The Fed holds interest rates steady as Trump’s trade agenda sparks uncertainty

The Federal Reserve held interest rates steady on Wednesday, as policymakers await clear signals of how the Trump administration’s tariffs and other policies will affect the U.S. economy.

Members of the central bank’s rate-setting committee voted to keep their benchmark rate between 4.25% and 4.5%. Updated forecasts released Wednesday show that on average, committee members expect to cut borrowing costs by about half a percent later this year, if inflation continues to ease.

Trump’s tariffs could complicate that process, though. Recent surveys suggest that more businesses are preparing to raise prices and consumers are expecting higher inflation since the president’s import taxes began taking effect last month.

Trump has added 20% tariffs on all imports from China and 25% tariffs on imported steel and aluminum from around the world. The president is preparing to impose additional import taxes beginning next month.

Uncertainty around trade policy and the on-again-off-again rollout of tariffs led to volatility in the stock market earlier this month.

Gauging the impact from tariffs

The Fed is trying to assess the overall economic effect of those tariffs along with the administration’s efforts to curb immigration, lower taxes, slash federal spending and roll back regulations.

“We are focused on separating the signal from the noise as the outlook evolves,” Fed Chair Jerome Powell said earlier this month. “We do not need to be in a hurry, and are well positioned to wait for greater clarity.”

Powell stressed that while the White House trade policy has sparked considerable uncertainty — with tariffs imposed one day and sometimes suspended the next — the overall economy has remained resilient. The unemployment rate was a low 4.1% in February while the annual inflation rate slowed to 2.8%.

Consumer spending has softened so far this year, however, which could lead to slower economic growth. If that happens, the Fed would face more pressure to lower interest rates.

On the other hand, if tariffs put upward pressure on prices, the Fed may want to keep interest rates high to avoid rekindling inflation. Members of the rate-setting committee are projecting somewhat higher inflation this year now than they were three months ago.

“Everybody is forecasting some inflation effect from tariffs,” Powell said, although how much the import taxes will raise prices remains unclear.

“We’re at a stage where we’re still very uncertain about what will be tariffed, for how long, at what level,” Powell said. “We’re going to have to wait and see all of that.”

Threats vs. tariffs

If tariffs simply trigger a one-time price increase that’s not repeated, the Fed would probably not feel the need to respond with higher interest rates. But a lengthy trade war in which tariffs continue to escalate would be a different story.

An example of that came last week, when the European Union threatened to retaliate for Trump’s steel and aluminum tariffs by taxing imports of U.S. whiskey, among other products. Trump fired back on social media, threatening to levy a 200% tariff on European wine and spirits.

While the economic saber rattling may not be followed-up with actual tariffs, the threat alone is enough to rattle financial markets and give business people pause about making new investments.

Three months ago, Fed policymakers were projecting the U.S. economy would grow 2.1% this year, while the unemployment rate would top out at 4.3%. On average, policymakers have downgraded their growth forecast to 1.7%. And they’re now predicting somewhat higher unemployment of 4.4%.

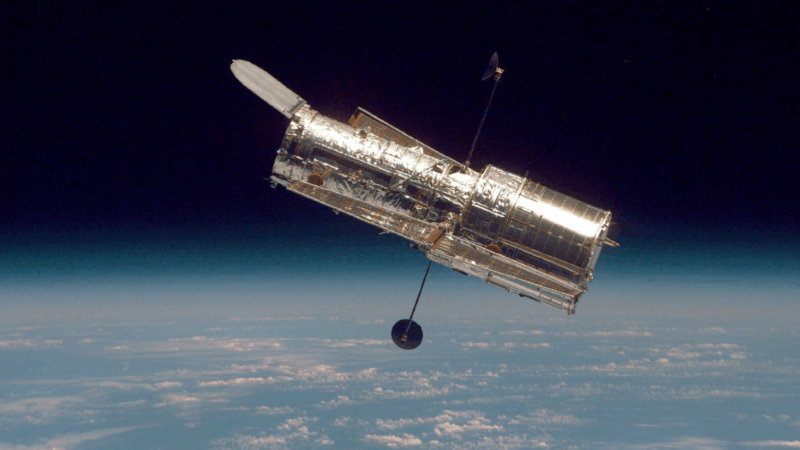

Light from satellites will ruin majority of some space telescope images, study says

Astronomers have long been concerned about reflections from satellites showing up in images taken by telescopes and other scientific instruments.

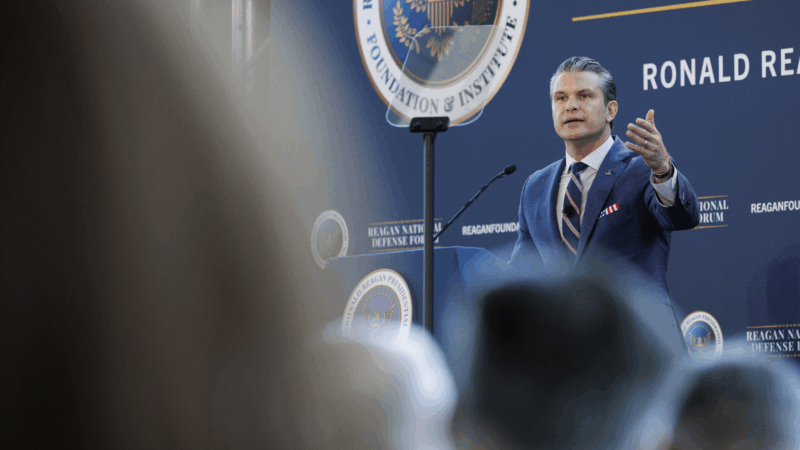

Defense Department is reviewing boat strike video for possible release, Hegseth says

In a speech on Saturday, Defense Secretary Pete Hegseth defended the strikes, saying: "President Trump can and will take decisive military action as he sees fit to defend our nation's interests."

Bama, Miami in, Notre Dame out and Indiana No. 1 in College Football Playoff rankings

Nobody paying attention for the past 24 months would be surprised to see Indiana – yes, Indiana – leading the way into this year's College Football Playoff.

McLaren’s Lando Norris wins first F1 title at season-ending Abu Dhabi Grand Prix

Red Bull driver and defending champion Max Verstappen won the race with Norris placing third, which allowed Norris to finish two points ahead of Verstappen in the season-long standings.

A ban on feeding pigeons ruffles lots of feathers in Mumbai

The pigeon population has exploded — a result of people feeding the birds. For some it's a holy duty and a way to connect to nature. Critics point to health risks tied to exposure to pigeon droppings.

UN humanitarian chief: world needs to ‘wake up’ and help stop violence in Sudan

The UN's top humanitarian and emergency relief official has told NPR that the lack of attention from world leaders to the war in Sudan is the "billion dollar question".