NFL and ESPN reach nonbinding agreement for sale of NFL Network and other media assets

Ever since the NFL announced it was looking to sell NFL Network and other media assets, ESPN had been seen as one of the favorites to make a deal.

Nearly five years later, a framework is finally in place.

The NFL announced Tuesday night that it has entered into a nonbinding agreement with ESPN. Under the terms, ESPN will acquire NFL Network, NFL Fantasy and the rights to distribute the RedZone channel to cable and satellite operators and the league will get a 10% equity stake in ESPN.

The league and ESPN still have to negotiate a final agreement and get approval from NFL owners. The agreement will also have to undergo regulatory approvals.

“Sometimes great things take a long time to get to the point where it’s right. And we both feel that it is at this stage,” NFL Commissioner Roger Goodell said in a call with The Associated Press.

Along with the sale of NFL Network, the NFL and ESPN will have a second nonbinding agreement where the NFL will license to ESPN certain NFL content and other intellectual property that can be used by NFL Network and other assets that have been purchased.

“We have been talking about it in earnest for the last few years. But interestingly enough, we started talking about this over a decade ago but nothing really ended up happening. And we got back at it when I came back to Disney after my retirement,” Disney CEO Bob Iger said in a call with the AP.

What ESPN gets

ESPN is expected to launch its direct-to-consumer service before the end of September. The service would give cord-cutters access to all ESPN programs and networks for $29.99 per month. The addition of more NFL programming increases the value.

Many viewers will receive the service for free as part of their subscription to cable, satellite and most streaming services.

“When I came back to Disney and assessed essentially the future of ESPN, it became clear that ESPN had to launch a bigger and more robust and digital or direct-to-consumer product, not only for the sake of ESPN’s business, but for the sports fan,” Iger said. “And obviously, when you start thinking about high-quality sports content, your eyes immediately head in the direction of the NFL because there’s really nothing more valuable and more popular than that.”

NFL Network — which has nearly 50 million subscribers — would be owned and operated by ESPN and would be included in ESPN’s direct-to-consumer product.

The NFL RedZone channel would be distributed by ESPN to cable and satellite operators. However, the NFL will continue to own, operate and produce the channel as well as retain the rights to distribute the channel digitally. ESPN would also get rights to the RedZone brand, meaning RedZone channels for college football and basketball or other sports could be coming in the future.

NFL Fantasy Football would merge with ESPN Fantasy Football, giving ESPN the official fantasy football game of the league.

NFL Network will still air seven games per season. Four of ESPN’s games, including some that are in overlapping windows on Monday nights, would move to NFL Network. ESPN will license three additional games that will be carried on NFL Network.

What the NFL receives (and retains)

The league gets a 10% equity stake in ESPN. Aidan O’Connor, a senior vice president at the Prosek Partners marketing firm, estimates the value of that would be $2.2 billion to $2.5 billion.

ESPN is currently 80% owned by ABC Inc. as an indirect subsidiary of The Walt Disney Company. The other 20% is owned by Hearst. Once the deal is official and approved, the breakdown of ESPN will be 72% ABC Inc., 18% Hearst and 10% NFL.

This isn’t the first time the league has had an equity stake in a digital or communications business. It had that in the past with Sirius Satellite Radio and SportsLine. The NFL could also have equity in the newly formed “Paramount Skydance Corporation,” which owns CBS, due to the league’s partnership with Skydance.

“This is new as far as a partner now operating a business that we built, ran and grew,” said Hans Schroeder, the NFL’s executive vice president of media distribution. “It’ll also be a little bit new again with some of the dynamics here, but we’ll continue to balance that in a really arm’s length way where we’ll think about how we manage and work across to all our partners.”

The league will continue to own and operate NFL Films, NFL+, NFL.com, the official websites of the 32 teams, the NFL Podcast Network and the NFL FAST Channel (a free ad-supported streaming channel).

“The moves align with the NFL’s longstanding ambition to reach $25 billion in annual revenue by 2027 — a target first set in 2010, when league revenue stood at approximately $8.5 billion,” O’Connor said. “Financially, the move also signals to investors that ESPN is doubling down on differentiation and content stickiness by offering a scarce and premium product in a crowded marketplace. Intentionally ceding equity to the NFL transforms ESPN from a media licensee into a true platform partner — with few properties rivaling the league in terms of cultural significance, appointment viewing, audience reach, and monetization efficiency.”

No major changes yet

Viewers will likely not see any immediate impacts until next year once everything is approved.

