Corporate America is having a weird tariff summer

Corporate America is living through two vastly different experiences of President Trump’s tariff summer.

More than 100 of the largest U.S. companies reported quarterly financial results in the last week, updating investors about how much money they earned (or lost) and what they’re expecting for the rest of the year. These updates provide a regular window into how CEOs and other business leaders feel not just about their companies but also about the broader economy.

Now, with another White House deadline looming next week for tariff deals with other countries — and plenty of uncertainty remaining over what these taxes will ultimately cost businesses and consumers — this month’s earnings reports have been closely watched.

And they’ve varied wildly. Some big companies, especially carmakers and other consumer-facing businesses, are reporting real financial pain from the tariffs that Trump has imposed so far. But for many of the tech and financial companies that are less reliant on imports, it has been a pretty great few months.

“There’s a large divergence in experiences among firms — some of whom are very exposed to import prices and some of whom really aren’t,” says Laura Veldkamp, a professor of finance and economics at Columbia Business School.

Investors seem to be focusing on the good news: The benchmark S&P 500 and the tech-heavy Nasdaq hit a series of record highs this week. (The Dow Jones Industrial Average, which is made up of many fewer companies, was tempered in part by bad news and share sell-offs at UnitedHealth Group. But it also rose more than 500 points, or almost 1.3%, this week.)

Here are three takeaways from what CEOs and their companies are saying about the economy this month.

1. They’re kind of tired of talking about tariffs

CEOs and other business leaders have spent months trying to figure out how to criticize Trump’s policies without drawing his ire. And in April, days after the president first unveiled his sweeping new tariffs, some of the United States’ most powerful executives used their earnings reports and other public appearances to warn about the potential damage these taxes could cause.

Since then, Trump has delayed or softened some of his proposed tariffs, although plenty of uncertainty about their final shape remains. And business leaders have continued cycling through the five stages of tariff grief.

But now some big companies are trying, as much as possible, to look beyond the trade elephant in the room.

“The corporate community has … sort of accepted that they just need to navigate through this and are kind of getting on with it,” JPMorganChase’s chief financial officer, Jeremy Barnum, told journalists during a conference call last week.

However, he acknowledged, “it’s still challenging for many individual firms.”

2. Not all big businesses are feeling the same effects

Carmaker General Motors said this week that tariffs cost it more than $1 billion in the past three months, joining a chorus of hurting automakers — though GM still posted a profit.

Meanwhile, restaurant chain Chipotle said customers are worried about the economy and buying fewer burritos, while the company braces to pay more for its ingredients.

But not all consumer-facing companies were weighed down by the same problems. For example, Coca-Cola and toy maker Hasbro both posted better-than-expected results.

Over in Silicon Valley, Google did so well that it’s throwing another $10 billion at its artificial intelligence efforts. And on Wall Street, big banks surfed this spring’s market volatility to a terrific quarter.

Columbia Business School’s Veldkamp points out that retailers and other sellers of material goods are usually the first companies to feel the impact of tariffs — because, after all, they have to import the avocados or toys or components of the physical goods that they sell.

Some companies, including Walmart, have said they will pass along some increased prices to consumers; others say they’re trying to avoid doing so (or at least have avoided announcing it so far).

“Those firms might try to absorb some of those tariffs for a while, especially because the tariffs themselves are uncertain,” Veldkamp adds.

But if eventually companies “can’t make a profit selling what it is that they’re selling at the prices they had been selling at it, we’ll see them pass those increases in prices on to consumers,” she adds.

Which means …

3. We’re still months away, at least, from seeing the final impact of tariffs

There are signs that consumers are already feeling some pain from tariffs. Government data released last week shows that inflation picked up in June.

But there are still plenty of unknown unknowns. Next Friday, Aug. 1, marks the latest deadline Trump has set for imposing sky-high import taxes on a large list of countries. That deadline was pushed back from earlier this month.

However long the United States takes to finalize its new tariff rates, businesses won’t have clarity on their new costs until then. And then it’ll take even more time for those costs, and how companies decide to handle them, to trickle down to consumers — and the overall U.S. economy.

Transcript:

ARI SHAPIRO, HOST:

Corporate America is having a weird tariff summer. Some big companies said this week that President Trump’s new import taxes are eating into their profits, but for others, business is booming, and so is the stock market. NPR financial correspondent Maria Aspan is here to make sense of this. Hi, Maria.

MARIA ASPAN, BYLINE: Hey there.

SHAPIRO: You’ve been looking at corporate earnings, which gives some window into how big businesses are feeling about the economy. What do they tell us right now?

ASPAN: They have been all over the place. More than a hundred of the company – of the country’s largest companies reported earnings just this week, and we’ve seen some big household names, like carmaker General Motors, warning that President Trump’s new tariffs are eating into their business. Or there was Chipotle saying that customers are losing confidence in the economy, and so they’re buying fewer burrito bowls.

On the other hand, some companies are having a great summer. For example, big tech companies like Google and Netflix and banks like JPMorganChase beat analyst expectations and made a ton of money in the last three months. There’s been kind of a change from what we heard during the last corporate earnings season in April, which, as you remember, was just after Trump first unveiled his tariffs.

SHAPIRO: Yeah.

ASPAN: At the time, we saw a lot of big companies sounding the alarm about how this would harm both their businesses and the larger economy. But fast-forward three months, and the view from corporate America is looking a little rosier.

SHAPIRO: That’s so interesting and kind of surprising. Do you know why?

ASPAN: Well, some of it is that many of the tariffs, as you know, haven’t been finalized.

SHAPIRO: Right.

