Where to find information about flood risk to your home

In the wake of deadly flash floods in Central Texas, many people are wondering what they can do to protect themselves from flooding where they live.

It’s a good question, and one that is relevant to people across the United States.

As the Earth gets hotter, flooding is becoming more common and severe in most of the country. More than 14 million apartments and houses have a substantial risk of flooding in the next 30 years, according to the Congressional Budget Office — from sea level rise and storm surge along the coasts, to heavy rain and river flooding inland.

And, because the climate is changing, many places that flooded a little in the past will flood a lot in the future, putting lives and property at enormous risk. It’s already happening: One-third of the federal disaster money distributed after floods goes to people who live outside official flood zones, according to the Federal Emergency Management Agency.

Yet, in many parts of the country, it is easy to move into a flood-prone building and not know you’re in harm’s way. Despite the risk, 14 states do not require that any information about flooding be disclosed to potential home buyers.

So, what questions should you ask about flood risk before you move? And how easy is it to find answers? NPR talked to flood experts and put together this guide, a version of which was originally published in 2020. You can use it to find information whether you’re planning to move soon, or just wondering about flood risk where you already live.

1. Has this building or area flooded before?

WHY SHOULD I ASK THIS?

Places that flood once often flood again, especially as the climate changes.

WHERE TO START

Landlords or real estate agents may share information about past flooding, but in many places they are not required to do so, and the information you do receive may not be complete. You can check the laws for homebuyers in your state using this map from the Natural Resources Defense Council, although it does not include disclosure requirements for renters, which are more rare.

Longtime residents and local media reports are often some of the best sources of information about past flooding in the area.

2. How likely is it that this building will flood while I live there?

WHY SHOULD I ASK THIS?

The flood history for your building or neighborhood isn’t enough information. What you really need to know is how sea level rise and more extreme rain are going to contribute to your flood risk in the future.

The answer depends on how long you intend to live there. If you’re buying a house using a 30-year mortgage, and planning to live in it for decades, you’re much more likely to experience a flood at that address than if you’re planning to rent the same house for one year.

WHERE TO START

Some real estate sites, such as Realtor.com and Redfin.com, include flood risk in their listings. People in coastal areas can also look up their flood risk on the Climate Central Riskfinder.

Some states and cities publish local information about flood risk, including Rhode Island’s coastal management mobile app and Louisiana’s coastal protection forecast. Contact your state’s emergency management agency to see if such information is available for your area.

3. Is this building in a FEMA-designated flood zone right now?

WHY SHOULD I ASK THIS?

FEMA publishes the flood maps that are used to set public flood insurance premiums. Many local and state governments also use them for planning.

It’s important to know your FEMA-designated flood zone, because you might need to buy flood insurance.

But even if the FEMA map says you’re at low risk, you might not be. Many FEMA flood maps are out of date, and even newly updated ones don’t take into account climate-driven heavy rain or sea level rise.

WHERE TO START

FEMA flood maps are publicly available and searchable online. Just put in your address here. Watch out: The map loads very slowly.

4. How much does flood insurance cost, and what does it cover?

WHY SHOULD I ASK THIS?

Most renter and homeowner insurance does not cover flood damage. Instead, you may want to purchase a separate flood insurance policy to cover flood damage to your belongings, the apartment or house itself, or both.

If you live in a flood-prone area, flood insurance can be expensive. If you’re moving to a place that FEMA thinks is at lower risk, however, your insurance premium will be much lower. That could end up being a good deal: About 25% of the flood damage covered by insurance are outside the highest-risk areas.

Flood insurance is sometimes mandatory. For example, if you buy a home in a high-risk area using a federally backed mortgage, or if you buy a house that flooded before and was rebuilt with federal disaster aid, you must buy flood insurance. In some states, including Louisiana and Texas, the seller is required to tell you if this is the case.

WHERE TO START

In most states prospective renters or buyers don’t have a right to know how much flood insurance will cost. FEMA provides the vast majority of residential flood insurance. However, the agency will not disclose to prospective buyers or tenants whether a property has a flood insurance policy, or how much that policy costs.

You can still ask the landlord, previous tenant or seller whether they have flood insurance and how much it costs. You can also ask other people who live in the building or neighborhood, or ask a local insurance agent for a quote.

5. What are landlords or sellers required to disclose to me?

WHY SHOULD I ASK THIS?

In some places, landlords and sellers do not have to tell you much about flood risk, and usually they are only required to disclose information after you’ve made an offer or applied for a lease. Tenants generally have a right to much less information than buyers. The details vary by state.

