What Trump’s One Big Beautiful Bill Act means for taxes on Social Security

In the hours after Congress passed President Trump’s megabill, an email from the Social Security Administration hit the inboxes of many Americans. It applauded the legislation’s passage and said it includes a provision that “eliminates federal income taxes on Social Security benefits for most beneficiaries.”

But experts say the email was misleading and that what’s really in the new law is a bit more complicated.

What’s in the new law?

Trump campaigned on the promise of “no tax on Social Security benefits.” But the new law doesn’t create a special exemption for taxes on Social Security benefits. Instead, it adds a new tax deduction for people 65 and older — and that means more of them will pay no taxes, or fewer taxes, on their Social Security benefits.

“The legislation that passed does make it so some people won’t pay taxes on their benefits,” says Marc Goldwein, senior vice president at the nonpartisan Committee for a Responsible Federal Budget. “The reason is that it’ll make it so that some seniors won’t pay any taxes, because it increases their standard deduction.”

The new senior deduction is $6,000 a year for individuals 65 or older.

About that email — and why it’s controversial

On July 3, the Social Security Administration blasted out an email with the subject line “Social Security Applauds Passage of Legislation Providing Historic Tax Relief for Seniors.”

The agency is not in the practice of sending political emails, so this was notable.

But that wasn’t the only issue, says Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center.

“The email was really pretty misleading. It included a number of assertions that simply are either not true or overstated or described in a way that is really going to confuse people,” says Gleckman.

First, the email implies that the bill changed how Social Security benefits are taxed — and the White House put out a news release headlined “No Tax on Social Security is a Reality in the One Big Beautiful Bill.”

But Social Security benefits are taxed like other income, and this law doesn’t change that.

Second, the email says, “the bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits.”

Indeed, the White House Council of Economic Advisers estimates that, under the new law, 88% of older adults receiving Social Security benefits will pay no taxes on them.

But Gleckman points out that by the administration’s own estimate, almost two-thirds of Social Security recipients already don’t pay taxes on their benefits, because they don’t make enough money for that tax to kick in.

NPR reached out to the Social Security Administration for a response to these critiques but did not hear back. In a news release with similar text to the email, the administration posted a correction that removes the language stating that the $6,000 annual deduction for older adults is in addition to another separate policy change.

Who will see a lower tax bill with this deduction?

It’s primarily middle- or upper-middle-class folks who will see a difference with the new senior deduction, says Gleckman. He and his colleagues at the Tax Policy Center estimate that about half of older adults will benefit.

Those who’ll see the biggest benefit are those with incomes between $80,000 and $130,000. They should receive an average tax cut of about $1,100.

Lower-income seniors won’t notice any change from this deduction, because they already earn too little to pay taxes. And higher-income folks won’t see a change, because individuals with incomes over $175,000 or couples over $250,000 won’t qualify for the new deduction.

The impact of the tax cuts on Social Security itself

The email quotes Social Security Administration Commissioner Frank Bisignano: “This legislation reaffirms President Trump’s promise to protect Social Security and helps ensure that seniors can better enjoy the retirement they’ve earned.”

But that depends on what you mean by “protect.”

Taxes paid on Social Security benefits go directly to shoring up the trust funds for Social Security and Medicare Part A. Cutting these taxes accelerates the timeline in which those trust funds will become insolvent.

According to an estimate from the Committee for a Responsible Federal Budget, that will now happen in late 2032. It estimates that Social Security benefits would be cut by an estimated 24% unless Congress makes changes before then.

In that way, cutting taxes that feed the trust fund does the opposite of protecting Social Security.

Wall Street is betting on tariff refunds after Supreme Court ruling

When the Supreme Court struck down many of President Trump's tariffs, it left importers wondering how long they'd have to wait to get their money back. Hedge funds are offering to help out.

A run for their money: Young candidates rival older incumbents in midterm fundraising

As a growing crop of young candidates challenge longtime Democratic incumbents, some are not just breaking through in the money race, but outraising their opponents altogether.

When ICE came, Minneapolis created underground health networks. Should other cities?

The Trump administration's immigration crackdown in Minneapolis forced some families into hiding and catalyzed informal medical networks to deliver critical health care services inside homes.

Announcing the 2025 NPR College Podcast Challenge Honorable Mentions

Here are some of the best entries in NPR's 2025 College Podcast Challenge.

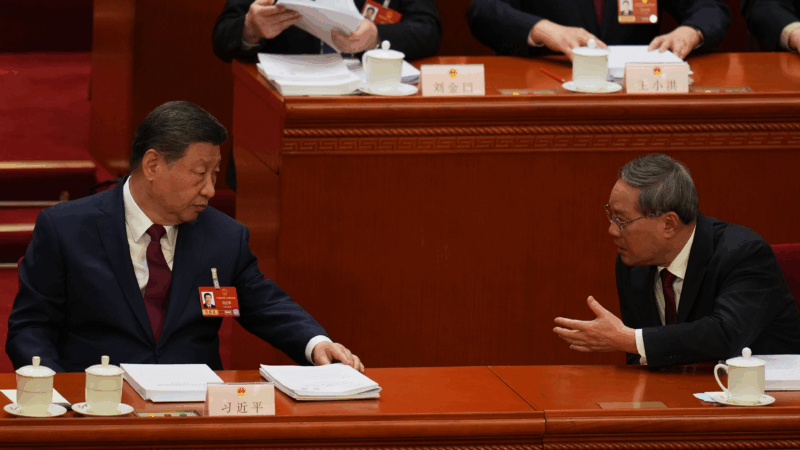

China sets a lower economic growth target of 4.5% to 5% for 2026 as challenges loom

China has signaled continuity rather than change for its economy, setting a slightly lower target for growth this year in the midst of a property slump and other headwinds at home and growing uncertainty abroad.

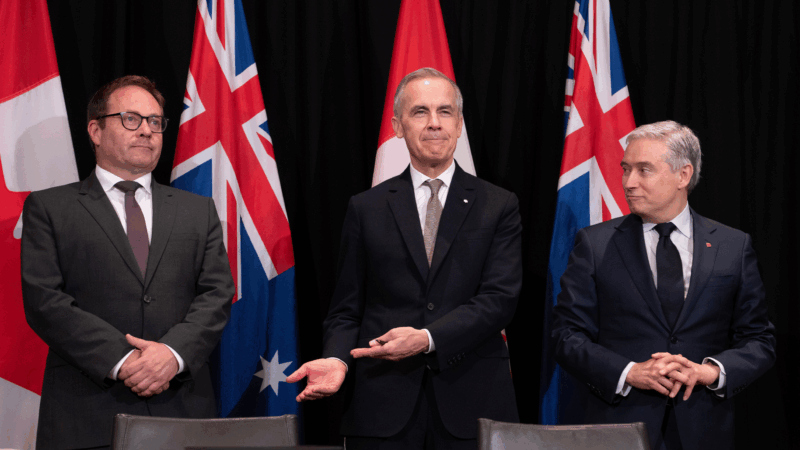

Carney says he backs strikes on Iran ‘with some regret’ as world order frays

Canadian Prime Minister Mark Carney says he supports the strikes on Iran "with some regret" as they represent an extreme example of a rupturing world order.