Why gold is having its best year since 1979

Gold has broken yet another record this week, illustrating just how anxious investors are about the health of the U.S. economy.

This week, the price of gold hit $4,000 per ounce for the first time ever. That’s the latest milestone in its massive ongoing rally, with prices rising more than 50% just this year.

The precious metal is usually seen as a “safe haven” investment, especially when more mainstream assets seem risky. The soaring demand for its perceived safety coincides with President Trump’s dramatic and often erratic economic policies, including upending global trade and threatening the independence of the Federal Reserve.

On the surface, Wall Street seems to have mostly shrugged off this spring’s worries about Trump’s policies. In recent weeks, the major U.S. stock market indices have hit record high after record high.

But at the same time, the value of the U.S. dollar has fallen about 10%. That threatens both the stability of the global economy, since the dollar undergirds so much of its financial system, and the United States’ long-established dominance as the world’s economic superpower.

“Gold usually rises when the dollar is weak,” says Jose Rasco, chief investment officer for HSBC Americas.

“Given all the uncertainty around policy, people said, ‘We’re not sure about the dollar’ … and the dollar has depreciated as a result,” he added.

Now gold is having its hottest year in nearly half a century — since the global energy and inflation crises of 1979.

And it’s showing no signs of stopping: This week, analysts at Goldman Sachs predicted that the price of gold would hit $4,900 by the end of 2026.

Daan Struyven, Goldman’s co-head of commodities research, co-authored that report. He tells NPR that he wouldn’t be surprised if gold beats his high expectations (or has what he calls “upside risk”).

“While our price forecast is quite elevated, we actually see some upside risk to that high price target,” Struyven says

Gold may be known as a “safe haven” — but there are risks, and costs, to buying it

Gold has long enjoyed a reputation for offering safety in what’s known as the “fear trade.” As a glittering precious metal that can be held (and hoarded!), gold offers the appearance of safety and solidity next to stocks and other (often less-material) financial instruments.

“When it seems like the world is going to hell in a handbasket, gold usually appreciates,” Lee Baker, a certified financial planner who is the founder and CEO of Claris Financial Advisors in Atlanta, told NPR this spring.

But he warns there can be downsides to buying and owning gold — even in times of crisis. For example, unlike stocks or bonds, gold doesn’t pay any dividends or interest. So the only way to make money from this investment is to buy some, and then hope to sell it after the price goes up.

There are also physical and logistical challenges to investing in gold — especially for people who want to buy the real thing. For example, buyers need to consider how to store it — and whether to pay for the security and insurance required to keep precious metals in their homes.

For those who are gold-curious but perhaps not ready to adopt a doomsday-prepper lifestyle, Baker notes that it’s possible to invest in gold-backed funds that don’t require physical ownership of precious metals.

More broadly, he says the current gold frenzy highlights a larger lesson about investing in more than just one asset class, such as stocks.

“Your mama told you not to put all your eggs in one basket. It applies to investing as well,” he says. “Diversification matters.”

Transcript:

A MARTÍNEZ, HOST:

Gold was already having a good year, and it just broke another record. This week, the price of gold went above $4,000 an ounce for the first time ever. NPR finance correspondent Maria Aspan explains why that is not a good sign for the economy.

MARIA ASPAN, BYLINE: Gold is one of the oldest investments around, especially in times of turmoil. It’s shiny and solid and widely seen as a safe haven when investors are worried about what else is going on in the world and especially in the United States.

JOSE RASCO: Gold usually rises if the dollar is weak.

ASPAN: That’s Jose Rasco, chief investment officer for HSBC in the Americas. As he points out, the dollar is weak. It’s down about 10% this year. That’s in part because of all the uncertainty created by President Trump from his tariffs to how he’s picking fights with the Federal Reserve. Investors around the world are worried about the long-term damage these policies could have on the broader economy. These worries aren’t obvious. Stock markets have been hitting record high after record high. But dig a little deeper, and it’s clear that investors are trying to hedge their bets and diversify away from the United States.

RASCO: Given all the uncertainty around policy, people said we’re not sure about the dollar. And the dollar has depreciated as a result.

ASPAN: Now, the price of gold is already up about 50% this year – its best run in nearly half a century. And Goldman Sachs this week predicted that it will go up even more by the end of next year. Daan Struyven is Goldman’s co-head of commodities research. He points out there’s another factor here – the Fed is cutting interest rates.

