Claire’s, the ear-piercing tween mall staple, is bankrupt — again

Claire’s — the ear-piercing, glittery tween mall staple — is once again on the brink of survival.

The chain on Wednesday filed for bankruptcy protection for the second time in seven years. It is struggling under the weight of new tariff costs just a year before an unwieldy loan of nearly $500 million is due. The retailer says that its Canadian arm will pursue a similar bankruptcy proceeding but that North American stores will remain open during the process.

Claire’s has blamed its declining sales on inflation and shoppers’ growing reluctance to spend on whims like faux-gold bangles, cat-shaped lip gloss, Hello Kitty socks and Barbie purses. Most of the store’s items come from China, whose products face the highest tariffs in President Trump’s renegotiation of world trade. That has added new costs for Claire’s as the importer.

“Increased competition, consumer spending trends and the ongoing shift away from brick-and-mortar retail, in combination with our current debt obligations and macroeconomic factors, necessitate this course of action for Claire’s and its stakeholders,” CEO Chris Cramer said in a statement.

Claire’s has been piercing ears across America since the 1970s, over time gobbling up Japanese, British and American rivals selling jewelry and accessories. By the peak of its popularity in the early 2000s, Claire’s had grown into a fixture of malls.

This made the chain attractive to private-equity firm Apollo, which in 2007 staged a leveraged buyout. The deal saw Claire’s take on extensive debt that it planned to pay off as the chain grew rapidly — until it didn’t. As malls began to contend with dropping traffic and mounting online competition, so did Claire’s.

In the past decade, the retailer tried to branch out, striking deals to sell baubles at CVS pharmacies and expanding brand deals for popular Disney and Mattel characters. But as Claire’s manages its fleet of roughly nearly 3,000 Claire’s and Icing brick-and-mortar stores, its young shoppers increasingly chase warp-speed trends on TikTok and get poached by deeper-pocketed rivals like Amazon and Walmart or the ultracheap Shein and Temu.

Claire’s exited its 2018 bankruptcy with $1.9 billion less debt as its creditors took over. In May, Bloomberg reported that Claire’s was deferring interest payments and planned to cover them with additional debt. The company’s nearly $500 million loan is due in December 2026.

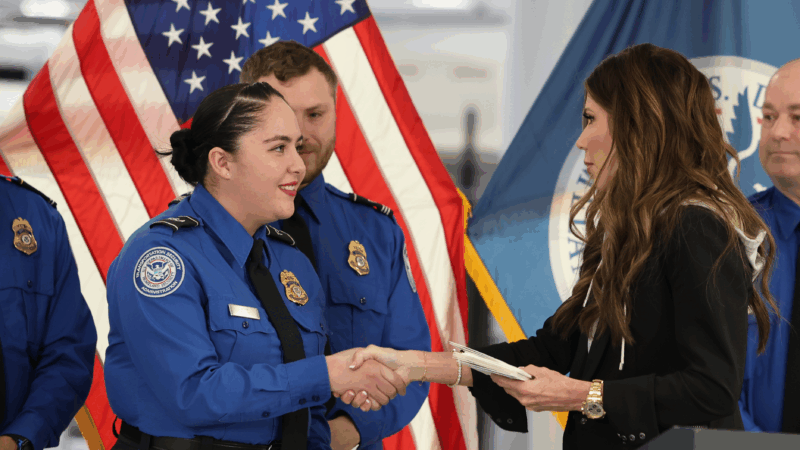

Homeland Security suspends TSA PreCheck and Global Entry airport security programs

The U.S. Department of Homeland Security is suspending the TSA PreCheck and Global Entry airport security programs as a partial government shutdown continues.

FCC calls for more ‘patriotic, pro-America’ programming in runup to 250th anniversary

The "Pledge America Campaign" urges broadcasters to focus on programming that highlights "the historic accomplishments of this great nation from our founding through the Trump Administration today."

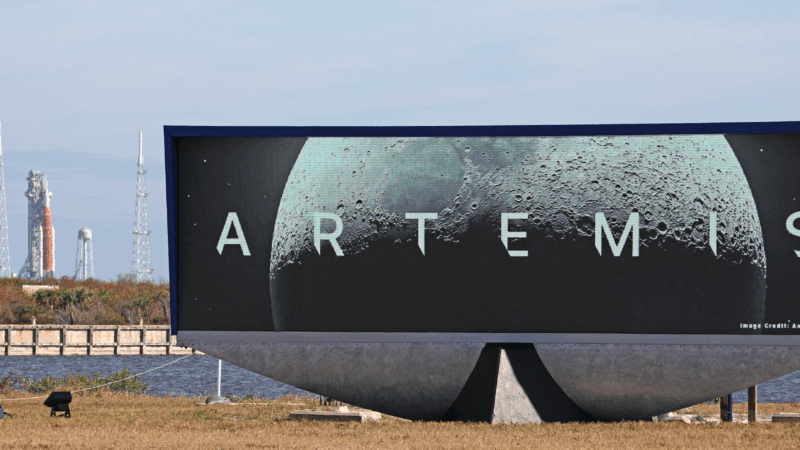

NASA’s Artemis II lunar mission may not launch in March after all

NASA says an "interrupted flow" of helium to the rocket system could require a rollback to the Vehicle Assembly Building. If it happens, NASA says the launch to the moon would be delayed until April.

Mississippi health system shuts down clinics statewide after ransomware attack

The attack was launched on Thursday and prompted hospital officials to close all of its 35 clinics across the state.

Blizzard conditions and high winds forecast for NYC, East coast

The winter storm is expected to bring blizzard conditions and possibly up to 2 feet of snow in New York City.

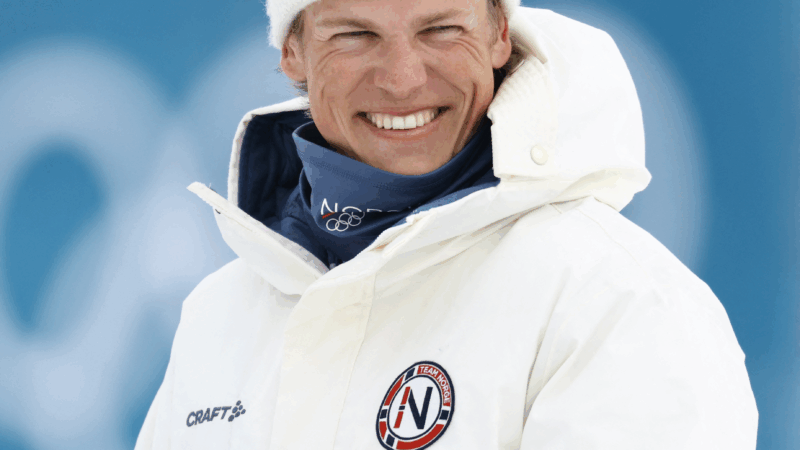

Norway’s Johannes Klæbo is new Winter Olympics king

Johannes Klaebo won all six cross-country skiing events at this year's Winter Olympics, the surpassing Eric Heiden's five golds in 1980.