Lynch v. Alabama Ruling

In a case with implications for school funding across Alabama, a federal judge excoriated Alabama’s property tax system but ultimately rebuffed the plaintiffs who alleged the system is unconstitutionally racist.

On Oct. 21, U.S. District Judge Lynwood Smith issued an 854-page opinion that seemed poised to turn Alabama’s property tax system on its head. But in the end, though clearly outraged by “unequal and inadequate public school funding,” Smith deferred to the will of the legislature, to the state’s Constitution, and to state Supreme Court precedent.

Alabama has the lowest property taxes in the nation, and provisions that protect farmers, timber owners, and other landowners bring in little local funding for school systems in rural areas. Homes, farms, and timberland are taxed at 10 percent of market value, but “current use” provisions mean property is assessed at its value as, say, productive farmland or timberland. That tends to come in much lower than that 10 percent assessment level would, which results in a lack of local revenue in districts with little developed real estate or commercial enterprise.

In 2008, parents of students in Lawrence and Sumter Counties sued the state on behalf of their children. They said the property tax system deprives rural, mainly black districts of the funding needed for an education comparable to that in other parts of the state, and that the history of property taxation and school funding in Alabama is a continuous narrative of state-sanctioned racism. They cited dilapidated buildings, limited programs, and textbook shortages as evidence. But according to Judge Smith, a Clinton appointee, the plaintiffs did not prove that the effects of the lowest-in-the-country property taxes fall along racial lines.

“None of this is meant to say, however, that the court is satisfied as to either the quality or the equality of public education in this state,” he wrote, adding that the lack of adequate funding hinders the life prospects of rural students, black and white, and therefore the long-term economic viability of the state.

Six months after a four-week trial that included more than 700 exhibits, 1,000 pages of documents, and testimony from historians on Reconstruction, cotton farming, poll taxes, George Wallace, the Civil Rights Movement, desegregation, and busing, Smith delivered his unusually long opinion.

State Attorney General Luther Strange said Smith’s ruling, “confirms the State’s consistent position that Alabama’s property tax structure does not violate the United States Constitution. It is the prerogative of the citizens of Alabama, through their elected representatives, to structure a tax system in a manner that best serves their interests. The Office of Attorney General remains committed to defending and vindicating this important right whenever necessary.”

But plaintiff’s attorney James Blacksher described it differently Tuesday evening:

“Judge Smith issued this exhaustive ruling, and then at the eleventh hour changed his mind. He had all these findings of fact that, when correct legal principles are applied, should find for the plaintiffs. If we appeal, that will be our argument. I’m going to recommend [to the plaintiffs] that we appeal.”

The plaintiffs and their legal team, including Blacksher, are planning to meet on Thursday to discuss that option.

Photo of farmland by Oakley Originals; photo of old textbook by CrazyTales562, courtesy of Flickr.

Shootings at school and home in British Columbia, Canada, leave 10 dead

A shooting at a school in British Columbia left seven people dead, while two more were found dead at a nearby home, authorities said. A woman who police believe to be the shooter also was killed.

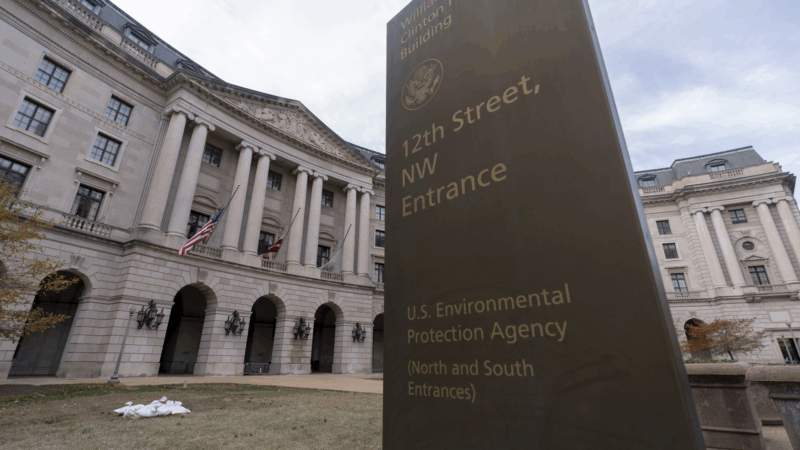

Trump’s EPA plans to end a key climate pollution regulation

The Environmental Protection Agency is eliminating a Clean Air Act finding from 2009 that is the basis for much of the federal government's actions to rein in climate change.

From gifting a hat to tossing them onto the rink, a history of hat tricks in sports

Hat tricks have a rich history in hockey, but it didn't start there. For NPR's Word of the Week, we trace the term's some 150-year-history and why it's particularly special on the hockey rink.

The U.S. claims China is conducting secret nuclear tests. Here’s what that means

The allegations were leveled by U.S. officials late last week. Arms control experts worry that norms against nuclear testing are unraveling.

Pam Bondi to face questions from House lawmakers about her helm of the DOJ

The attorney general's appearance before the House Judiciary Committee comes one year into her tenure, a period marked by a striking departure from traditions and norms at the Justice Department.

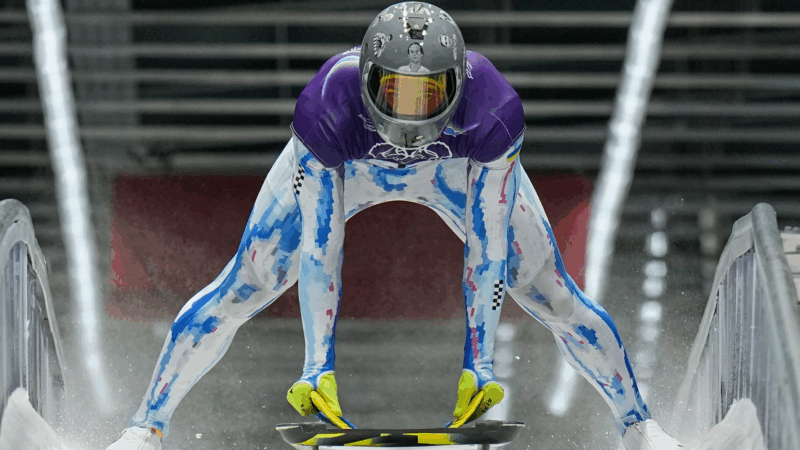

Ukrainian sled racer says he will wear helmet honoring slain soldiers despite Olympic ban

Vladyslav Heraskevych, a skeleton sled racer, says he will wear a helmet showing images of Ukrainian athletes killed defending his country against Russia's full-scale invasion. International Olympic Committee officials say the move would violate rules designed to keep politics out of the Olympics.