Impact Alabama’s Savings Contest

If you’ve ever bought a lottery ticket or played a slot machine, you probably know the thrill that comes with a chance to win a fortune. Of course, if you don’t make the long odds, you’re out some cash. But what if that same excitement could be turned into savings? One Alabama organization is using the current income tax season as a savings contest for low income residents. But as WBHM’s Andrew Yeager reports it’s an untested idea.

A volunteer shreds paperwork at a free tax prep workshop at Birmingham’s Smithfield Library. James Brown just wrapped up his taxes but he’s also leaving with something he didn’t plan on. He’s using his refund to buy two U.S. savings bonds.

“[I] think it’s just something to do. You know, save a little money and a chance to win a little money.”

In fact, those bonds could win him $20,000.

“Twenty thousand dollars, I’ll get me a boat.”

“A boat?

“Yeah.”

Brown entered a sweepstakes started by Impact Alabama. The non-profit organization runs this tax prep site. The group’s founder Stephen Black is actually anti-gambling. But he believes…

“There’s nothing inherently wrong with the excitement and fun about a game of chance and a chance to win a big prize. Can’t that be used as an incentive for low income families in this case to be more willing to save their own money?”

So here’s what Impact Alabama is doing. For every $50 dollars eligible participants buy in U.S. savings bonds during tax season, they’ll be entered into a drawing for $20,000 dollars in April. The contest is limited to families earning up to $50,000 dollars a year. Twenty-five thousand dollars is the limit for individuals. Stephen Black admits it sounds fishy.

“There aren’t a lot of non-profits out there who are willing to give away $20,000 for no fee, for no cost, just as an incentive for you to save money for your children.”

Impact Alabama is putting up the money for the contest. It’s called a prize-linked savings program. Some call it a “no lose lottery” because even if you don’t win the big prize, you haven’t lost any money. It’s probably not familiar to most Americans, but pairing savings with some sort of incentive has been done overseas for decades.

“A lot of our work is chocolate covered broccoli.”

Joanna Smith-Ramani is with the Doorways to Dreams Fund. The Boston-based non-profit studies and promotes savings ventures aimed at low income individuals. It advised Impact Alabama on its sweepstakes. She says a similar program in Michigan resulted in almost 12,000 new savings accounts.

“In our first year in Michigan 56% of savers had never saved before. It was new savings. I consider that a success.”

But programs like this aren’t common in the U.S. because banking and gambling regulations often prevent them. The savings contest in Michigan continues because of a loophole there. Smith-Ramani says seven other states have recently passed or are considering legislation allowing prize-linked savings programs.

Alabama, though, is funny about gambling. Voters rejected a state lottery and former Governor Bob Riley shut down electronic bingo casinos across the state. But bingo and track betting are allowed under certain constitutional amendments. Impact Alabama’s Stephen Black believes his contest is legal because participants don’t purchase tickets and the group doesn’t make money.

“We don’t get a fee. They can buy it wherever they want. At a tax site, a bank or a credit union.”

Black says former Alabama Attorney General Troy King cleared the program. A spokeswoman for current Attorney General Luther Strange says his office is still reviewing the contest. Jefferson County District Attorney Brandon Falls says Impact Alabama’s sweepstakes is legal because no one is making money off it. If this were a private company, he adds, the situation would be different. Stephen Black says there’s an additional element for those concerned about a game of chance.

“The final person whose name is draw will then in this case have to pass a financial literacy exam that we’ve put together.”

He says the test isn’t designed to be an obstacle and they’ll tutor the winner if need be.

“Almost like a drivers exam. There are no surprises here. It’s not a pop quiz.”

Black says he hasn’t personally run into opposition. If it were to come, he expects it from those against gambling. Black says so far Impact Alabama has sold more than 21,000 dollars in savings bonds. And he’d like to see the program expand next year with prize money from corporate donors. Even a partnership with the state. Meanwhile Alabamians who participate wait to see if the guarantee of a savings bond can bring them a little luck as well.

Kalshi reveals insider trading case against editor for MrBeast

With prediction markets booming, so have concerns about insider trading. Now, Kalshi has disclosed its first public actions against accounts suspected of trading on confidential information.

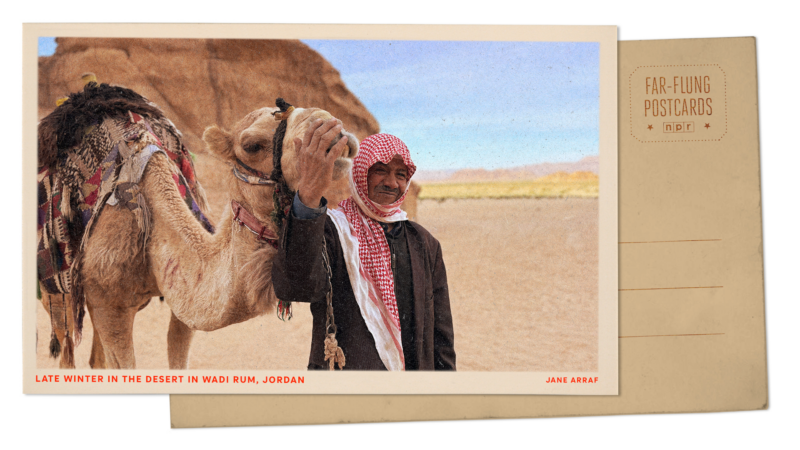

Greetings from Jordan’s Wadi Rum desert, where patches of green emerge after winter rains

Wadi Rum's otherworldly landscape is where Star Wars movies and The Martian were filmed. In late winter, plants emerge in this desert — but some are toxic to camels, so their herders must protect them.

Lack of transportation keeps many Alabamians from working. Rural public transit programs are trying to help

While lack of transportation is a major employment barrier in Alabama, few people take public transit to work. That dynamic is even more pronounced in rural areas.

When a horse whinnies, there’s more than meets the ear

A new study finds that horse whinnies are made of both a high and a low frequency, generated by different parts of the vocal tract. The two-tone sound may help horses convey more complex information.

Hundreds of American nurses choose Canada over the U.S. under Trump

More than 1,000 American nurses have successfully applied for licensure in British Columbia since April, a massive increase over prior years.

Trump’s many tariff tools mean consumer prices won’t go down, analysts say

The Supreme Court struck down President Trump's signature tariffs. But the president has other tariff tools, and consumers shouldn't expect cheaper prices anytime soon, economists say.