China put steep tariffs on U.S. exports. Farmers are worried

Tariffs are making life more expensive for John Pihl. He’s been farming in Northern Illinois for more than 50 years.

“These tariffs are going to affect everything. It’ll affect our parts — it’s just across the board. Which is going to hurt everything,” he said.

Not only do tariffs affect the cost of farm supplies, but they also raise the risk of retaliation against exports of U.S. crops: a double-whammy for farmers like Pihl.

“It’s a good way to lose your customers,” he said. “And I think we’ll probably lose more on this round too, because I know that Mexico is our biggest importer of corn. But this time, they may figure out that they can get corn from South America just as easily as from the U.S.”

President Trump has imposed tariffs on countries from the world over, including 25% on steel and aluminum, 25% on some Canadian and Mexican goods, and a staggering 145% on Chinese goods. So far, the most notable retaliation has come from China, which has now imposed a 125% tariff on U.S. goods.

The White House is considering ways to help farmers. “We’re already starting to think about what a mitigation effort might look like,” Secretary Brooke Rollins said on Fox News this week.

She nodded to aid that Trump’s administration gave farmers during his first-term trade dispute with China, money that came from a fund called the Commodity Credit Corporation (CCC).

It’s a fund that had been around since the Great Depression, explained Joseph Glauber, a former USDA chief economist. “This was really a new thing that the Trump administration did, is that they tapped the CCC certainly at a level that had not been seen before for extraordinary payments,” Glauber said.

Trump spent $28 billion in his first term helping farmers hurt by tariffs

All told, the first Trump administration spent $28 billion bailing out farmers. This time around, the tariffs are much higher than they were six years ago, and it’s unclear how long they will persist.

NPR asked the White House for details on what relief is under consideration this time, but received no response.

The payments were helpful, Pihl said. But they weren’t a fix for the longer-term damage done by Trump’s first-term tariffs.

“That was just for the one year. What about the market loss that continued through his term and into Biden’s term? I think the amount is incredible,” he said.

China went elsewhere for soybeans

Soybeans are where that damage is most visible. China has long been the largest market for U.S. soybean exports. But during the trade dispute in Trump’s first term, China ramped up its purchases of Brazilian soybeans, replacing U.S. soybeans. The U.S. market share has never recovered.

Trump expressed confidence this week that he will be able to reach a deal with China to end the escalating trade fight. For now, some in the farm sector are hopeful about Trump making deals to help farmers.

“You know, he’s a negotiator,” said Kenneth Hartman, Jr., president of the corn board at the National Corn Growers Association. “He did a good job negotiating the [U.S-Mexico-Canada Agreement] USMCA when he negotiated that his first term. So we’re hoping that he can do something like that,” Hartman said.

Tariffs — and aid — can distort market signals

There’s another wrinkle to this all, which is timing. All of this tariff drama is unfolding in the spring, when farmers are making decisions about planting big export crops, like corn and soybeans.

American soybean farmers might decide to grow other crops, like corn, to avoid market risks in China. That could weigh on corn markets.

But also, an aid package announced too soon has the potential to distort markets, said Glauber, the former USDA economist.

“If you’re too generous with one crop vis-à-vis another, you could have farmers making planting decisions based on what they think those compensation payments might be,” Glauber said.

Farmers also say government aid is helpful, but it’s not their first choice.

“Farmers want markets. We need markets. We want to sell our grain at a profit,” said Hartman, adding that CCC payments are only a short-term fix.

“It’s supplemental, it’s needed because it keeps farmers from getting in worse financial situation, but payments are not the answer to a future successful agriculture operation in the United States,” Hartman said.

John Pihl feels similarly about the subsidies. “I don’t want it, but I’ll take it. I’d be an idiot not to take it. That’s about all I can say.”

Transcript:

AILSA CHANG, HOST:

Yesterday, President Trump said that he is backing away from some of his highest tariffs, but others remain on certain goods from Canada and Mexico, along with a staggering 145% tariff on Chinese goods. And China has retaliated. It’s causing problems for U.S. farmers, so the White House is considering how to help. NPR’s Danielle Kurtzleben reports.

DANIELLE KURTZLEBEN, BYLINE: Tariffs are making life more expensive for John Pihl. He’s been farming in northern Illinois for more than 50 years.

JOHN PIHL: These tariffs are going to affect everything. It’ll affect our parts. Yeah, it’s just across the board. It’s going to hurt everything.

