Who is Fed nominee Stephen Miran, and why is he so controversial?

The Senate is set to vote Monday night to fill a vacancy on the Federal Reserve Board, the seven-member body that sets the nation’s monetary policy and has found itself increasingly under attack by President Trump.

Trump has long pressured the Fed to lower interest rates, and in July floated the idea of firing Federal Reserve Chairman Jerome Powell — whom he has attacked as a “knucklehead” and “numbskull” — for not doing so. In August, Trump escalated his fight against the Fed by attempting to fire governor Lisa Cook, a move that a federal judge temporarily blocked last week.

It’s against this backdrop that Fed governor Adriana Kugler unexpectedly stepped down last month, opening up a seat on the board that Trump has been so publicly seeking to influence. He quickly nominated Stephen Miran, one of his top economic advisers, to finish the remainder of her term, which runs through January 2026.

At a Senate Banking Committee hearing earlier this month, Miran said that he would not resign his position as chair of the White House Council of Economic Advisers if he were confirmed to the role, but would take an unpaid leave of absence.

That, coupled with some of his previous writings calling for less independence for the Fed, rattled Democrats in the room.

“Right now, the banking committee should be investigating the president’s direct attacks on that independence, not pretending that it’s business as usual,” Sen. Elizabeth Warren, D-Mass., the committee’s highest-ranking Democrat, told NPR in September.

The committee ultimately voted 13-11 along party lines to advance Miran’s nomination to the full Senate. If confirmed, as expected, Miran would join the Fed in time for its highly anticipated two-day meeting on interest rates, which begins Tuesday.

“This is setting us up for a very tight process in advance of a very important central bank meeting,” Lisa Gilbert, the co-president of the nonprofit consumer advocacy organization Public Citizen, told NPR.

But critics are worried about more than just the timing. They say his unprecedented plan to take unpaid leave from the White House rather than resign altogether is alarming, warning it could give the president undue influence at the Fed, which is supposed to operate independently of the administration.

“It functionally means he remains a White House employee at the same time as working for the importantly independent Federal Reserve,” Gilbert said. “So we’re really concerned about this and what it means for the independence of this agency.”

White House spokesperson Kush Desai told NPR in a statement that Miran will take an unpaid leave of absence from the Council of Economic Advisers, have no White House email access, lose his White House badge and “not provide any advisory guidance as part of CEA in any way.”

“Instead of resorting to ignorant or intentionally misleading attacks, Democrats and ‘nonpartisan’ watchdog groups should just admit that Dr. Stephen Miran is eminently qualified to serve on the Fed, and he will do so in compliance with the law,” Desai wrote.

Who is Stephen Miran?

Miran holds a Ph.D. in economics from Harvard University. His dissertation advisor was Martin Feldstein, an influential economist who served as Ronald Reagan’s chairman of the White House Council of Economic Advisers.

Miran graduated in 2010 and began his career in financial markets, working as an analyst for Lily Pond Capital Management, Fidelity Investments and Sovarnum Capital. In 2020, he joined the first Trump administration as a senior advisor to the Department of the Treasury.

He left that role after former President Joe Biden was inaugurated and returned to the private sector, eventually joining Hudson Bay Capital Management and the libertarian-leaning Manhattan Institute.

There, he wrote dozens of op-eds criticizing Biden’s economic policy (including the Inflation Reduction Act) and, notably, advocating for a less independent Federal Reserve. The Fed is designed to be independent of the executive branch, though it is accountable to Congress.

“Central bank independence is widely regarded as an essential element of effective economic stewardship,” Miran wrote in March 2024. “Yet pure independence is incompatible with a democratic system.”

Miran has proposed controversial reforms like shortening Fed board members’ terms and “clarifying that members serve at the will of the U.S. president.” As it stands, the Federal Reserve Act requires presidents to demonstrate “cause” for removing members before the end of their 14-year terms, which no president has successfully done.

Gilbert, of Public Citizen, said the Fed has intentionally been “kept away from the whims of the White House,” because it sets monetary policy based on the relative success of the economy — not on politics.

“If you’re a president, you might have reason to be touting how the economy is doing as part of a political gambit or something you want to share in an electoral context — not factors that should influence our markets,” she said.

What has Miran said about his potential role?

Trump announced his intention to nominate Miran as his Council of Economic Advisers in December 2024, and the Senate confirmed him in March of this year with a party-line vote. Miran has backed Trump’s trade policies and is widely credited as the architect behind the administration’s so-called “reciprocal tariffs” on U.S. trading partners.

