More homes are finally hitting the spring market. Will buyers take the plunge?

It’s springtime, and “For Sale” signs are popping up in front of homes across the country.

But with so much uncertainty in the economy, it’s an open question whether the spring housing market will be hot … or not. Let’s check out the forecast.

Mortgage rates and home prices are both high

It’s certainly not the cheapest time to buy a home. The average 30-year mortgage rate is now 6.65%, down a bit from January, but still pretty high.

Many analysts predict that mortgage rates will linger around this level for now, especially since the Federal Reserve has indicated it’s unlikely to cut interest rates until later this year.

Selma Hepp, chief economist at real estate analysis firm Cotality, says market volatility could bring down mortgage rates. That’s because mortgages typically follow the yield on 10-year Treasury bonds, which are affected by investors’ worries about the economy.

“Because of the concerns around a slowing job market, because of concerns maybe about rising risks of a recession,” Hepp says.

But there are other factors keeping mortgage rates high – among them, inflationary policies like tariffs.

Another deterrent for buyers is the elevated cost to buy a home. The median home price has shot up 47% in just the last five years.

Good news for buyers: more homes are hitting the market

Last year was the slowest existing home sales market since 1995. It’s wasn’t that people didn’t want to buy — there simply wasn’t much for sale.

The big question now is whether a frozen market can begin to thaw. Signs suggest things are starting to shift, with more inventory coming on the market.

In February, there were 17% more existing homes for sale compared to last year, followed by a 10% increase in new listings in March compared to a year ago.

In the last couple years, as mortgage rates climbed, there’s been concern about a “lock-in effect” causing homeowners with low interest rates to never move. But the recent uptick in listings suggests that as time goes on, people do end up moving.

More listings should translate to more sales. Return to office mandates are also spurring some folks to move closer to cities, now that they’ve got to be in the office several days a week.

Increased inventory will put buyers on better footing, giving them more options and more leverage.

For sellers, more competition could mean they have to be more flexible on price. That’s already starting to happen. Over 17% of active listings included price reductions in March, according to Realtor.com — the highest for any March since 2016.

Economic uncertainty clouds the forecast

Jeremy Masem, 40, is trying to become a homeowner. For the past year, he and his wife have been looking for a home in Fairfield County, Conn.

A few weeks ago, they offered $161,000 over a home’s asking price. But their bid still wasn’t enough.

This week, they lost again – theirs was one of 17 offers. Masem says they may decide to just keep renting for a while.

“I am a little nervous … All the various tariffs,” he says. “What’s going to happen? What’s not going to happen? Maybe just waiting and seeing for another year or two would be in our best interest.”

Others may be making that same choice. Pending listings — that is, homes under contract — fell 5.2% year over year in March, according to data from Realtor.com.

Those who are worried about losing their jobs might not want to commit to a big down payment right now.

“They tend to stay put,” says Hepp at Cotality. “They end up not moving unless they have to.”

Also adding to the uncertainty is that costs of homeownership that used to be pretty steady, like home insurance or HOA fees, have skyrocketed in some places.

That can make buying a home feel like more of a gamble than it used to.

On top of everything else, how agents are paid has changed

Last year, a settlement with the National Association of Realtors led to a few big changes for both buyers and sellers.

Before these new rules went into effect, sellers would typically pay both their own agent and the buyers’ agent. Now, that’s no longer a given. It’s up to the seller whether to pay the buyer’s agent—and how much.

A second big change is that now buyers who want to work with a real estate agent must sign an agreement that sets the agent’s compensation – before they can go see any homes.

So, pretty much the only way to see a home without signing something these days, is to go to an open house –- or represent yourself and reach out to listing agents directly.

Many real estate agents say the system really hasn’t changed much. But the new rules mean more things to negotiate amid what can already be a tricky process in a very expensive transaction.

“There’s still confusion over who’s paying whose percentage,” says Masem, the Connecticut home shopper.

He says the whole process of looking at homes and making offers can be draining and time-consuming.

“A lot of our free time is spent looking at this stuff,” says Masem. “I feel like we’re missing out on just regular things we would like to do.”

U.S. lawmakers wrap reassurance tour in Denmark as tensions around Greenland grow

A bipartisan congressional delegation traveled to Denmark to try to deescalate rising tensions. Just as they were finishing, President Trump announced new tariffs on the country until it agrees to his plan of acquiring Greenland.

Trump has rolled out many of the Project 2025 policies he once claimed ignorance about

Some of the 2025 policies that have been implemented include cracking down on immigration and dismantling the Department of Education.

Can exercise and anti-inflammatories fend off aging? A study aims to find out

New research is underway to test whether a combination of high-intensity interval training and generic medicines can slow down aging and fend off age-related diseases. Here's how it might work.

The 2026 Olympics are the most widespread in history. See what’s happening where

Competitions will be hosted at 25 venues spanning an area of more than 8,000 square miles. Here's what's happening at each of the four main clusters.

High-speed trains collide after one derails in southern Spain, killing at least 21

The crash happened in Spain's Andalusia province. Officials fear the death toll may rise.

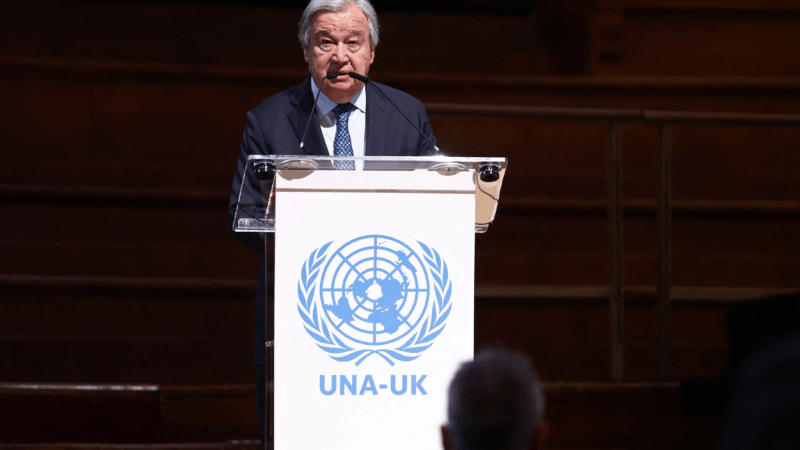

United Nations leaders bemoan global turmoil as the General Assembly turns 80

On Saturday, the UNGA celebrated its 80th birthday in London. Speakers including U.N. Secretary-General António Guterres addressed global uncertainty during the second term of President Trump.