The Fed is likely to hold interest rates steady despite intense pressure from Trump

The Federal Reserve is expected to hold interest rates steady on Wednesday despite intense pressure from President Trump to cut borrowing costs.

Investors are almost certain the central bank will keep its benchmark rate between 4.25% and 4.5%, according to the CME Group’s tracking of futures markets. But investors are optimistic that a rate cut could be in store at the Fed’s next meeting, in September.

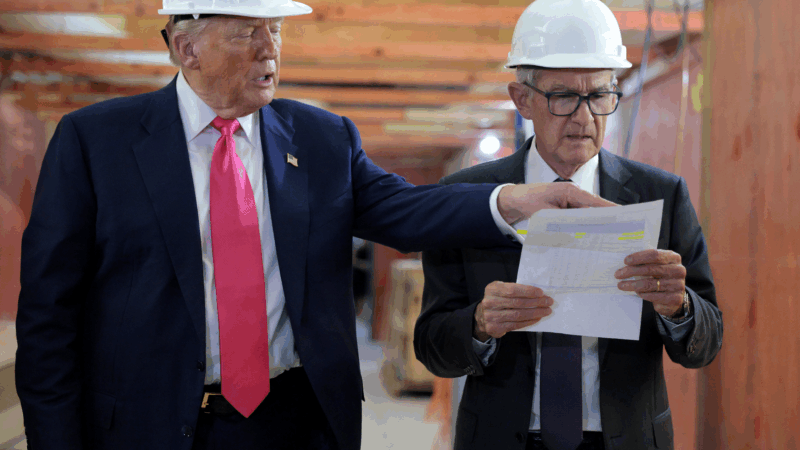

Trump has repeatedly criticized Federal Reserve Chair Jerome Powell and his colleagues for not moving more aggressively to lower rates, even assigning the nickname “Too Late” to Powell. The White House has also complained about cost overruns on the $2.5 billion renovation of two Fed office buildings in Washington. Last week, Trump and Powell sparred verbally during a tour of the project when the president claimed the price tag was over $3 billion. Powell corrected Trump, saying that figure included a third building that was completed earlier.

Since cutting rates by a full percentage point last year, the Fed has been in a holding pattern, as policymakers wait to see how the president’s new tariffs and other initiatives affect the broader economy.

Powell insists the personal attacks haven’t affected his decision-making.

“I’m very focused on just doing my job,” the Fed chair said at a central bankers’ meeting in Portugal this month.

“I have a little more than 10 months left on my term as chair,” said Powell, whose term expires in May. “I want to hand over to my successor an economy in good shape.”

Some argue for rate cuts

Inflation is still above the Fed’s 2% target — and economists worry that Trump’s tariffs could push prices higher. Consumer prices in June were up 2.7% from a year ago — a larger annual increase than the previous month.

At the same time, unemployment remains low, putting little pressure on the Fed to cut borrowing costs right away. The Labor Department is set to report on July’s job gains on Friday.

Still, some Fed officials are advocating a rate cut now.

Fed governor Chris Waller says that while Trump’s tariffs may cause a one-time increase in prices, they’re not likely to be a persistent driver of inflation. Waller also worries that the job market may be weaker than the low 4.1% unemployment rate would indicate.

“We should not wait until the labor market deteriorates before we cut,” Waller said this month in New York.

Fed governor Michelle Bowman has also said she’s open to cutting rates at this month’s meeting. Other members of the Fed’s rate-setting committee want to take more time, but most believe rate cuts could be appropriate later this year, according to minutes of the most recent Fed meeting, in June.

When a horse whinnies, there’s more than meets the ear

A new study finds that horse whinnies are made of both a high and a low frequency, generated by different parts of the vocal tract. The two-tone sound may help horses convey more complex information.

Hundreds of American nurses choose Canada over the U.S. under Trump

More than 1,000 American nurses have successfully applied for licensure in British Columbia since April, a massive increase over prior years.

Trump’s many tariff tools mean consumer prices won’t go down, analysts say

The Supreme Court struck down President Trump's signature tariffs. But the president has other tariff tools, and consumers shouldn't expect cheaper prices anytime soon, economists say.

Tax credits for solar panels are available, but the catch is you can’t own them

Rooftop solar installers are steering customers toward leases instead of purchases. Federal tax credits for purchased systems have ended but are still available for leased ones.

5 takeaways from Trump’s State of the Union address

President Trump hit familiar notes on immigration and culture in his speech Tuesday night, but he largely underplayed the economic problems that voters say they are most concerned about.

China restricts exports to 40 Japanese entities with ties to military

China on Tuesday restricted exports to 40 Japanese entities it says are contributing to Japan's "remilitarization," in the latest escalation of tensions with Tokyo.