Compass-Anywhere real estate merger could squeeze small brokerages

A proposed $1.6 billion merger would unite the nation’s two largest real estate behemoths, Compass and Anywhere, combining Compass’s regional brokerages with Anywhere’s nationally recognized brands, including Century 21 and Coldwell Banker. However, some industry observers caution that the consolidation may increase pressure on mom-and-pop brokerages.

The deal, announced last week, is between Madison, N.J.-based Anywhere Real Estate and New York-based Compass, the largest U.S. residential real estate brokerage by sales volume. The combined brokerage company is expected to be worth $10 billion. It would create a combined 340,000-agent network at a time when the housing market is softening. The market has seen a decline in existing home sales, limited inventory, higher home prices and mortgage rates that remain stubbornly high following historic pandemic-era lows.

The merger is expected to go forward pending approval from shareholders and regulators.

Compass CEO and founder Robert Reffkin hailed the merger in a statement as a melding of resources that would preserve the independence of Anywhere’s leading brands while creating “a place where real estate professionals can thrive for decades to come.”

“We have a unique opportunity to utilize the incredible breadth of talent across our companies, especially our world-class agents and franchisees, to deliver even more value to home buyers and home sellers across every phase of the home buying and home selling experience,” Anywhere CEO & President Ryan Schneider said in a statement about the deal.

NPR reached out to Compass and Anywhere for comment, but did not receive a reply before publication.

Tomasz Piskorski, a real estate professor at Columbia Business School, says it’s too early to say for sure how the move will play out for consumers.

“On one hand, bigger firms can wield monopoly power, limiting transparency and raising the risk of monopolistic practices,” he says. “On the other, scale brings efficiencies — technology adoption, cost savings, and potentially lower fees — that can benefit consumers.”

The merger is expected to take place in the second half of 2026.

In recent years, the U.S. real estate brokerage industry has seen a reduction in the number of players, with larger firms gaining market share through mergers and acquisitions, significantly expanding the reach of the combined brokerages. In 2024, the three largest brokerages — Compass, Anywhere and eXp Realty — accounted for 17% of total sales volume, and the top 10% of brokerages represented 42%. The mergers have also helped drive a consolidation of Multiple Listing Services, or MLSs, which allow brokerages to share information on properties they have listed for sale.

In March, Rocket Companies, the parent of Rocket Mortgage — the online mortgage lender and refinancing portal — announced it was acquiring real estate listing company Redfin. Weeks later, it agreed to buy out Mr. Cooper, a mortgage industry competitor.

Despite the trend toward fewer, larger, firms, Piskorski and others point out that the newly merged Compass/Anywhere combo would control less than a 20% share of the market, leaving several large and well-known competitors, such as eXp Realty, RE/MAX, investor Warren Buffett’s Berkshire Hathaway HomeServices and Redfin.

Peng (Peter) Liu, a professor of real estate and finance at Cornell University, says large brokerages offer wider reach for sellers, stronger customer databases, advanced technology and access to more potential buyers. He acknowledges concerns over market power, but believes they are overstated. “Both consumers and agents can switch firms readily, with households enjoying a wide range of options,” including local brokerages, discount models and options such as iBuyers, which let homeowners skip agents and sell directly to tech-driven companies who then typically renovate and re-sell the property, according to Liu.

However, real estate market analyst Jack McCabe, CEO of McCabe Research and Consulting, fears that the wave of consolidation in the industry is making it harder for independent firms to remain competitive. “Some will be pushed out of business; others will join the big firms because they really have no choice,” he says.

McCabe acknowledges that it may not matter for the luxury end of the market, where buyers and sellers tend to go with agents with the strongest track record. At the lower-end of the market, however, “people often go with someone they know — a family member, a neighbor, a church friend.”

He also notes the speed with which the industry is consolidating. “It’s like the Great Recession, when 200 banks were swallowed up by five big investment banks. We’re seeing the same thing now in real estate,” he says. “Compass only started in 2012, and now — just 13 years later — they could become the largest brokerage in the world. That’s remarkable.”

Piskorski says U.S. real estate commissions, typically around 5% to 6% of the sales price, are roughly double the global average — and that predates the current round of mergers. He expects that technological innovation brought by consolidation, as well as pressure from regulation and other market forces, will eventually reduce those fees.

