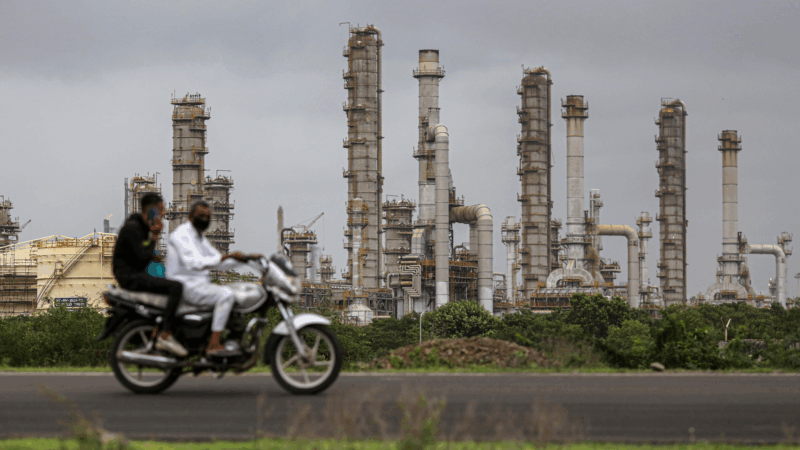

The U.S. is a major importer of Indian products made from Russian oil

MUMBAI, India — Tariffs on many Indian-origin goods entering the United States have now been doubled to 50%. While India has long been seen by the U.S. as a bulwark against China, Indian goods now face some of the highest import taxes of products made anywhere in the world.

The Trump administration asserts that the additional tariff is punishment for India’s alleged funding and profiting off the Ukraine war by becoming a leading buyer of Russian crude oil at a discount and selling oil products the world over.

In a recent interview on Bloomberg Television, White House trade adviser Peter Navarro doubled down on the accusation that Indian Prime Minister Narendra Modi was financing the Kremlin’s “war machine,” even calling the Russia-Ukraine conflict “Modi’s war.”

But while a majority of the oil that India imports is for its own use, Indian refineries also export oil products. An NPR analysis found that the U.S. is one of their biggest customers.

The U.S. bought oil products worth an estimated $1.4 billion from India between January and July of this year, says the Finnish think tank Centre for Research on Energy and Clean Air (CREA).

According to shipping data sourced by CREA, more than 90% of the Indian oil products imported by the U.S. came from the Reliance Industries refinery, owned by Asia’s richest man, Mukesh Ambani. The data also shows that the Reliance refinery gets nearly half its crude oil from Russia.

That means the U.S. is buying fuel made directly or indirectly from Russian oil, according to Isaac Levi, a researcher at CREA.

Loading…

Levi points out that the European Union recently banned imports of seaborne crude oil and refined oil products from Russia. He says, “The U.S. must follow suit if they want to stop sending hundreds of millions of dollars to the Kremlin war chest each year.”

Countries importing oil products, which can include gasoline and diesel, made from Russian oil include both allies and adversaries of the United States. Yet, none has faced penalties like India. (President Trump imposed a 50% tariff on Brazilian goods for different political reasons.)

China is the biggest importer of Russian crude, buying more than $4 billion worth of the fuel from Russia in July alone, according to CREA. Despite recent cutbacks, annual imports of Russian goods and fossil fuels by the U.S. and the EU run in the billions of dollars.

Indian Foreign Minister S. Jaishankar recently took issue with the U.S. decision to single out India, saying there were bigger trading partners with Russia to go after.

So far, India has projected defiance in the face of U.S. pressure, saying it will import from whichever country offers the best deal. It is also mending ties with rival China after years of tensions along their border. Last month, China’s ambassador to India said his country stands with New Delhi, telling reporters, “Silence only emboldens the bully.”

But in spite of its public stance, shipping data obtained from CREA suggests India’s imports from Russia declined after Trump’s threat of higher tariffs.

Impact of Trump’s penalty

Trump has been threatening for months to impose tariffs on countries importing Russian oil.

In mid-July, he gave Moscow an ultimatum to agree to a ceasefire, failing which its trade partners would face secondary tariffs.

Loading…

About a third of India’s oil imports are from Russia. According to CREA, average daily imports from Russia decreased 24% in July compared with June. They picked up in August, but the increase over July was only 5%.

Analysts, however, warn against seeing the dip as a direct consequence of Trump’s threats.

“Nearly 60% of the oil India buys is on long-term contracts,” says Lydia Powell, an analyst with the New Delhi-based Observer Research Foundation. Any disengagement from Russia can thus take months, if not longer, to kick in.

A possible explanation for July’s dip, says Powell, could be some refineries sourcing oil from spot markets where they got a better value. “While politics has a role in oil imports, most such decisions are influenced by economics,” says Powell.