DAAN STRUYVEN: When interest rates go down, demand for gold from investors tends to rise.

ASPAN: That’s partly because lower rates can lead to higher inflation, and gold is a hedge against inflation. It can also just feel like a security blanket for nervous investors. After all, the last time gold was this hot was back in 1979, in the middle of a global energy and inflation crisis that made the world seem very uncertain.

Maria Aspan, NPR News, New York.

(SOUNDBITE OF SONG, “GOOD AS GOLD”)

DOLLY PARTON AND PORTER WAGONER: (Singing) And that’s as good as gold.

R&B stars consider two ways to serve an audience

Two albums released the same day — Jill Scott's return from a long absence, and Brent Faiyaz's play for a mid-career pivot — offer opposing visions of artistic advancement in the genre.

Baby chicks link certain sounds with shapes, just like humans do

A surprising new study shows that baby chickens react the same way that humans do when tested for something called the "bouba-kiki effect," which has been linked to the emergence of language.

American Jordan Stolz speedskates to a third Olympic medal — silver this time

U.S. speedskater Jordan Stolz had a lot of hype accompanying him in these Winter Olympic Games. He's now got two gold medals, one silver, with one event to go.

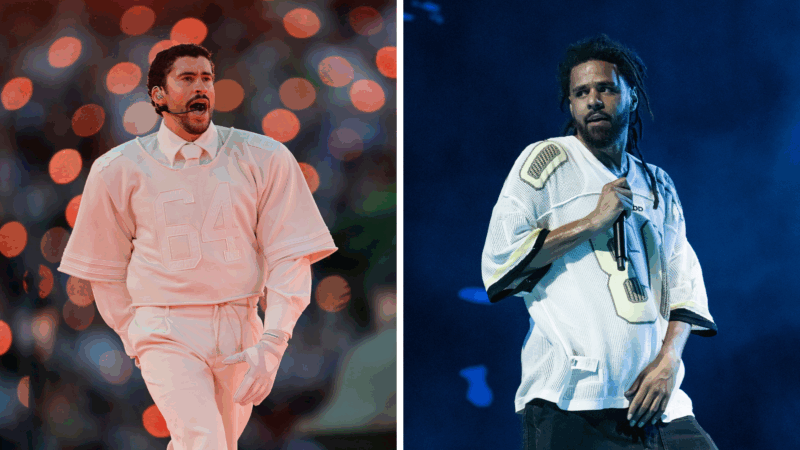

Bad Bunny and J. Cole rule the pop charts

These days, the Super Bowl halftime show is a massive driver of the streaming, airplay and sales that fuel the Billboard charts. This week, Bad Bunny benefits from that influence.

Reporter’s notebook: My Olympic Lunar New Year

An NPR reporter covering the Olympics in Milan takes us on cultural side quests, to a hospitality house and a candy store.

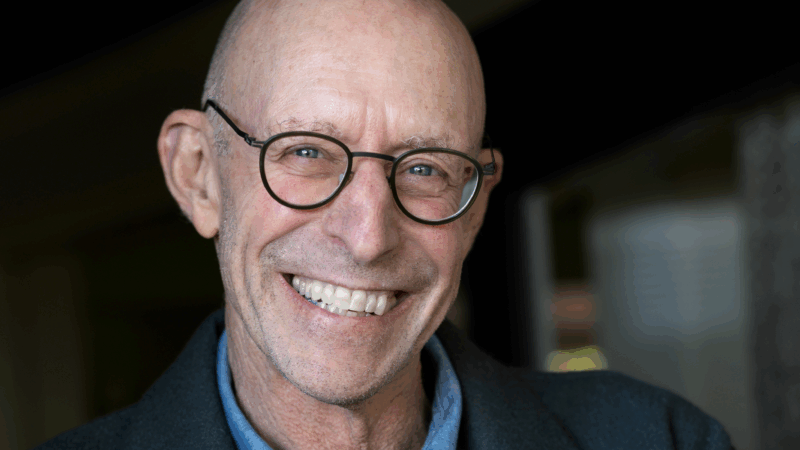

Michael Pollan says AI may ‘think’ — but it will never be conscious

"Consciousness is under siege," says author Michael Pollan. His new book, A World Appears, explores consciousness on both a personal and technological level.