KURTZLEBEN: Pihl sums up the double whammy of how tariffs affect farmers. First off, U.S. tariffs make the cost of supplies higher, and it raises the risk of retaliation against exports of U.S. crops.

PIHL: It’s a good way to lose your customers, and I think we’ll probably lose more on this round, too, because I know that Mexico is our biggest importer of corn. This time, they may figure out that they can get corn from South America just as easily as from the U.S.

KURTZLEBEN: And that’s why the White House is considering direct payments to farmers. It’s something the Trump administration did during Trump’s first-term trade dispute with China. Back then, Agriculture Secretary Sonny Perdue used a fund called the Commodity Credit Corporation, or CCC. Here’s current Ag Secretary Brooke Rollins on Fox News this week.

(SOUNDBITE OF ARCHIVED RECORDING)

BROOKE ROLLINS: We’re already starting to think about what a mitigation effort might look like. Obviously, under Secretary Purdue and President Trump in Trump One (ph), they did do some mitigation with a $25 billion CCC fund. Again, hopefully, none of that is necessary.

KURTZLEBEN: It’s a fund that’s been around since the Great Depression, explains Joseph Glauber, a former USDA chief economist.

JOSEPH GLAUBER: This was really a new thing that the Trump administration did, is that they tapped the CCC in a way that – and certainly at a level that had not been seen before for extraordinary payments.

KURTZLEBEN: NPR asked the White House for details on what relief is under consideration this time but received no response. Government aid is helpful, but it’s not farmers’ first choice.

KENNETH HARTMAN: Farmers want markets. We need markets. We want to sell our grain at a profit.

KURTZLEBEN: Kenneth Hartman is president of the corn board at the National Corn Growers Association. He said that CCC payments are only a short-term fix.

HARTMAN: It’s supplemental. It’s needed because it keeps farmers from getting in worse financial situation, but it’s not – you know, them payments are not the answer to a future successful agriculture operation in the United States.

KURTZLEBEN: Hartman says he’s hopeful about Trump making deals to help farmers.

HARTMAN: Well, now, with the tariffs coming on, obviously we’re hoping that the president – you know, he’s a negotiator. He did a good job negotiating the USMCA when he negotiated that his first term. So we’re hoping that he can do something like that.

KURTZLEBEN: There’s another wrinkle to this all, which is timing. All of this tariff drama is unfolding in the spring, when farmers are making decisions about planting big export crops like corn and soybeans. China usually imports a lot of American soybeans but is also now tariffing U.S. goods at 84%. That means, first of all, a lot of American soybean farmers might decide to grow other crops, like corn, which would drive those prices down. But also, an aid package announced too soon might distort markets, says Glauber, the former USDA economist.

GLAUBER: Because if you’re too generous with one crop vis-a-vis another, you could have farmers making planning decisions based on what they think those compensation payments might be.

KURTZLEBEN: Farmers have worries beyond the next year, though. In Illinois, Pihl says that the payments in Trump’s first term were helpful, but he adds…

PIHL: That was just for the one year. What about the market loss that continued through his term and into Biden’s term? I think the amount is incredible.

KURTZLEBEN: Soybean exports to China plummeted during Trump’s first trade fight with China, and they haven’t recovered. China instead chose to buy more from Brazil, and that’s still the case now. Pihl fears that this trade war will make that worse, so aid payments just might be necessary.

PIHL: I don’t want it, but I’ll take it. I’d be an idiot not to take it. That’s about all I can say.

KURTZLEBEN: Both the U.S. and Chinese tariffs are much higher than they were six years ago. Depending on how long they persist, there’s no way of knowing just how much they’ll hurt farmers. Danielle Kurtzleben, NPR News.

(SOUNDBITE OF CROOKED STILL SONG, “ECSTASY”)

