The IRS finalizes a deal to share tax information with immigration authorities

WASHINGTON — The Internal Revenue Service has reached an agreement with immigration authorities to share tax information about some immigrants without legal status, marking a major change in how tax records can be used.

The memorandum of understanding between the IRS and U.S. Immigration and Customs Enforcement was signed on Monday and made public the same day in a court filing. It’s not clear when information-sharing between the two agencies will begin.

Under the terms of the deal, ICE officers can ask the IRS for information about immigrants who have final orders of removal or are under criminal investigation — including for the crime of failing to leave the country after 90 days.

The framework establishes a “clear and secure process to support law enforcement’s efforts to combat illegal immigration,” according to an emailed statement from Sophie Delquie, senior adviser for public affairs at the Treasury Department.

The agreement was signed by Homeland Security Secretary Kristi Noem and Treasury Secretary Scott Bessent.

Many parts of the 15-page document are redacted, making it difficult to understand exactly what the IRS has agreed to share. The framework includes several pages of rules and requirements for how ICE officers must handle the information they receive.

Still, that did not assuage immigrant advocates’ concerns.

“The IRS’s decision to share confidential information with the Department of Homeland Security threatens the safety of thousands of workers while forcing them further into the shadows, and discourages tax compliance,” said Murad Awawdeh, CEO of the New York Immigration Coalition. “Instead of punishing people who contribute and comply with our tax laws, our government should be working to protect their rights and build trust.”

The Department of Homeland Security did not reply to a request for comment about the agreement. The court filing came in a lawsuit brought by immigrant advocacy groups that are seeking to block any information-sharing between the IRS and ICE.

Immigrants without legal status pay billions of dollars in taxes, many through a nine-digit code known as an Individual Taxpayer Identification Number. For years, immigrant advocates and tax experts say, the IRS has consistently assured undocumented taxpayers that their information is confidential, and that it would be safe for them to file tax returns.

Dozens of congressional Democrats signed on to a letter to Secretary Noem and the head of the IRS urging them not to go through with the agreement.

“If immigrants fear that filing taxes could expose them to deportation, many will choose not to file, reducing Federal revenues that contribute to funding public schools, health care, and disaster relief for Americans while shifting resources to the informal economy,” they wrote last month. “This would increase deficits and shift a higher proportion of the tax burden onto American citizens.”

But the IRS and DHS pushed forward with the deal anyway.

The Treasury Department said it is committed to protecting the confidentiality of taxpayer data — but that the law also provides an exception for criminal investigations.

“The bases for this MOU are founded in longstanding authorities granted by Congress, which serve to protect the privacy of law-abiding Americans while streamlining the ability to pursue criminals,” the department said in its emailed statement.

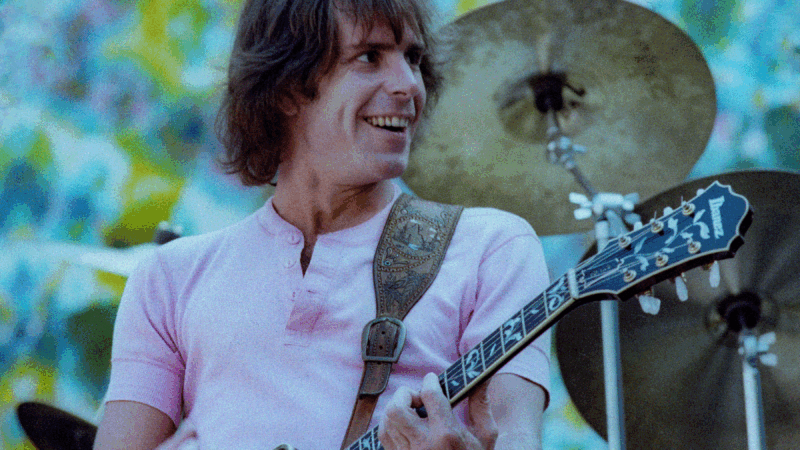

Bob Weir, guitarist and founding member of the Grateful Dead, has died at 78

For three decades with the Grateful Dead and three more after the group ended following the 1995 death of his bandmate Jerry Garcia, Weir helped build and sustain the band's legacy across generations.

