Car makers are feeling tariff pain: GM is the 2nd company to take a hit to profits

In a quarterly earnings call with investors, the chief financial officer of General Motors said Tuesday morning that tariffs cost the company approximately $1.1 billion over three months, bringing the company’s profit margin from 9% down to 6.1% — that is, from meeting their target profitability to falling several percentage points short.

CFO Paul Jacobson said that so far, the company has only been able to reduce the blow to profits by a minimal amount. But they’re hoping that will change.

“We’re still tracking to offset at least 30% of the $4 to $5 billion full-year 2025 tariff impact,” he said, through a combination of changes in manufacturing, “targeted cost initiatives,” and the prices that consumers pay.

U.S. tariff policy has been unpredictable and rapidly changing over the last few months, and GM executives acknowledged that’s likely to continue. For example, the possibility of bilateral deals between the U.S. and other countries suggests that some of those costs might be avoided entirely.

For now, despite a tariff of 25%, GM is still importing vehicles it makes in Korea, including some of its most affordable models. “They’re very much in demand,” CEO Mary Barra told investors.

GM stock dropped 6% after it revealed its earnings, signaling Wall Street’s displeasure with the company’s strategy so far of absorbing tariffs as a hit to profits.

“To put full year targets in reach,” analysts Daniel Roska and Christopher Gray of research and brokerage firm Bernstein wrote in a note, “GM needs to start mitigating tariff cost.”

Meanwhile, Stellantis, the automaker that owns the Chrysler, Jeep, Dodge and Ram brands, reported this week that it paid about $387 million in tariffs over the last quarter, and that production pauses — a strategy to avoid paying tariffs — contributed to a 6% year-over-year decline in the number of vehicles the company shipped to dealers.

Industry-wide data has suggested that, at least so far, car manufacturers have mostly absorbed higher tariffs as a hit to their profits, rather than passing them along to customers (many of whom are already balking at new car prices that average nearly $49,000.)

The most recent data from Kelley Blue Book showed the average price that car buyers paid for new vehicles in June was up 1.2% year over year, well below the 10-year average annual increase.

“The modest increase in transaction prices suggests the businesses are absorbing more of the burden and not passing the added costs to consumers — something that will impact profitability if the trend persists,” Erin Keating, executive analyst at Cox Automotive, wrote in a post accompanying the data.

Judge rules 7-foot center Charles Bediako is no longer eligible to play for Alabama

Bediako was playing under a temporary restraining order that allowed the former NBA G League player to join Alabama in the middle of the season despite questions regarding his collegiate eligibility.

American Ben Ogden wins silver, breaking 50 year medal drought for U.S. men’s cross-country skiing

Ben Ogden of Vermont skied powerfully, finishing just behind Johannes Hoesflot Klaebo of Norway. It was the first Olympic medal for a U.S. men's cross-country skier since 1976.

An ape, a tea party — and the ability to imagine

The ability to imagine — to play pretend — has long been thought to be unique to humans. A new study suggests one of our closest living relatives can do it too.

How much power does the Fed chair really have?

On paper, the Fed chair is just one vote among many. In practice, the job carries far more influence. We analyze what gives the Fed chair power.

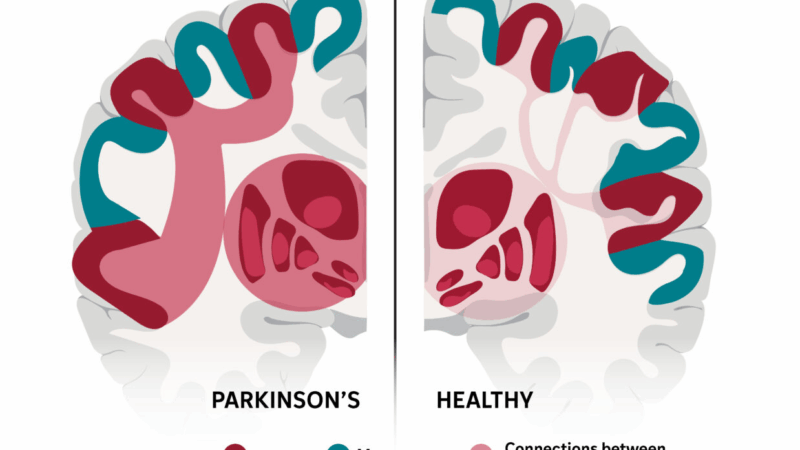

This complex brain network may explain many of Parkinson’s stranger symptoms

Parkinson's disease appears to disrupt a brain network involved in everything from movement to memory.

‘Please inform your friends’: The quest to make weather warnings universal

People in poor countries often get little or no warning about floods, storms and other deadly weather. Local efforts are changing that, and saving lives.