Making Do: The McCoys’ Housing Dilemma

The economy continues to weaken and Moody’s credit rating company reports nearly 10 million homeowners are having trouble making their mortgage payments. People who track the housing industry say another wave of foreclosures is on its way. All the while, some homeowners are treading water, trying to stay afloat. WBHM’s Tanya Ott has one Hoover family’s story.

This is not a story about people who speculated in real estate and ended up in mortgage trouble. Kitty McCoy and her husband followed the American script. They got married and bought a little house. They had a couple kids and bought a bigger house, but held onto the little house thinking it would eventually help pay for their kids college. But the McCoys story takes a turn when, in 2006, Mr. McCoy took a job in Alabama. They put their Florida house on the market and got an offer.

“And about 3 days before the closing for the sale of our house in Florida, the buyer had a heart attack.”

“We’re not unaccustomed to doing things the heard way, but we thought we could take a little bit a breather at this point… but… there’s not a lot of oxygen out there!”

(Tanya) “It’s pretty stressful. I can see it in your face.”

“Uh, well, it’s really hard to watch my husband with it. He struggles as wanting to be the provider that I think men envision themselves to be and wanting to solve all the problems and take care of it. And you know, just, every month there’s something that you didn’t plan for, you didn’t see on the horizon that comes up and it’s like, you know, where do you squeeze the balloon to get the result you need. The money you need to solve the problem.”

The balloon that popped is college. The McCoys had to take out a student loan their oldest son. Another son is taking a year off, because he can’t afford the tuition. And their daughter, Summer, graduates high school in May.

“They’re gonna do whatever they can to help me. They’re not going to throw me out the door with my bags packed and go ‘see ya’. But I don’t want to put them in the position that they feel like they have to do everything.”

Summer McCoy says she’s really nervous. She’s been accepted at the University of Alabama, but her part-time job at a movie theatre isn’t enough to pay the tuition.

“The whole thing fell apart and they lost the investment property as well as the primary residence. And so it’s, it’s unfortunate.”

Unfortunate, and unhealthy. Financial planner and life coach Brady Stamps says he knows some homeowners who are so stressed out they’ve developed high blood pressure, depression and other medical problems.

The McCoys have looked at refinancing their mortgages. They keep hearing about the historic low rates right now. But their debt-to-income ratio is too high so they don’t qualify, even though they say they’ve always had good credit and they make their payments on time. So, they’re looking to Washington for relief.

Earlier this month, the House of Representatives passed a bill that would allow bankruptcy judges to rewrite the terms of failing mortgages. Judges could lower a homeowner’s interest rate or slash the principle loan amount. The bill currently faces opposition in the Senate.

~ Tanya Ott, March 24, 2009.

Arson engulfs Mississippi synagogue, a congregation once bombed by Ku Klux Klan

A suspect is charged with arson in a fire that burned through a synagogue in Mississippi. Flames and smoke destroyed its library, housing Torahs.

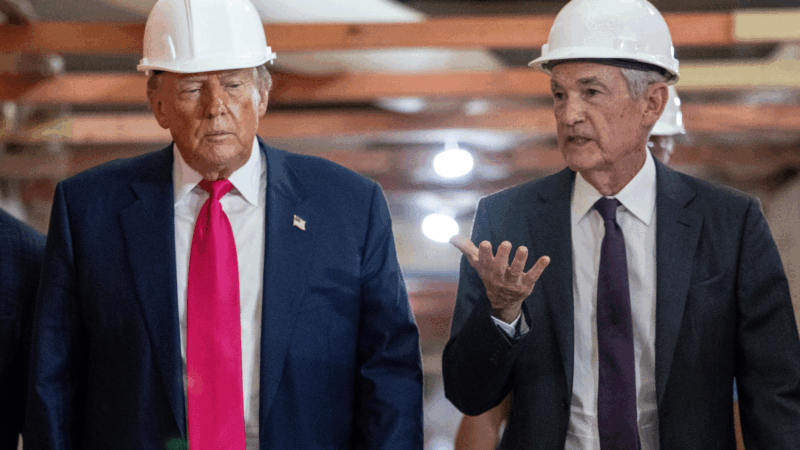

DOJ subpoenas Federal Reserve in escalating pressure campaign

The Justice Department has subpoenaed the Fed over chair Jerome Powell's testimony over the central bank's headquarters renovation. Powell calls it part of a pressure campaign over interest rates.

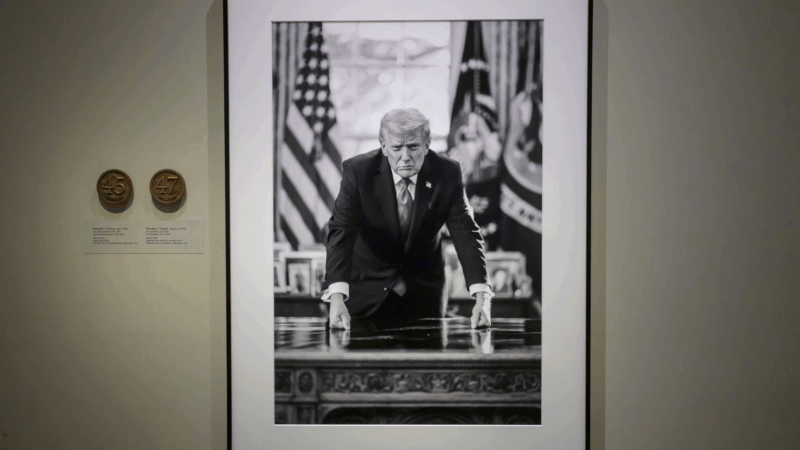

National Portrait Gallery removes impeachment references next to Trump photo

A new portrait of President Trump is on display at the National Portrait Gallery's "America's Presidents" exhibition. Text accompanying the portrait removes references to Trump's impeachments.

America’s top figure skaters dazzled St. Louis. I left with a new love for the sport.

The U.S. Figure Skating National Championships brought the who's who of the sport to St. Louis. St. Louis Public Radio Visuals Editor Brian Munoz left a new fan of the Olympic sport.

DHS restricts congressional visits to ICE facilities in Minneapolis with new policy

A memo from Homeland Security Secretary Kristi Noem, obtained by NPR, instructs her staff that visits should be requested at least seven days in advance.

Historic upset in English soccer’s FA Cup as Macclesfield beat holders Crystal Palace

The result marks the first time in 117 years that a side from outside the major national leagues has eliminated the reigning FA Cup holders.