Indian media quoted a senior official of the state-owned Bharat Petroleum Corp. as saying that the discount on Russian crude had contracted, which led to import volumes dipping in July. Days ahead of the fresh U.S. tariffs on India, Russia announced that it would offer a 5% discount to India on oil imports.

Powell says that the offer is “significant” but that one would need to track the oil procurement data for “at least a couple of months” before it could be said which is having a bigger impact: Trump’s threats or Russia’s inducements.

Loading…

No alternative to Russian oil

Most analysts, however, agree that even if India slashes its Russian imports, it will not be able to bring them down to zero. “Russia exports about 7.5 million barrels a day,” says Amit Bhandari, an energy expert at the Mumbai-based think tank Gateway House. Even though oil markets worry about an oversupply, Bhandari says, “There isn’t that much spare capacity in all of the world to frankly make that difference up.”

Any attempts to slash imports of Russian oil, says Bhandari, would spike up oil prices. “Say Russian oil miraculously stops coming into the world market. We are then probably looking at $150-a-barrel oil” — more than double the cost on world oil markets today. “That spike will be for every single consumer in the world, including the U.S., China and Europe.”

Ajay Srivastava, founder of the New Delhi-based Global Trade Research Initiative, says the combined U.S. tariffs on Indian goods are likely a ploy to get a better trade deal. Negotiations between the two countries have been stuck since July over India’s unwillingness to open up its dairy and agricultural sector to American companies.

The U.S. is India’s biggest export market. A 50% tariff is expected to hit India’s labor-intensive sectors the hardest, like textiles, gemstones and jewelry, seafood and automobiles. While there are tariff exemptions on Indian medicines and electronics, U.S. businesses and, potentially, customers buying shrimp, clothes and spices from India would end up paying a lot more.

The biggest casualty, says Srivastava, will be the goodwill between India and the United States, built after decades of bitterness over Washington’s support of India’s adversaries like Pakistan.

“The current generation of India’s youth grew up enamored with the U.S.,” he says. Trump’s actions will send them a message, he adds: “That the U.S. cannot be trusted.”

Forget the State of the Union. What’s the state of your quiz score?

What's the state of your union, quiz-wise? Find out!

A team of midlife cheerleaders in Ukraine refuses to let war defeat them

Ukrainian women in their 50s and 60s say they've embraced cheerleading as a way to cope with the extreme stress and anxiety of four years of Russia's full-scale invasion.

As the U.S. celebrates its 250th birthday, many Latinos question whether they belong

Many U.S.-born Latinos feel afraid and anxious amid the political rhetoric. Still, others wouldn't miss celebrating their country

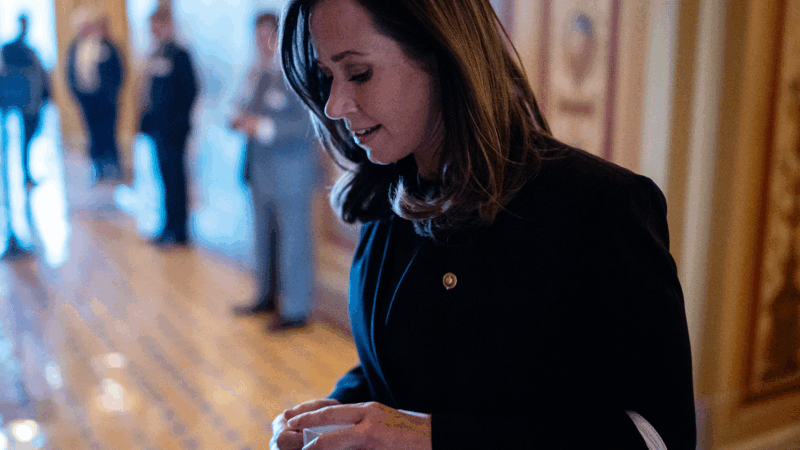

SNL mocked her as a ‘scary mom.’ In the Senate, Katie Britt is an emerging dealmaker

Sen. Katie Britt, Republican of Alabama, is a budding bipartisan dealmaker. Her latest assignment: helping negotiate changes to immigration enforcement tactics.

Nancy Guthrie case: How do families of missing people cope with the uncertainty?

When a loved one goes missing, relatives can feel guilty simply for eating, says Charlie Shunick, whose sister was kidnapped. Shunick now helps others navigate a nightmare "nobody is prepared for."

This community festival embraces the joys of a frozen lake — while it still has one

As climate change accelerates, local experts say the date Wisconsin's Lake Mendota freezes over is getting later, making safe conditions for activities that rely on snow and ice harder to predict.