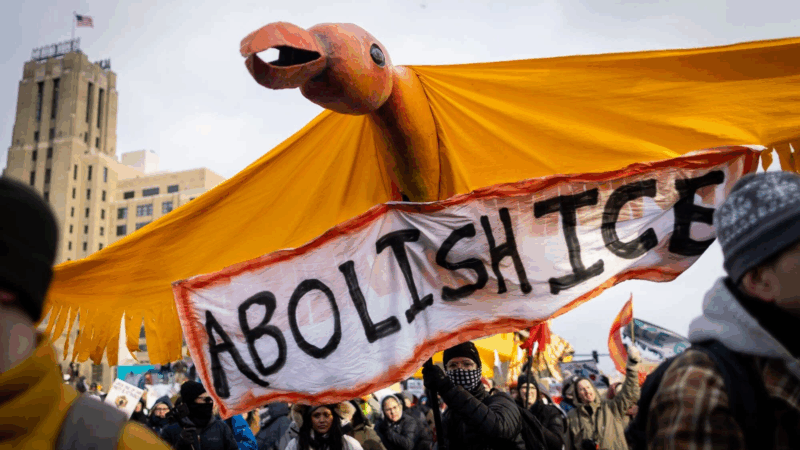

Nationwide anti-ICE protests call for accountability after Renee Good’s death

Activist organizations are planning at least 1,000 protests and vigils this weekend. Officials in major cities cast Saturday's demonstrations as largely peaceful.

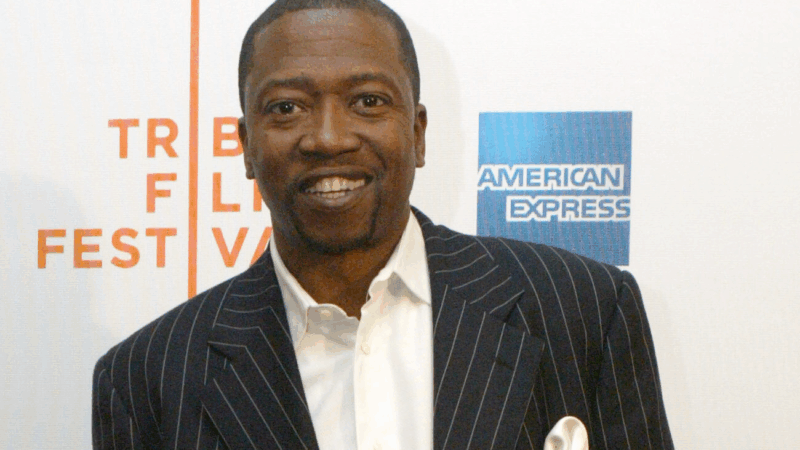

Veteran actor T.K. Carter, known for ‘The Thing’ and ‘Punky Brewster,’ dies at 69

T.K. Carter gained fame as Nauls the cook in John Carpenter's 1982 horror classic, "The Thing."

Who is Reza Pahlavi, the exiled Crown Prince encouraging demonstrations across Iran?

In exile for nearly 50 years, Iran's Crown Prince Reza Pahlavi has issued calls urging Iranians to join protests sweeping the country. But support for him may not be clear cut.

US launches new retaliatory strikes against ISIS in Syria after deadly ambush

The U.S. has launched another round of strikes against the Islamic State in Syria. This follows last month's ambush that killed two U.S. soldiers and an American civilian interpreter.

6 killed in Mississippi shooting rampage, authorities say

The alleged gunman, 24, has been charged with murder after the Friday shootings in northeast Mississippi. The victims include his father, uncle, brother and a 7-year-old relative, authorities said.