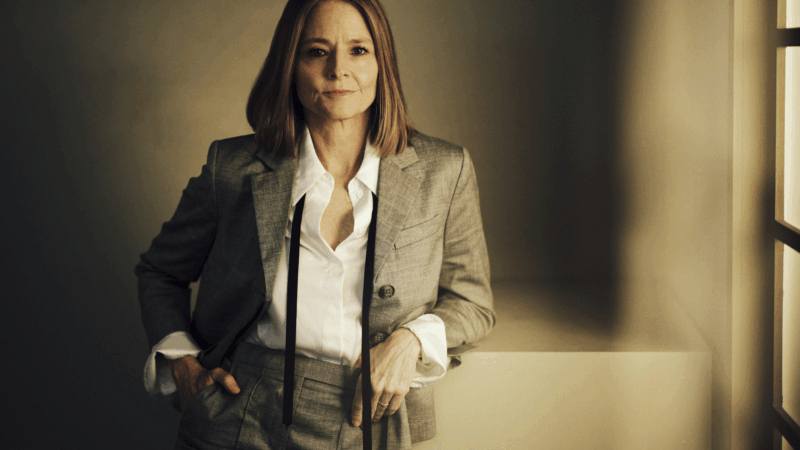

‘My role was making movies that mattered,’ says Jodie Foster, as ‘Taxi Driver’ turns 50

Foster was just 12 years old when she starred in the 1976 film. "What luck to have been part of that, our golden age of cinema in the '70s," she says. Her latest film is Vie Privée (A Private Life).

Supreme Court appears likely to uphold state bans on transgender athletes

To date, 27 states have enacted laws barring transgender participation in sports.

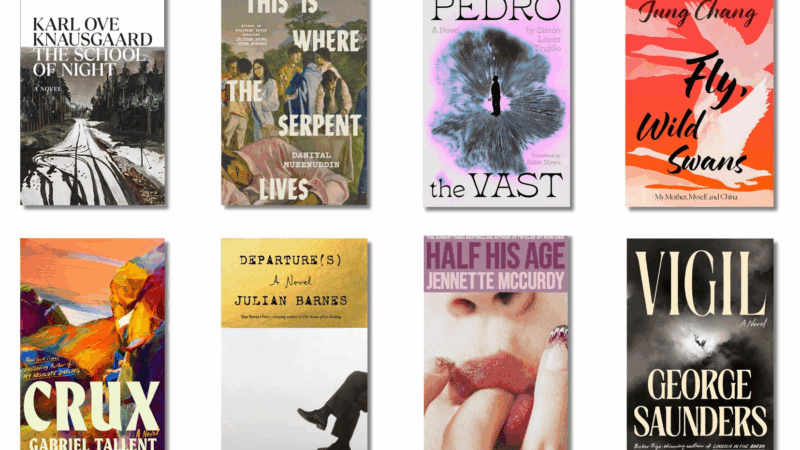

Keep an eye out for these new books from big names in January

The new year begins with a host of promising titles from George Saunders, Julian Barnes, Jennette McCurdy, Karl Ove Knausgaard and more. Here's a look ahead at what's publishing this month.

Want to play a Tiny Desk concert? The 2026 Contest is now open for entries

The 2026 Tiny Desk Contest, our annual search for the next great undiscovered artist, is now officially open for entries.

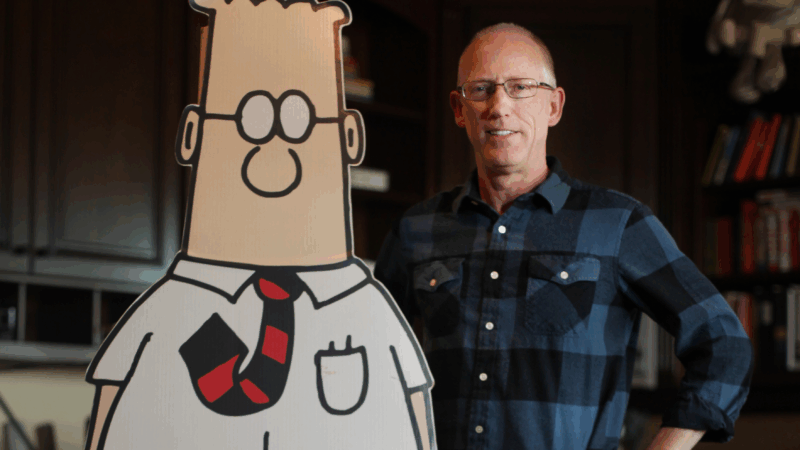

Scott Adams, the controversial cartoonist behind ‘Dilbert,’ dies at 68

Adams announced in May that he was dying of metastatic prostate cancer. Thousands of newspapers carried his strip satirizing office culture from the '90s until a controversy in 2023.

As Iran’s protests continue, Israelis and Palestinians watch closely

There is broad support for the protests among Israeli officials, but Palestinians say they hope the Iranian regime stays in place and the protests die down soon.