Besides ESPN, the biggest winner in this could be NFL Network, which had seen reductions in original programming the past couple years. “Total Access,” the network’s flagship show since its launch in 2003, ended in May 2024 amid a series of layoffs and cost-cutting moves. “Good Morning Football” also moved from New York, where it had been since its start in 2016, to Southern California last year.

NFL Network moved to a broadcast facility across the street from SoFi Stadium in Inglewood, California, in 2021.

“The thing that’s exciting for us is that we have put a lot into the network. I think it’s been very effective for fans. We know it’s in good hands,” Goodell said. “They’re innovative, they recognize great production and know how to produce it. They will do a fantastic job of operating the network and taking it to another level.”

Trump administration’s embattled FDA vaccine chief is leaving for the second time

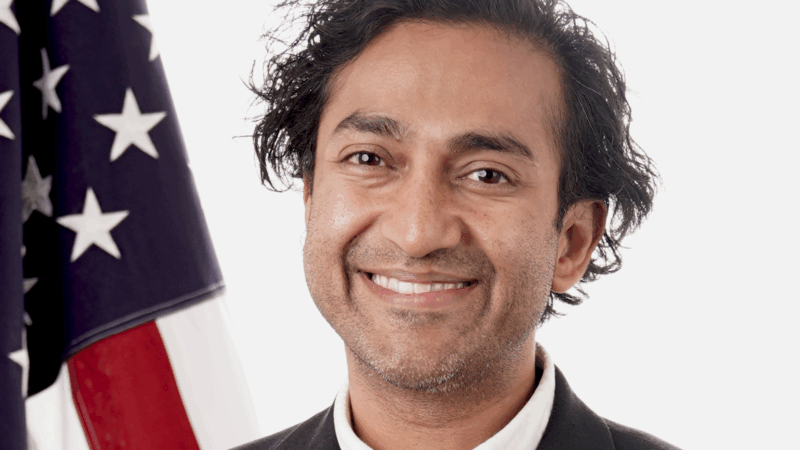

The FDA's controversial vaccine chief, Dr. Vinay Prasad, is leaving the agency. It's the second time he has abruptly departed following decisions involving the review of vaccinations and specialty drugs.

Family, former presidents and a Hall of Famer give Rev. Jesse Jackson a final sendoff

Several speakers at Jackson's funeral invoked his hallmark catchphrases: "Keep hope alive" and "I am somebody."

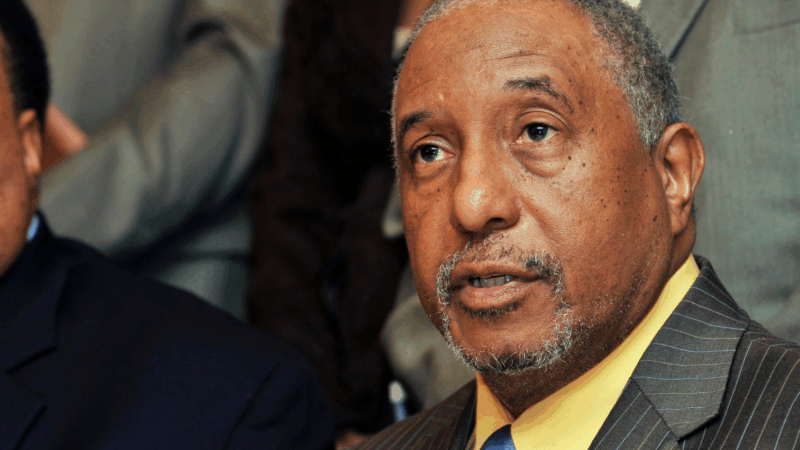

Bernard LaFayette, Selma voting rights organizer, dies at 85

Bernard LaFayette, who died Thursday, laid the foundations of the Selma, Alabama, campaign that culminated in the passage of the Voting Rights Act. He was a Freedom Rider and helped found the Student Nonviolent Coordinating Committee.

Oil surges to its highest price since 2023, and stocks drop after U.S. jobs report

Stocks fell Friday on worries that the economy could become stuck in a worst-case scenario of stagnating growth and high inflation. Oil prices touched their highest levels since 2023 after surging again because of the Iran war.

No lawsuits required: U.S. Customs is working on a system to refund tariffs

U.S. Customs told the trade court it aims for a streamlined process in 45 days to return importers' money without requiring individual lawsuits.

Poll: A majority of Americans opposes U.S. military action in Iran

Most Americans disapprove of President Trump's handling of Iran, and a majority sees Iran as either only a minor threat or no threat at all, an NPR/PBS News/Marist poll finds.