ASPAN: And as the White House announces more trade deals, some of these new taxes are lower than feared. For example, this week, the White House announced tariffs of 15% on Japanese imports, which is still a lot, but it’s not as bad as the previously threatened 25%.

Another reason is that not every big company is directly affected by tariffs. I mean, think about banks or tech companies. They just don’t rely as much on imports.

And also, some businesses are just a little tired of worrying about tariffs. I was struck by a comment last week by JPMorganChase’s chief financial officer, who told journalists that the bank’s business customers have accepted that they just need to navigate through this and get on with it.

SHAPIRO: Well, what about the consumers, the rest of us? What does it mean for us?

ASPAN: It is a little wait and see. I mean, it seems like prices are rising. We saw inflation ticking up a little last month. But it may be a while before we start to get the full picture, especially, again, while we’re waiting for the White House to finalize more tariffs. I talked about this with Laura Veldkamp. She’s a professor of finance and economics at Columbia Business School.

LAURA VELDKAMP: But it might first affect firms’ profits and earnings and then show up as an increase in consumer prices.

ASPAN: Now, some big companies say they’re trying to avoid passing on costs to consumers, at least for the time being, but we don’t know yet what prices we’ll be seeing a few weeks or months from now.

SHAPIRO: You’re describing this kind of mixed bag from American corporations, so why is the stock market hitting record highs?

ASPAN: Well, some of it is investors focusing on the good news – better-than-expected earnings, better-than-expected trade deals – especially after all the panic and volatility of April. But Veldkamp and others are worried that after all the tariffs back and forth, investors have also started downplaying what President Trump says. Ultimately, what markets are doing right now and what big companies are reporting – they’re both really useful snapshots of this moment in time, but we still don’t know, and won’t know for a while, what the full impact of tariffs will be on the economy.

SHAPIRO: That’s NPR’s Maria Aspan. Thank you.

ASPAN: Thank you.

R&B stars consider two ways to serve an audience

Two albums released the same day — Jill Scott's return from a long absence, and Brent Faiyaz's play for a mid-career pivot — offer opposing visions of artistic advancement in the genre.

Baby chicks link certain sounds with shapes, just like humans do

A surprising new study shows that baby chickens react the same way that humans do when tested for something called the "bouba-kiki effect," which has been linked to the emergence of language.

American Jordan Stolz speedskates to a third Olympic medal — silver this time

U.S. speedskater Jordan Stolz had a lot of hype accompanying him in these Winter Olympic Games. He's now got two gold medals, one silver, with one event to go.

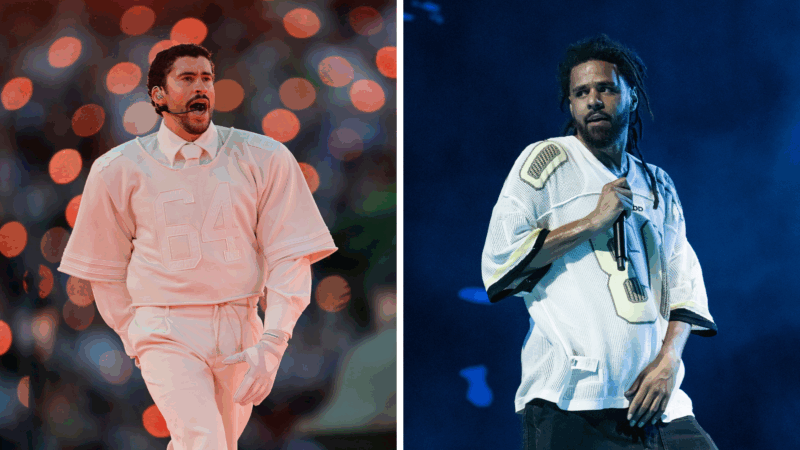

Bad Bunny and J. Cole rule the pop charts

These days, the Super Bowl halftime show is a massive driver of the streaming, airplay and sales that fuel the Billboard charts. This week, Bad Bunny benefits from that influence.

Reporter’s notebook: My Olympic Lunar New Year

An NPR reporter covering the Olympics in Milan takes us on cultural side quests, to a hospitality house and a candy store.

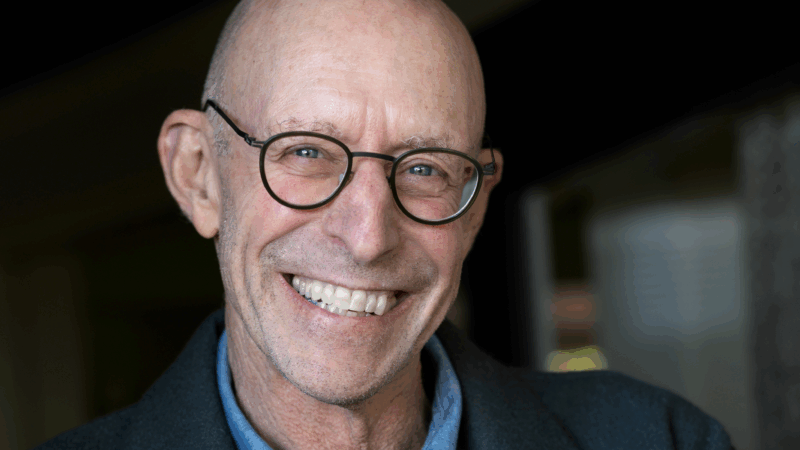

Michael Pollan says AI may ‘think’ — but it will never be conscious

"Consciousness is under siege," says author Michael Pollan. His new book, A World Appears, explores consciousness on both a personal and technological level.