Why being in credit card debt doesn’t mean you’re bad with money

People can feel a lot of shame about being in credit card debt. They think it means they’re bad with money. That it’s something to avoid, or a burden they can never pay off.

But for financial educator Rita-Soledad Fernández Paulino, founder of Wealth Para Todos, we should simply see debt for what it is. “It’s just what we use when we don’t have access to cash reserves,” she says.

And unfortunately, our assumptions and emotions around debt can prevent us from managing our money with confidence, she says. They can stop us from being honest with ourselves about our financial situation, getting the support we need to pay off our debt or even leveraging debt to our advantage.

Here are three common debt myths and how they can affect our finances.

Myth: People in credit card debt are terrible with money

Some people think that those with debt have a spending problem or don’t know how to budget, says Fernández Paulino. But that’s often not the case.

About 45% of respondents to a 2025 Bankrate survey said that their credit card debt came from emergencies or unexpected expenses. That includes car problems, medical bills and home repairs.

People also rack up debt during stressful life events. “The clients that come my way have usually dealt with the death of a loved one and are struggling with so much grief that they struggle to show up for work,” Fernández Paulino says. “Or they’ve been dealing with medical issues and are in debt for treatment.”

That’s why it’s so important to stash money away for emergencies while creating your plan to pay down your debt, she says. If an unforeseen event happens and you don’t have those funds, you may get stuck in another cycle of debt.

Create your plan to pay down debt. Sign up for Life Kit’s newsletter series.

Myth: You should avoid debt at all costs

People may feel scared or guilty about using a credit card for many reasons. Maybe they grew up in a family that struggled with debt, didn’t talk about finances or dealt with bankruptcy or a home foreclosure, Fernández Paulino says. “They grow up thinking: Debt is the problem, so I’m never going to use it.”

Others avoid credit cards because they grew up with misconceptions about debt, stemming from a lack of knowledge about how finances work in the U.S., says Fernández Paulino, who works with many immigrants. “So when they start using a credit card, they don’t know how to use it.”

Everyone should have at least one credit card in good standing, says John Kiernan, managing editor of WalletHub, a personal finance website. “It sends positive information to the credit bureaus each month, which makes your credit report look better and leads to a better credit score, which opens a lot of doors for lending.”

Learning more about how debt works can help you understand how to use your credit card strategically, Fernández Paulino says.

To learn more about how credit cards work, sign up for Life Kit’s newsletter series.

Myth: Getting out of debt is impossible

“It isn’t true that you can’t get out of debt,” Fernández Paulino says. “What’s true is that without enough monthly surplus — money left after fixed expenses and variable expenses, minimum payments and some saving — progress is slow.”

If you want to pay off your debt faster, focus on “building a surplus so there’s significant extra cash to throw at balances,” she says. That might mean tightening your budget to save more money, or getting an extra source of income.

“When clients build that surplus, they can make dents quickly,” she says. “I’ve had clients eliminate five figures of debt in six months, others take 12-36 months.”

The timeline of when you pay off your debt is driven by three variables: starting balance, interest rate and consistent extra cash flow, she says.

Find out how to save money in your budget to pay off debt. Sign up for Life Kit’s newsletter series.

Sign up for Life Kit’s Guide to Paying Off Credit Card Debt

In this one-month newsletter series, financial educators explain how to create a credit card payment plan that works with your budget, so you can save money and make a meaningful dent in your debt. Click here to subscribe to the newsletter now.

The digital story was edited by Clare Marie Schneider and Marielle Segarra, with art direction by Beck Harlan. We’d love to hear from you. Leave us a voicemail at 202-216-9823, or email us at [email protected].

Listen to Life Kit on Apple Podcasts and Spotify, or sign up for our newsletter.

Mixed reactions, including relief, greet news the Coast Guard is buying BSC campus

The U.S. Coast Guard will take possession of the 192-acre campus in the northeast corner of Birmingham’s Bush Hills Neighborhood and will begin work to refit it as a training center for officers and enlisted personnel.

Travel industry pushes Congress to end DHS shutdown and pay federal security workers

With the busy spring break travel season looming, travel and aviation industry leaders urged Congress to end the stalemate over DHS funding before workers at TSA and ports miss a full paycheck.

Trump fires Kristi Noem as DHS chief, names Sen. Markwayne Mullin to replace her

President Trump has fired his homeland security secretary, Kristi Noem, and said Markwayne Mullin, a senator from Oklahoma, would replace her.

They were led off course in a big race. But a fix is more complicated than prize money

Top finishers in the Atlanta half marathon are calling for U.S. track officials to ensure that Jess McClain and two other athletes aren't excluded from the world championships because of an error.

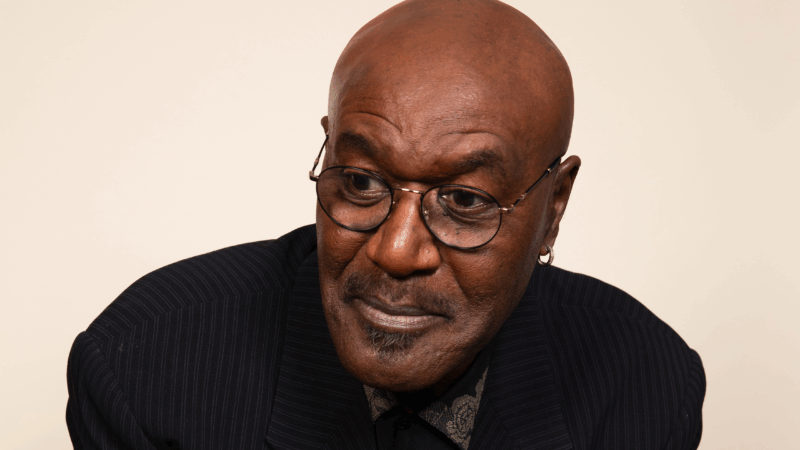

No matter what happens at the Oscars, Delroy Lindo embraces ‘the joy of this moment’

Lindo is nominated for best supporting actor for his role in Sinners. At the BAFTA awards on Sunday, Lindo was presenting when a man with Tourette syndrome in the audience yelled out a racial slur.

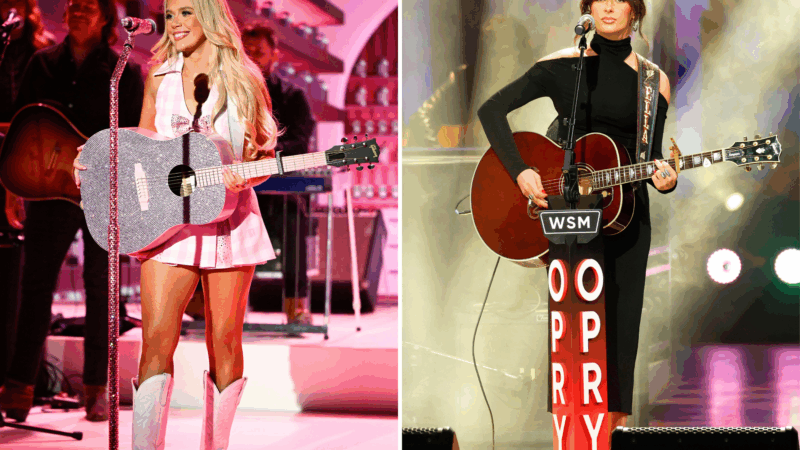

Between Megan Moroney and Ella Langley, country women rule the charts

It's a big week for women in country music — and, it turns out, for women whose songs are favored by women in figure skating.