Cloudy with a chance of showers? Fed’s economic forecast coming today

The Federal Reserve is expected to hold interest rates steady Wednesday, as policymakers wait to see how President Trump’s tariffs and fighting in the Middle East will affect the U.S. economy.

The Fed has been in a holding pattern since December, after cutting rates by a full percentage point last year.

Investors who place bets are nearly certain that the central bank will keep its benchmark interest rate unchanged Wednesday — between 4.25% and 4.5% — according to the CME Group’s FedWatch tool.

Loading…

“Uncertainty about the economic outlook has increased,” the Fed’s rate-setting committee said in a statement after its last meeting, in May.

Three months ago, committee members said they expected to cut interest rates by an average of half a percentage point this year. Markets will be watching closely for an update to that forecast on Wednesday afternoon.

Inflation hasn’t risen yet, despite tariffs

Inflation has been relatively tame in recent months. But Fed officials worry that Trump’s tariffs — which are the highest in nearly a century — could rekindle price pressures.

Israel’s attack on Iran last week added a new wrinkle to the outlook by triggering a spike in crude oil prices. If sustained, that could jeopardize the drop in gasoline prices that has helped keep the overall cost of living in check.

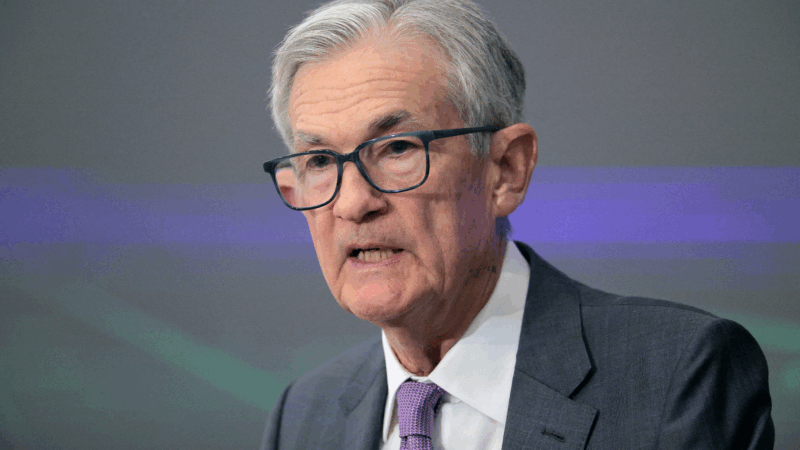

Trump continues to exert pressure on Fed chief Powell

Trump has been urging the central bank to cut interest rates more aggressively, arguing that lower borrowing costs will goose the economy while also saving the federal government money on its $36 trillion debt.

“GREAT NUMBERS!” Trump wrote in all caps on social media last week, after a report showed that consumer prices rose just 2.4% for the 12 months ending in May. “FED SHOULD LOWER ONE FULL POINT.”

Trump later called Federal Reserve Chair Jerome Powell a “numbskull” for not lowering interest rates more quickly.

Bonds aren’t doing well, and that’s not good for America

The government’s own borrowing costs are set by the bond market, which is not directly tied to the short-term rates set by the Fed. And those borrowing costs have only risen in recent months.

Bond yields ordinarily fall during times of turmoil, as investors flock to the safety of U.S. government debt. But yields on Treasury bonds unexpectedly rose last week after Israel’s attack on Iran, suggesting investors are not as confident in the U.S. government’s creditworthiness as they once were.

Loading…

The combination of high debt and rising bond yields can be costly not just for the government but also for taxpayers. Interest on the federal debt totaled $776 billion in the first eight months of the fiscal year — the government’s third-biggest expense after Social Security and Medicare.

The higher bond yields also make mortgages, car loans and other types of consumer borrowing more expensive.

Foreign-born workforce shrinks by 1 million people

In addition to tariffs, the Fed is monitoring the combined effects of Trump’s policies on taxes, regulation and immigration. Tax cuts and deregulatory moves have the potential to boost the economy while strict border controls and large-scale deportations could make it harder for businesses to find the workers they need.

The foreign-born workforce shrank by more than a million people in the last two months, according to surveys from the Labor Department.

Fewer immigrant workers could “add meaningful upward pressure to inflation by the end of the year in sectors reliant on immigrant labor such as agriculture, construction, food processing, and leisure and hospitality,” Fed Governor Adriana Kugler warned in a speech this month.

Demand for workers has been cooling in recent months, but the unemployment rate remains low, at 4.2%.

When a horse whinnies, there’s more than meets the ear

A new study finds that horse whinnies are made of both a high and a low frequency, generated by different parts of the vocal tract. The two-tone sound may help horses convey more complex information.

Trump’s many tariff tools mean consumer prices won’t go down, analysts say

The Supreme Court struck down President Trump's signature tariffs. But the president has other tariff tools, and consumers shouldn't expect cheaper prices anytime soon, economists say.

Hundreds of American nurses choose Canada over the U.S. under Trump

More than 1,000 American nurses have successfully applied for licensure in British Columbia since April, a massive increase over prior years.

Tax credits for solar panels are available, but the catch is you can’t own them

Rooftop solar installers are steering customers toward leases instead of purchases. Federal tax credits for purchased systems have ended but are still available for leased ones.

5 takeaways from Trump’s State of the Union address

President Trump hit familiar notes on immigration and culture in his speech Tuesday night, but he largely underplayed the economic problems that voters say they are most concerned about.

China restricts exports to 40 Japanese entities with ties to military

China on Tuesday restricted exports to 40 Japanese entities it says are contributing to Japan's "remilitarization," in the latest escalation of tensions with Tokyo.