WHERE TO START

The Natural Resources Defense Council tracks state flood disclosure requirements for people buying homes.

6. Has anyone in the neighborhood taken a buyout?

WHY SHOULD I ASK THIS?

Some local governments are trying to move people out of the riskiest areas. One way to do this is to purchase homes that have flooded repeatedly and demolish them to make room for water to spread out harmlessly.

This only applies to a small percentage of neighborhoods, but if your new neighborhood is one of them, you probably want to know before you move there.

WHERE TO START

You can search for your ZIP code in this NPR database to see whether any homes were purchased and demolished in your area between 1989 and 2017. It’s most helpful in places that have had a lot of flooding for a long time.

Iran’s president defies U.S. demands while apologizing for strikes on neighbors

President Masoud Pezeshkian said Saturday that a demand by the U.S. for an unconditional surrender is a "dream that they should take to their grave." He also apologized for Iran's attacks on regional countries.

What the Trump administration says about why it went to war with Iran

The Trump administration says it is "laser focused" and mission driven, but the messaging has been varied. The range of cited motivations for striking Iran now are sometimes at odds with each other.

Trump looks to turn attention to Western Hemisphere at Americas summit

President Trump is set to gather with Latin American leaders on Saturday at his Miami-area golf club as his administration looks to turn attention to the Western Hemisphere, at least for a moment.

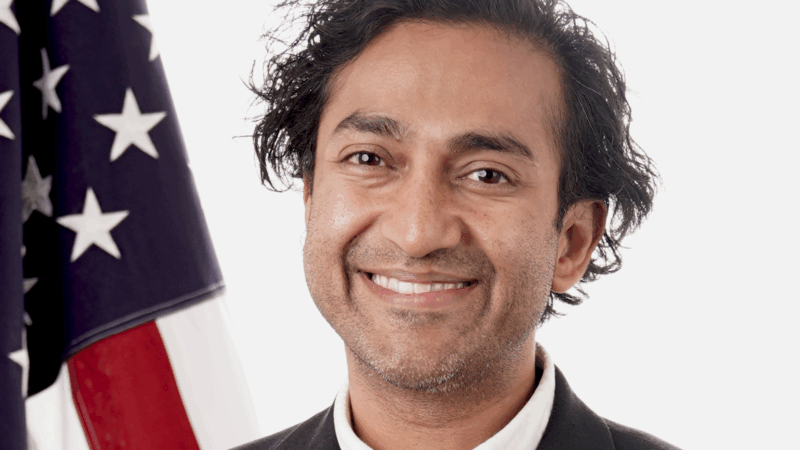

Trump administration’s embattled FDA vaccine chief is leaving for the second time

The FDA's controversial vaccine chief, Dr. Vinay Prasad, is leaving the agency. It's the second time he has abruptly departed following decisions involving the review of vaccinations and specialty drugs.

Family, former presidents and a Hall of Famer give Rev. Jesse Jackson a final sendoff

Several speakers at Jackson's funeral invoked his hallmark catchphrases: "Keep hope alive" and "I am somebody."

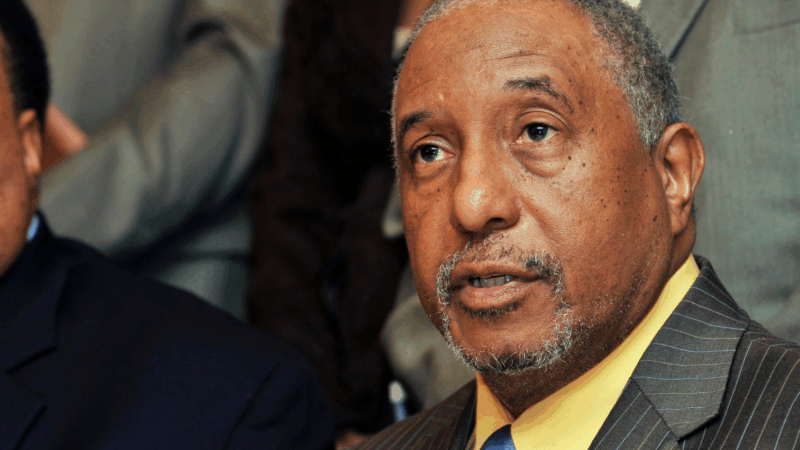

Bernard LaFayette, Selma voting rights organizer, dies at 85

Bernard LaFayette, who died Thursday, laid the foundations of the Selma, Alabama, campaign that culminated in the passage of the Voting Rights Act. He was a Freedom Rider and helped found the Student Nonviolent Coordinating Committee.