In the end “customers value convenience and speed” maximized by the current trends, Piskorski says. “That’s why Rocket Mortgage became the largest U.S. lender — even though it charged slightly higher rates — because people were willing to pay for a seamless digital experience.”

But that trend doesn’t bode well for small, independent brokerages, he says. “The Holy Grail is digital closing: You click on a house, reserve it, see the appraisal and title instantly, get loan offers, and become a homeowner in days instead of weeks.”

Mixed reactions, including relief, greet news the Coast Guard is buying BSC campus

The U.S. Coast Guard will take possession of the 192-acre campus in the northeast corner of Birmingham’s Bush Hills Neighborhood and will begin work to refit it as a training center for officers and enlisted personnel.

Travel industry pushes Congress to end DHS shutdown and pay federal security workers

With the busy spring break travel season looming, travel and aviation industry leaders urged Congress to end the stalemate over DHS funding before workers at TSA and ports miss a full paycheck.

Trump fires Kristi Noem as DHS chief, names Sen. Markwayne Mullin to replace her

President Trump has fired his homeland security secretary, Kristi Noem, and said Markwayne Mullin, a senator from Oklahoma, would replace her.

They were led off course in a big race. But a fix is more complicated than prize money

Top finishers in the Atlanta half marathon are calling for U.S. track officials to ensure that Jess McClain and two other athletes aren't excluded from the world championships because of an error.

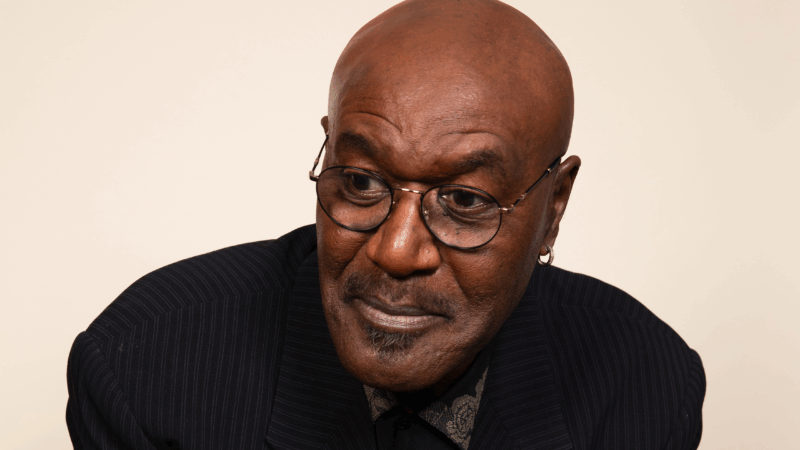

No matter what happens at the Oscars, Delroy Lindo embraces ‘the joy of this moment’

Lindo is nominated for best supporting actor for his role in Sinners. At the BAFTA awards on Sunday, Lindo was presenting when a man with Tourette syndrome in the audience yelled out a racial slur.

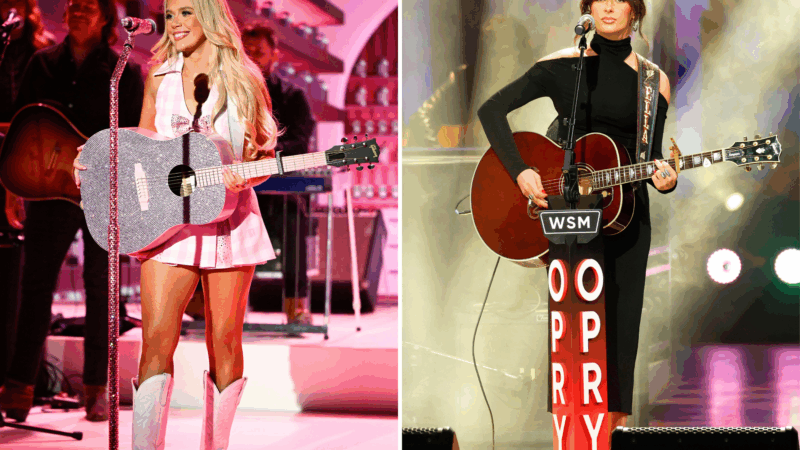

Between Megan Moroney and Ella Langley, country women rule the charts

It's a big week for women in country music — and, it turns out, for women whose songs are favored by women in figure skating.