Hotel Tax Dispute

More travelers will hit the roads this holiday weekend. AAA expects fourth of July travel across the south to rise about 11% over last year. Many of those tourists will book hotel rooms. And that means hotel lodging taxes for local cities. But Birmingham doesn’t think it’s getting all it’s due from online travel sites. So it’s suing. WBHM’s Andrew Yeager reports.

Let’s say I’ve got family coming and I need to put them up somewhere.

“Okay, let’s go to Travelocity. Birmingham…Alabama…let’s see what they have next weekend.”

And why don’t we splurge a little bit? Put them up in the new Hyatt Place downtown. They’ve got two queens for $110 a night. Now if we go through Hyatt’s website…

“There we go. Two queen beds. Same thing. $110 a night.”

But they’re not the same thing for Birmingham’s city coffers. If I rent that room directly from the hotel, Birmingham’s 14% hotel tax gets applied to the full amount – in this case $110. Here’s the thing though. Travelocity or any other online travel company actually pays the hotel a discounted rate to get that room and then pass it on to me. In this case it would be about $88. So if I book with Travelocity, the tax is applied to that discounted price. The difference in taxes is about three dollars. All those hotel rooms – it adds up

“It’s a rip off.”

So attorney Henry Frohsin is suing on behalf of Birmingham and eight other Alabama cities. They hope to recoup the lost revenue. It could be in the millions of dollars. His colleague Ron Brunson says the law is clear.

“The lodging tax applies to all charges made for the room. It’s very specific.”

But the online travel companies – Expedia, Orbtiz or Priceline – they see things differently. Andrew Weinstein is with the industry trade group Interactive Travel Services Association.

“These laws were drafted decades ago in a world that didn’t have online travel companies. So they were never intended to apply to online travel companies. That said, they were drafted when there were many other intermediaries providing the same services and charging fees for them, including travel agents and tour operators, and they’ve never been applied to those entities either.”

Birmingham’s suit is like dozens of similar cases litigated across the country in recent years. Stephen Yoder is a UAB Business Law Professor. He says few cases have been decided. And those that have, have gone both ways.

“Unfortunately for those who are involved there’s really very little guidance there.”

The Birmingham case is expected to be heard this summer. Regardless of the verdict, the result could be bad for Birmingham. Columbus, Georgia, filed a similar suit. The Georgia Supreme Court ruled against the online travel companies. The companies then removed that city from their sites. So now, if you search for Columbus, Georgia, you’ll get hotels across the border in Phenix City, Alabama.

Andrew Weinstein with the industry trade group insists the move is not about retribution. He says it takes money to comply with the ruling.

“And companies have to make their own decisions about whether the benefits of doing business in that municipality outweigh the costs of having to implement all those systems.”

So just how much money is at stake? The Birmingham lawsuit doesn’t ask for a specific amount. It only asks the court to rule IF the tax can be collected. Attorney Henry Frohsin won’t put a number on it, but you can read between these lines.

“There are a lot of rooms that have been rented in Tuscaloosa for the Alabama football games and a lot of rooms that have been rented in Auburn for the Auburn football game. Orange Beach certainly before this disaster. There’s a lot of money involved, plus there’s interest.”

Both sides travel the twisting legal path, confident the law is on their side. Confidence, though, is no guarantee. UAB’s Stephen Yoder says the situation is ripe for legislation from Washington. And although nothing has been introduced yet, a so-called “Internet Travel Tax Fairness Act” has been floating around Congress.

Oil prices rise sharply in market trading after attacks in Middle East disrupt supply

The high prices came as U.S. and Israeli attacks on Iran and retaliatory strikes against Israel and U.S. military installations around the Gulf sent disruptions through the global energy supply chain.

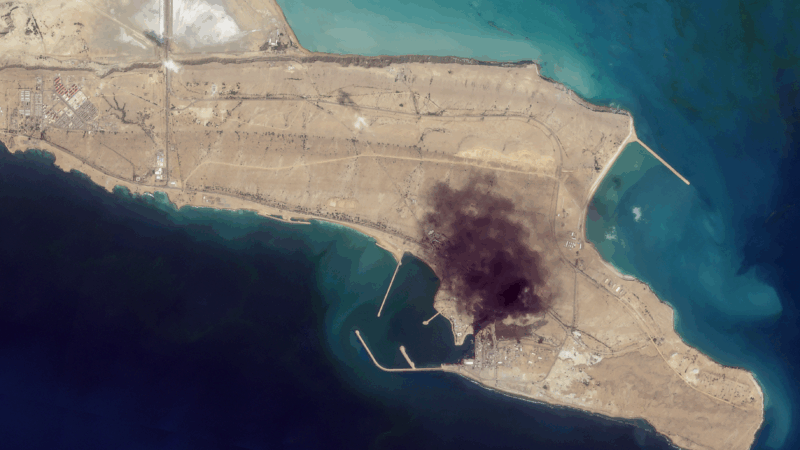

Satellite images provide view inside Iran at war

Satellite images from commercial companies show the extent of U.S. and Israeli strikes, and how Iran is responding.

Mideast clashes breach Olympic truce as athletes gather for Winter Paralympic Games

Fighting intensified in the Middle East during the Olympic truce, in effect through March 15. Flights are being disrupted as athletes and families converge on Italy for the Winter Paralympics.

A U.S. scholarship thrills a teacher in India. Then came the soul-crushing questions

She was thrilled to become the first teacher from a government-sponsored school in India to get a Fulbright exchange award to learn from U.S. schools. People asked two questions that clouded her joy.

U.S.-Israeli strikes in Iran continue into 2nd day, as the region faces turmoil

Israel said on Sunday it had launched more attacks on Iran, while the Iranian government continued strikes on Israel and on U.S. targets in Gulf states, Iraq and Jordan.

Trump warns Iran not to retaliate after Ayatollah Ali Khamenei is killed

The Iranian government has announced 40 days of mourning. The country's supreme leader was killed following an attack launched by the U.S. and Israel on Saturday against Iran.