The GOP’s massive bill would add trillions of dollars to the country’s debt

The massive tax cut and spending bill passed by the Senate this week is expected to add trillions of dollars over the next decade to an already hefty federal debt.

The precise level of additional red ink depends on the forecast. The Yale Budget Lab says it would add $3 trillion over the next 10 years, while the Congressional Budget Office (CBO) estimates it would add $3.4 trillion. Meanwhile, the Committee for a Responsible Federal Budget puts the total at $4 trillion or more.

But bean counters all agree: The measure, if passed, would push the government’s finances even further out of balance. The bill now heads back to the House, which had passed a somewhat different version earlier this year.

“The level of blatant disregard we just witnessed for our nation’s fiscal condition and budget process is a failure of responsible governing,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “These are the very same lawmakers who for years have bemoaned the nation’s massive debt, voting to put another $4 trillion on the credit card.”

Lower taxes, little boost to growth

The bill would extend tax cuts from the first Trump administration and add additional tax breaks, reducing government revenues. The measure also increases government spending on defense and immigration enforcement. While it makes cuts to spending on Medicaid and food assistance, those cuts offset only a fraction of the bill’s total cost.

At the same time, the measure is expected to do little to boost economic growth. CBO has not yet estimated the economic effects of the Senate bill. But an earlier House version was found to provide only modest economic gains, which were dwarfed by the cost of higher interest payments.

Most of the savings from the House bill’s tax cuts were expected to flow to the richest taxpayers, while people at the bottom of the income ladder would be worse off, since any tax savings would be outweighed by lost government benefits.

On average, people earning less than about $55,000 a year would be net losers from the House bill, according to the CBO forecast. Middle-income taxpayers would save between $500 and $1,000 a year, while the top 10% would see gains of about $12,000.

Top 5 takeaways from the House immigration oversight hearing

The hearing underscored how deeply divided Republicans and Democrats remain on top-level changes to immigration enforcement in the wake of the shootings of two U.S. citizens.

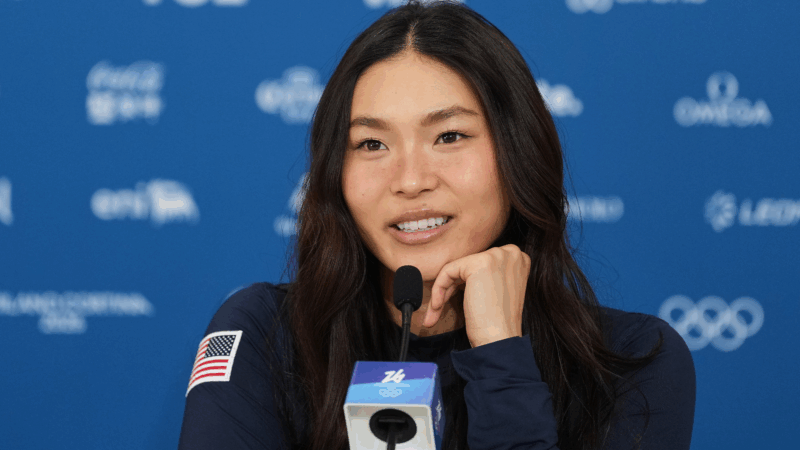

Snowboarder Chloe Kim is chasing an Olympic gold three-peat with a torn labrum

At 25, Chloe Kim could become the first halfpipe snowboarder to win three consecutive Olympic golds.

Pakistan-Afghanistan border closures paralyze trade along a key route

Trucks have been stuck at the closed border since October. Both countries are facing economic losses with no end in sight. The Taliban also banned all Pakistani pharmaceutical imports to Afghanistan.

Malinowski concedes to Mejia in Democratic House special primary in New Jersey

With the race still too close to call, former congressman Tom Malinowski conceded to challenger Analilia Mejia in a Democratic primary to replace the seat vacated by New Jersey Gov. Mikie Sherrill.

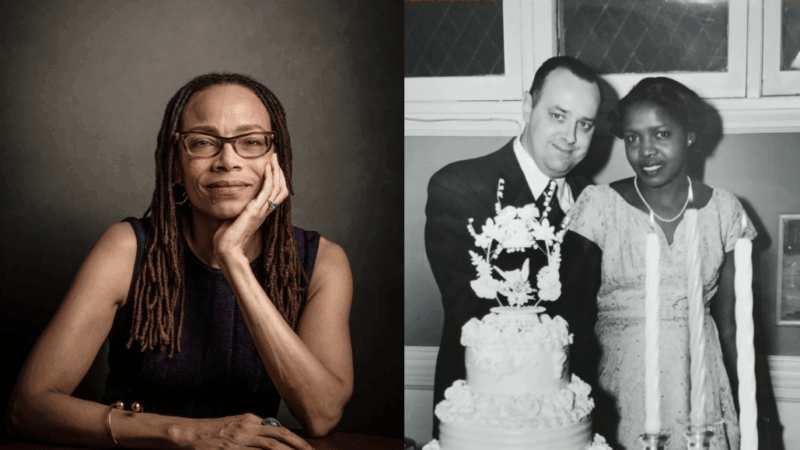

A daughter reexamines her own family story in ‘The Mixed Marriage Project’

Dorothy Roberts' parents, a white anthropologist and a Black woman from Jamaica, spent years interviewing interracial couples in Chicago. Her memoir draws from their records.

FBI release photos and video of potential suspect in Guthrie disappearance

An armed, masked subject was caught on Nancy Guthrie's front doorbell camera one the morning she disappeared.