Despite the pause on high tariffs, Chinese factories still face high uncertainty

BEIJING — Hours after the U.S. announced it was temporarily pausing most of its high tariffs on Chinese goods on May 12, NPR checked in with Jiang Kun, a freight forwarder based in southern China.

How was business going?

Within seconds, he replied with just two words: “Taking off.”

Just last month, goods from China faced an eye-watering tax of up to 245% if they came to the U.S. Then, the U.S. and China announced a 90-day pause on most of those tariffs, unleashing a surge in pent-up exports from China to the U.S. that has snarled logistics lines and jacked up freight prices as shippers frantically divert capacity back to China.

“Like children playing a game”

But there is still huge uncertainty among factory owners in China, who tell NPR orders are down overall as spooked American retailers hedge over whether tariffs will come roaring back after the pause.

“It is like watching two children play a game between themselves,” Joyce Tian scoffed, when asked about U.S.-China trade relations.

Tian, a sales manager in Dongguan, where many Chinese factories are located, says exports to the U.S. make up half of her company’s business. They make fans and heaters, for which American importers would normally be placing orders in just a few weeks in preparation for the fall. But this year, overall sales volumes are low.

“Some [American retailers] still have not made a decision [about whether to buy from us]. They have not responded to our emails. Maybe they are still waiting and watching,” says Ivy Lee, a sales manager at a Chinese homeware manufacturer that sold to retailers like Walmart before the tariffs hit.

Lee believes demand will return eventually: “These are everyday consumables. If they need them, they will buy.” As for the broader uncertainty, she adds, “I try not to worry too much. Policy changes are out of our hands.”

Some small businesses in the U.S. are rushing to buy whatever stock Chinese factories already have on hand, in case tariffs go back up again.

Chinese exporters are rushing to ship goods to the U.S. during the truce

“For now, everyone is trying to get as much of their shipments to the U.S. completed as possible within these few months,” says Tian Xin, a freight forwarder who arranges logistics for large freight and also coordinates paperwork for customs clearance for Chinese exports.

Jenny Tian works in freight forwarding in the southern Chinese city of Shenzhen and says she has been fielding calls for huge product orders. But the problem is shipping.

“We might soon be facing what we call ‘container rollovers,’ where even if you have already paid for a container spot on the ship, your container might not get loaded and is pushed onto the next available vessel,” Tian says. For her company, the cost of shipping to the West Coast of the U.S. has increased by $1,500 per container.

Many ships servicing the routes between the West Coast and China have been diverted to other routes, creating delays as exporters in China wait for ships to return to ports in China.

“You need those vessels at minimum to come back [to China], and you create disturbances, and you don’t have enough empty containers, et cetera,” says Eric Martin-Neuville, an executive vice president in Singapore for GEODIS, the French logistics company.

“The U.S. policies are unstable right now”

In the meantime, Chinese freight forwarders are making immediate contingency plans that exclude selling to the U.S.

“We have to be looking every day” for new clients, says Mike Zhong, a freight forwarder based in southern China.

Chris Que, a regional director at a home appliances factory in the southern city of Guangzhou, says his company has held off selling to the U.S. market for now, due to concerns over volatility. The company produces home appliances, including gas boilers and heat pumps.

“The U.S. policies are unstable right now. Tariffs can be raised or changed at any moment,” said Que. Instead, he is focusing on European customers.

Data from China’s national statistics bureau shows that when U.S. tariffs reached their peak, the value of overall exports actually jumped by 8.1% in April when compared to the previous year, beating economists’ predictions.

Trade with the U.S had dropped, but exports to Southeast Asia and Europe surged by levels high enough to make up for the lost business — though it is possible some of those exports still ended up in the U.S.

Emily Feng reported from Washington, D.C., and Aowen Cao contributed research from Beijing.

Pregnant migrant girls are being sent to a Texas shelter flagged as medically risky

Government officials and advocates for the children worry the goal is to concentrate them in Texas, where abortion is banned.

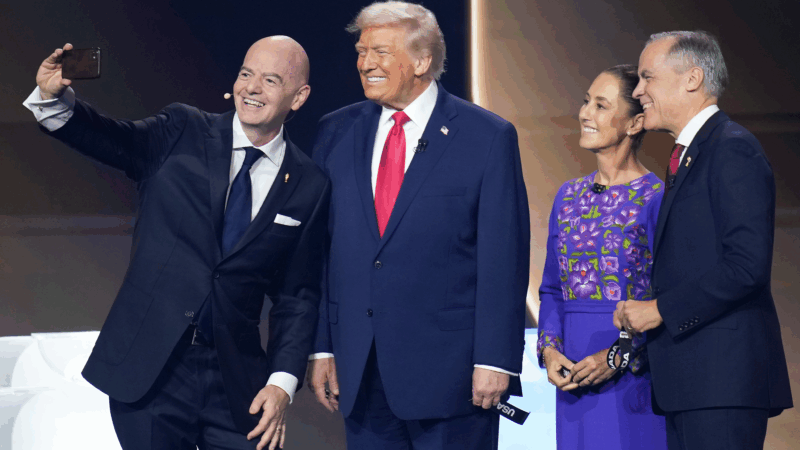

The 2026 World Cup faces big challenges with only 100 days to go

Will Iran compete? Will violence in Mexico flare up? And what about funding for host cities in the U.S.? With only 100 days left before it beings, the 2026 World Cup in North America is facing a lot of uncertainty.

A glimpse of Iran, through the eyes of its artists and journalists

Understanding one of the world's oldest civilizations can't be achieved through a single film or book. But recent works of literature, journalism, music and film by Iranians are a powerful starting point.

Mitski comes undone

She may be indie rock's queen of precisely rendered emotion, but on Mitski's latest album, Nothing's About to Happen to Me, warped perspectives, questionable motives and possible hauntings abound.

This quiet epic is the top-grossing Japanese live action film of all time

The Oscar-nominated Kokuho tells a compelling story about friendship, the weight of history and the torturous road to becoming a star in Japan's Kabuki theater.

The Live Nation trial could reshape the music industry. Here’s what you need to know

On Tuesday opening statements will begin for the federal antitrust trial against Live Nation, one of the largest entertainment companies in the world.