, insurance industry reps, business people,and state legislators.

Tim Russell is a probate judge in Baldwin County and chairman of the committee. He says, historically Central and North Alabama were at best lukewarm about discussing insurance reform. They saw it as a South Alabama issue. But that changed last year.

“The problem moved up north with these catastrophic tornadoes, and it was very, very sad, and none of us are happy that that happened, but it’s kind of ironic because now, an improved, broader commission outlook should comes as a result of what did happen,” said Russell.

In March, the Affordable Homeowners Insurance Commission recommended three proposed changes to insurance laws. Create savings accounts, which would give homeowners tax benefits on money they set aside to pay for storm damage. Require insurance companies to offer premium discounts throughout the state, for folks who build their homes to meet codes. And, allow insurance companies, who are only able to offer certain policies to certain folks, to receive funding to offer policies statewide.

Still, experts say one of the most important factors in lowering home insurance rates is fortifying your home: installing reinforced doors and certified storm shutters and strap down loose objects in your yard that could become missiles.

Kalshi reveals insider trading case against editor for MrBeast

With prediction markets booming, so have concerns about insider trading. Now, Kalshi has disclosed its first public actions against accounts suspected of trading on confidential information.

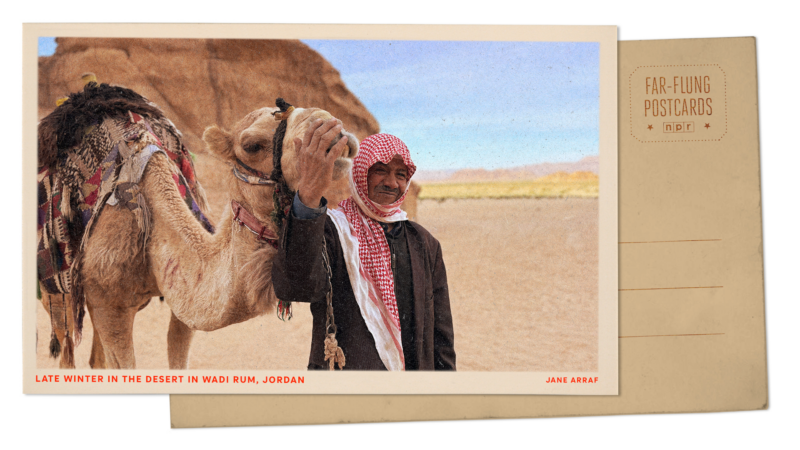

Greetings from Jordan’s Wadi Rum desert, where patches of green emerge after winter rains

Wadi Rum's otherworldly landscape is where Star Wars movies and The Martian were filmed. In late winter, plants emerge in this desert — but some are toxic to camels, so their herders must protect them.

Lack of transportation keeps many Alabamians from working. Rural public transit programs are trying to help

While lack of transportation is a major employment barrier in Alabama, few people take public transit to work. That dynamic is even more pronounced in rural areas.

When a horse whinnies, there’s more than meets the ear

A new study finds that horse whinnies are made of both a high and a low frequency, generated by different parts of the vocal tract. The two-tone sound may help horses convey more complex information.

Hundreds of American nurses choose Canada over the U.S. under Trump

More than 1,000 American nurses have successfully applied for licensure in British Columbia since April, a massive increase over prior years.

Trump’s many tariff tools mean consumer prices won’t go down, analysts say

The Supreme Court struck down President Trump's signature tariffs. But the president has other tariff tools, and consumers shouldn't expect cheaper prices anytime soon, economists say.