Trump nominated Miran for the Fed role in early August. At his Senate Banking Committee hearing earlier this month, Miran acknowledged that Trump nominated him “because I have policy views that I suppose that he liked.”

But, he said, if confirmed, “I will act independently, as the Federal Reserve always does, based on my own personal analysis of economic data.”

Miran’s views on the Fed’s independence were called into question at the hearing, when he said he would not resign his White House job if confirmed to the Fed.

“I have received advice from counsel that what is required is an unpaid leave of absence from the Council of Economic Advisers,” Miran said. “And so, considering the term for which I’m being nominated is a little bit more than four months, that is what I will be taking.”

That prompted immediate concern from lawmakers on both sides of the aisle. Sen. Jack Reed, D.-R.I., said that Miran’s “independence has already been seriously compromised,” while Sen. John Kennedy, R-La., asked Miran to commit to “ignore all the rhetoric from all politicians,” which he did.

In one exchange, Sen. Andy Kim, D-N.J. questioned why Miran wants the Fed job and why he didn’t push back on his counsel’s advice to take unpaid leave.

“You have every right to say ‘No, I’m going to resign.’ You can determine your own career — you know that, right?” Kim asked Miran, who responded affirmatively. “You could very well be continuing to act in a way that is in the political interest of the president because you know he is going to be your future boss again.”

Miran said that if he were later confirmed to a longer term, he would resign his White House role. Trump said when he nominated Miran that he would continue to search for a nominee to fill a fresh, 14-year term beginning in early 2026.

Gilbert said Miran’s plans not to resign from the White House are concerning regardless of the length of his Fed term, saying there is a “slippery slope when it comes to Fed independence.”

She says the conflict of interest is especially worrisome because it’s happening at the same time as Trump is trying to remove Cook, another Fed governor. She called the administration’s “attempt to put a finger on the direction of the Fed … obvious and really problematic.”

“The central bank is intended to keep us stable,” she told NPR. “It matters for regular Americans as we think about our economy, as we think about how we are interacting as consumers. And it is simply a problem to have it not be independent.”

The 2026 Alabama legislative session begins Tuesday

State lawmakers will return to Montgomery Tuesday to kick off the 2026 legislative session. It's the final session for Gov. Kay Ivey. It also comes against the backdrop of statewide elections this fall. For a look ahead to what to expect this session we turn to Todd Stacy, host of Capital Journal on Alabama Public Television.

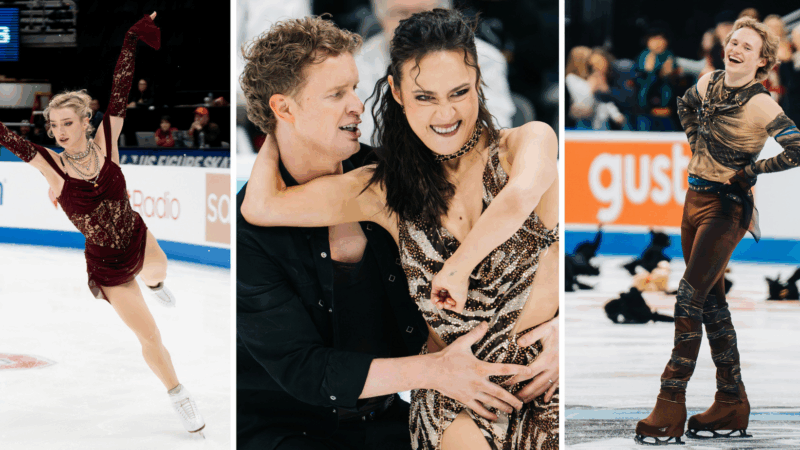

Who are the figure skaters representing Team USA? Key names and backstories to know

Sixteen U.S. figure skaters are competing in all four Olympic disciplines: men's, women's, pairs and ice dance. The team includes a mix of seasoned vets, world champions and rising stars.

How IVF has led to a record number of single moms in their 40s

Who gets to be a parent has been reshaped by IVF: Single women in their 40s are increasingly opting to become moms.

Marrying for health insurance? The ACA cost crisis forces some drastic choices

While Congress debates bringing back Affordable Care Act subsidies , many Americans have already made life-altering decisions to afford health care.

Exercise is as effective as medication in treating depression, study finds

New research shows exercise is as effective as medication at reducing symptoms of depression. And you don't need to run a marathon to see benefits. So how much is enough?

Celebrities wear pins protesting ICE at the Golden Globes

Some celebrities donned anti-ICE pins at the Golden Globes on Sunday in tribute to Renee Good, who was shot and killed by an Immigration and Customs Enforcement officer last week in Minneapolis.