Alabama Economy: Regions Bank

“I’m here at Bragg Middle School in Gardendale and I’m in the kitchen with…”

“Eleicia Roden.”

Roden chops vegetables and assembles the lettuce, cherry tomatoes and other ingredients into salads. At the other end of the kitchen we have…

“Kyong Chae. But a lot of people can’t pronounce [it] so they call me Kim.”

Kim dumps flour into a mixer and lets the machine churn the concoction into dough. Then Kim spreads the dough across the counter, cuts out the individual rolls and it’s into a warming cabinet to briefly rise. After a few minutes in the oven, you have a couple hundred rolls for today’s lunch.

Now trust me, this does have to do with banking. Birmingham Southern Business School Dean Stephen Craft says a public institution like the Jefferson County School Corporation is like that salad. The money to operate a school is really just redistributed like the cherry tomatoes, cucumbers or carrot sticks. They don’t change size whether they’re in separate bins or on a plate. But Craft says Regions is like the rolls. The company makes loans to expand business and that creates more jobs and more wealth. The dough expands.

So with today’s financial climate, how well can Regions grow the dough?

“You know at this point in time capital is king.”

Regions spokesman Tim Deighton says the more cash banks have on hand, the easier it is to move money around and keep the doors open. It also allows banks to absorb losses. At the end of August the federal government allowed Regions to take over the failed Integrity Bank in Georgia, giving Regions more than $900 million in deposits. And in the second quarter of this year, Regions cut its dividend by almost 75%, again to hang onto more capital. Birmingham Southern’s Stephen Craft says that certainly means less income for stockholders, but it’s adding to the long term health of the company.

“So in the long run, this is really in the stock holder’s benefit.”

“So you’re having a little pain now for less severe pain later.”

“Exactly.”

“We haven’t been immune from the things that have happened in the economy.”

Tim Deighton says with the collapse of the housing market means Regions has had some losses, but that’s been minimized because the company wasn’t a big player in sub-prime lending. Regions is making money but second quarter profits were down about half. And the company’s stock? After yesterday’s market plunge it’s slid down almost 75% from a year ago. So what to do?

“Our focus is to manage our business well…to put ourselves in the position of

strength for long term growth.”

Stephen Craft says Regions is basically making the right moves, like cutting dividends. So with the housing collapse, credit crunch, federal bailout, all those pictures of Wall Street traders hands to their heads, what’s his assessment of Regions?

“Regions, right now, it does not appear that they are being as strongly impacted as other banks.”

Better news for Birmingham and that mechanism of expanding the local economic bread.

High-speed trains collide after one derails in southern Spain, killing at least 21

The crash happened in Spain's Andalusia province. Officials fear the death toll may rise.

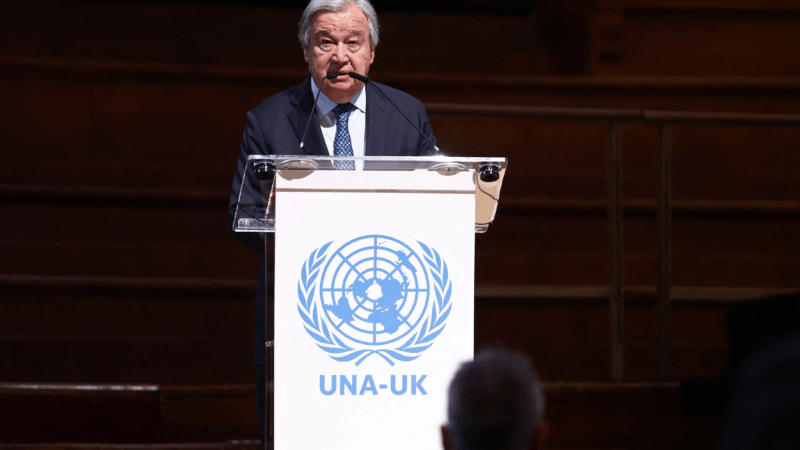

United Nations leaders bemoan global turmoil as the General Assembly turns 80

On Saturday, the UNGA celebrated its 80th birthday in London. Speakers including U.N. Secretary-General António Guterres addressed global uncertainty during the second term of President Trump.

Parts of Florida receive rare snowfall as freezing temperatures linger

Snow has fallen in Florida for the second year in a row.

European leaders warn Trump’s Greenland tariffs threaten ‘dangerous downward spiral’

In a joint statement, leaders of eight countries said they stand in "full solidarity" with Denmark and Greenland. Denmark's Prime Minister Mette Frederiksen added: "Europe will not be blackmailed."

Syrian government announces a ceasefire with the Kurdish-led Syrian Democratic Forces

Syria's new leaders, since toppling Bashar Assad in December 2024, have struggled to assert their full authority over the war-torn country.

U.S. military troops on standby for possible deployment to Minnesota

The move comes after President Trump again threatened to invoke the Insurrection Act to control ongoing protests over the immigration enforcement surge in Minneapolis.